XRP has made headlines once again in the cryptocurrency market after a surge in trading volume pushed it ahead of USDT in market capitalization. This unexpected move indicates XRP’s growing relevance in global crypto spaces, particularly fueled by activity from South Korea’s top digital exchanges.

XRP has made headlines once again in the cryptocurrency market after a surge in trading volume pushed it ahead of USDT in market capitalization. This unexpected move highlights XRP’s growing relevance in global crypto spaces, particularly fueled by activity from South Korea’s top digital exchanges.

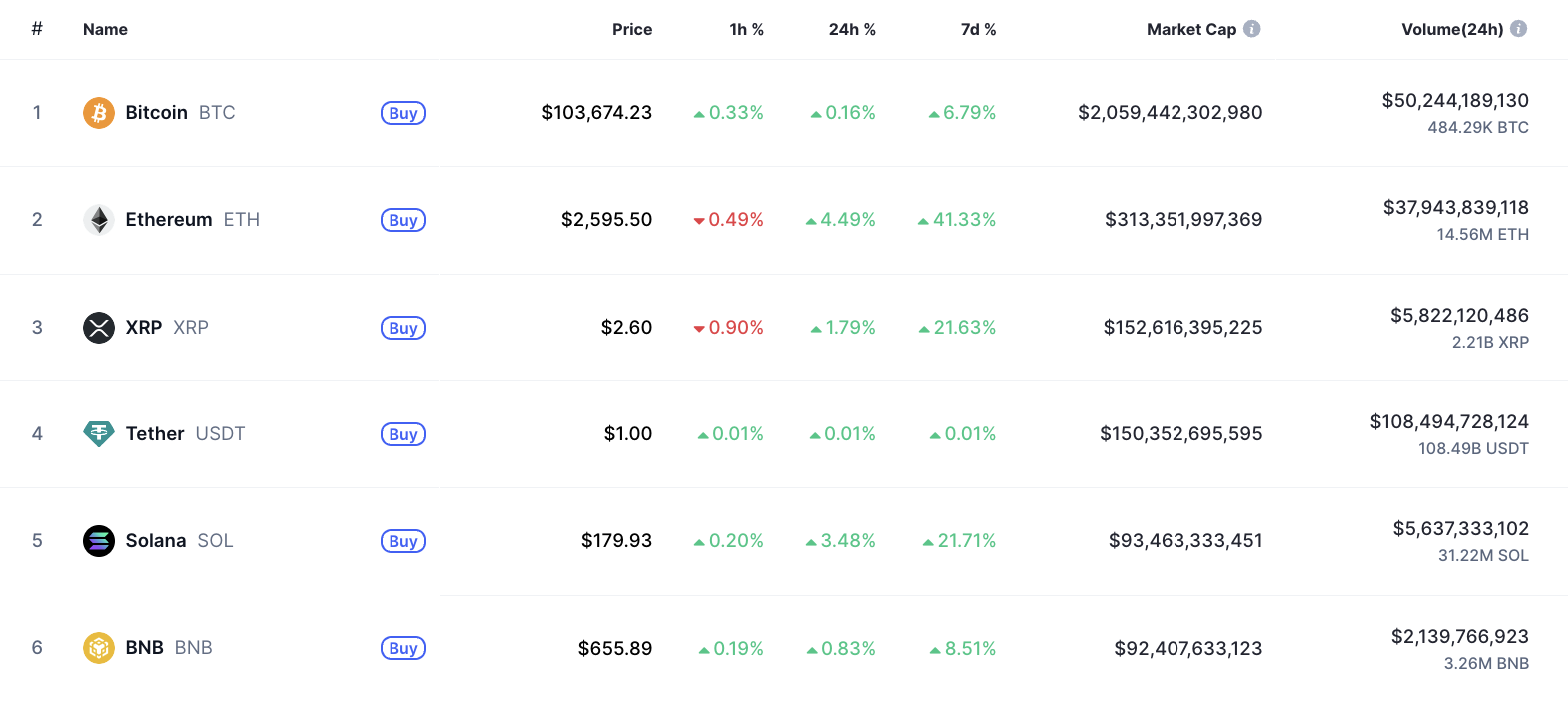

According to recent data, XRP has climbed to the third position in global cryptocurrency rankings by market cap, overtaking Tether (USDT). The digital asset now boasts a market capitalization exceeding $153 billion, slightly edging past USDT’s $150 billion. This significant leap is primarily attributed to a spike in trading volume across South Korean platforms, including Upbit and Bithumb. Over just 24 hours, the total XRP/KRW trading volume exceeded $1.2 billion.

On Upbit, XRP/KRW transactions accounted for approximately 18.34% of the exchange’s total trading activity. Bithumb followed closely with XRP/KRW contributing to 18.02% of its volume. These figures underscore the considerable influence the South Korean market wields over XRP’s valuation. The strong traction in KRW pairings not only showcases local demand but also reflects the effective fiat on-ramp integration and heightened attention around altcoins in the region.

This momentum has translated into a noticeable upward trend for the XRP token. At the time of publishing, XRP prices ranged between $2.62 and $2.63, supported by an evident bullish pattern on the four-hour trading charts. If the trend continues, XRP could potentially solidify its standing and widen the gap further against USDT.

Meanwhile, other shifts are occurring in the broader crypto market. Solana (SOL) has surpassed Binance Coin (BNB), claiming the fifth spot in the total market capitalization rankings. Solana’s market value currently stands around $93.9 billion, slightly ahead of BNB’s $92.5 billion. Both coins have seen consistent growth over the past week, but Solana’s daily gains have been robust enough to outperform its competition decisively.

On a larger scale, the cryptocurrency ecosystem remains volatile. Bitcoin still holds the top position, trading above $103,000, while Ethereum remains strong in second place, having experienced growth of over 42% in the past week. These fluctuations are shaping an increasingly dynamic market where rapid changes in ranking and volume are becoming more frequent.

The recent developments clearly reflect a growing appetite for XRP in Asian markets, particularly where local currencies like the Korean won play an outsized role in determining asset values. Ripple’s established presence and the token’s liquidity have made it a preferred asset in parts of the world where altcoin trading is deeply integrated into local financial systems.

Related: Expert Advice: Sell XRP If You’re Confused

As XRP continues to gain momentum, its ability to challenge longstanding leaders like Tether illustrates the potential of altcoins in reshaping the landscape of digital finance. The current trajectory suggests Ripple’s ecosystem may benefit further as regional interest, infrastructure, and user adoption expand, particularly in Asia.

Quick Summary

XRP has made headlines once again in the cryptocurrency market after a surge in trading volume pushed it ahead of USDT in market capitalization. This unexpected move highlights XRP’s growing relevance in global crypto spaces, particularly fueled by activity from South Korea’s top digital exchanges.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.