Ripple XRP is encountering renewed challenges as its recent rally loses momentum, with key indicators signaling weakening market engagement.

Ripple XRP is encountering renewed challenges as its recent rally loses momentum, with key indicators signaling weakening market engagement. The cryptocurrency, following a robust two-week uptrend that lifted it from around $2.12 to a peak of $2.65 on Wednesday, now faces increased sell-side pressure and a slowdown in network activity.

The latest data shows XRP pulling back slightly to trade at $2.51. This cooling comes amid a broader market deceleration, despite supporting macroeconomic developments like easing trade tensions between the United States and China, as well as a bilateral deal between the US and UK. These events initially supported bullish sentiments across financial markets, including digital assets.

However, sentiment around XRP began to shift as analytics revealed a substantial decrease in network growth. According to measures from Santiment, the number of new addresses on the XRP Ledger has fallen significantly—from nearly 16,000 in January to around 3,400 by early May. This 78.7% drop highlights tapering user participation and potentially diminishing demand for XRP.

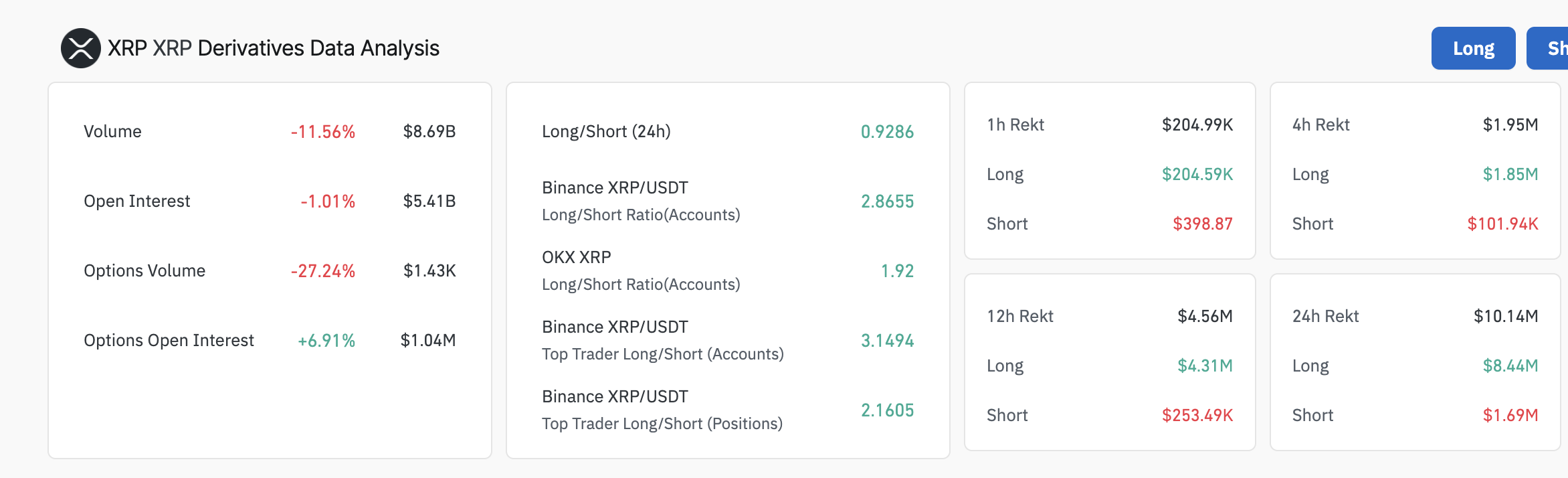

Further complicating the outlook are substantial liquidations in XRP futures. CoinGlass data points to over $10 million in liquidations within a 24-hour period, with $8.44 million attributed to long positions. This paints a picture of a market adjusting from a highly speculative stance. The decline in open interest—down 1% to $5.41 billion—alongside a fall in trading volume from $19.5 million on Monday to $8.69 million, signals that trader enthusiasm is receding.

This combination of factors—plummeting network growth, rising liquidations, and thinning volume—raises concerns over XRP’s immediate upward potential as it aims for the psychological $3.00 resistance level. Technical indicators offer mixed signals. On the bullish side, XRP remains securely above its major Exponential Moving Averages (50-day, 100-day, and 200-day EMAs), suggesting strong market structure support.

The Moving Average Convergence Divergence (MACD) continues to flash a buy signal, remaining in positive territory with upward-trending histograms. This suggests that bullish momentum still lingers in the market. However, caution is advised as the Relative Strength Index (RSI) currently stands at 63.34 but is trending lower toward the neutral 50 mark. This weakening could open the door for deeper pullbacks.

Should bearish pressure intensify, potential support levels to watch include the 50-day EMA at $2.27, the 100-day EMA at $2.25, and a firmer floor at the 200-day EMA near $2.00. Profit-taking and position adjustments could accelerate this downward phase in the short term, especially if market confidence continues to wane.

In summary, while Ripple XRP continues to trade within bullish territory from a technical perspective, faltering network activity and heightened liquidation levels point to increased volatility ahead. Traders and investors will need to monitor on-chain and market performance closely to assess whether XRP can regain upward momentum and revisit the $3.00 target or if it will succumb to corrective pressures.

Related: Expert Advice: Sell XRP If You’re Confused

Quick Summary

Ripple XRP is encountering renewed challenges as its recent rally loses momentum, with key indicators signaling weakening market engagement. The cryptocurrency, following a robust two-week uptrend that lifted it from around $2.12 to a peak of $2.65 on Wednesday, now faces increased sell-side pressure and a slowdown in network activity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.

%20%5B07-1747287474330.12.55,%2015%20May,%202025%5D.png)