XRP has been leading the crypto market recovery with an impressive surge, but recent data suggests early investors are now starting to lock in gains, even as the XRP ecosystem shows significant progress.

XRP has been leading the crypto market recovery with an impressive surge, but recent data suggests early investors are now starting to lock in gains, even as the XRP ecosystem shows significant progress.

Currently trading above the $2 mark, XRP has soared well above its levels from October 2024, delivering returns north of 300% for those who entered early. While this performance reinforces XRP’s status as a major digital asset, it’s also prompting many early holders to begin taking profits. This trend has ramped up recently, revealing growing distribution pressure as XRP’s rally matures.

According to data from blockchain intelligence firm Glassnode, realized profits for XRP wallets—measured by the 7-day simple moving average—peaked at $68.8 million earlier this June. That level represents the highest uptick in over a year and signals widespread moves by early investors to exit while prices remain strong.

This wave of profit realization appears to be stalling XRP’s upward momentum, with the asset repeatedly failing to sustain levels above $2.20. Despite encouraging news and improving technicals, the sheer volume of outgoing tokens seems to be creating a wall of resistance just below XRP’s 2021 high.

Read more: XRP Drops 5% as High-Volume Selling Pressure Dominates Market

While short-term price fatigue is evident, the broader outlook for XRP remains positive. Regulatory clarity in the United States continues to fuel institutional and retail interest, especially after Ripple’s recent advancements in tokenized finance infrastructure. This momentum suggests there may be further upside ahead—once current holders finish cashing out and the market absorbs the surplus.

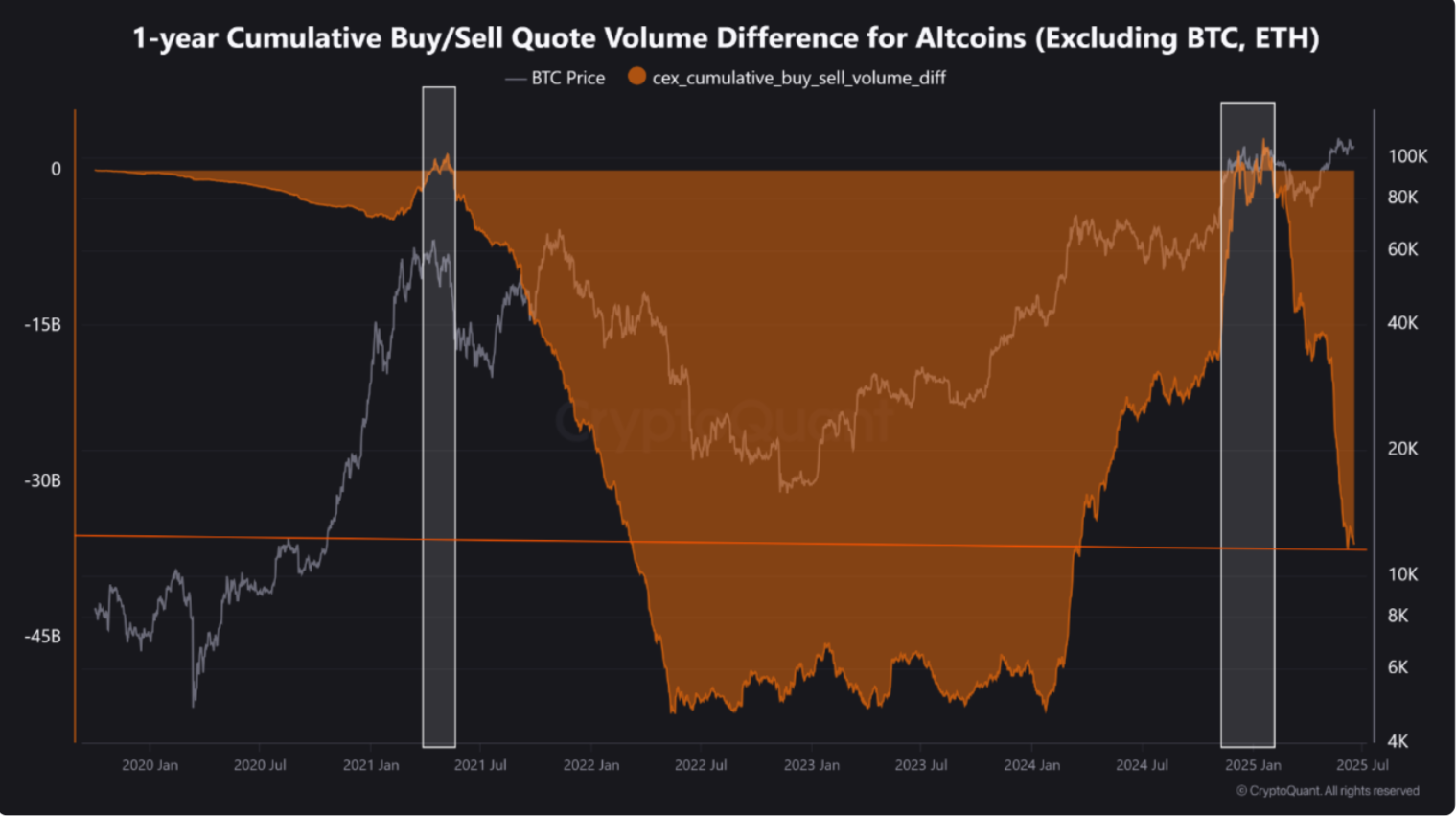

Looking at the wider altcoin landscape, some trends contrast significantly. CryptoQuant recently reported that the cumulative one-year buy/sell volume difference for non-BTC and non-ETH altcoins has dipped to -$36 billion. This dramatic shift follows a brief positive flip in December 2024, when investor enthusiasm for altcoins briefly reached a peak.

Since that peak, the momentum has reversed with consistent outflows, indicating risk aversion among altcoin holders. As CryptoQuant analyst Burak Kesmeci noted, key sectors like Layer 1 protocols, DeFi, and blockchain gaming aren’t seeing the uptick expected during a typical “altseason.”

Still, XRP stands out as a positive outlier. Alongside tokens like SOL and a select few assets tied to real-world applications, XRP’s ecosystem expansion and regulatory momentum are helping the project carve out near-term sustainability in an otherwise tepid altcoin market.

That said, investors should be mindful of the existing overhead supply, with whales and early retail participants actively de-risking their positions. Until this supply is fully absorbed and risk appetite makes a return to crypto’s broader sectors, XRP might continue to face short-term consolidation—even as its fundamentals improve.

Related: Expert Advice: Sell XRP If You’re Confused

XRP’s recent rally and the behavioral patterns of its largest holders reflect a key transition for the coin: from speculative asset to a maturing ecosystem backed by clearer legal standing and tangible enterprise applications. Whether this alone is enough to spark a broader altcoin recovery remains to be seen, but for now, XRP’s unique positioning offers both promise and caution for market participants.

Quick Summary

XRP has been leading the crypto market recovery with an impressive surge, but recent data suggests early investors are now starting to lock in gains, even as the XRP ecosystem shows significant progress.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.