XRP has become the centerpiece of market drama following an extraordinary liquidation event that sent shockwaves through the crypto community.

XRP has become the centerpiece of market drama following an extraordinary liquidation event that sent shockwaves through the crypto community. The digital asset, associated with Ripple, witnessed an eye-popping 51,209% liquidation imbalance, catching bears completely off guard and raising eyebrows across derivatives platforms.

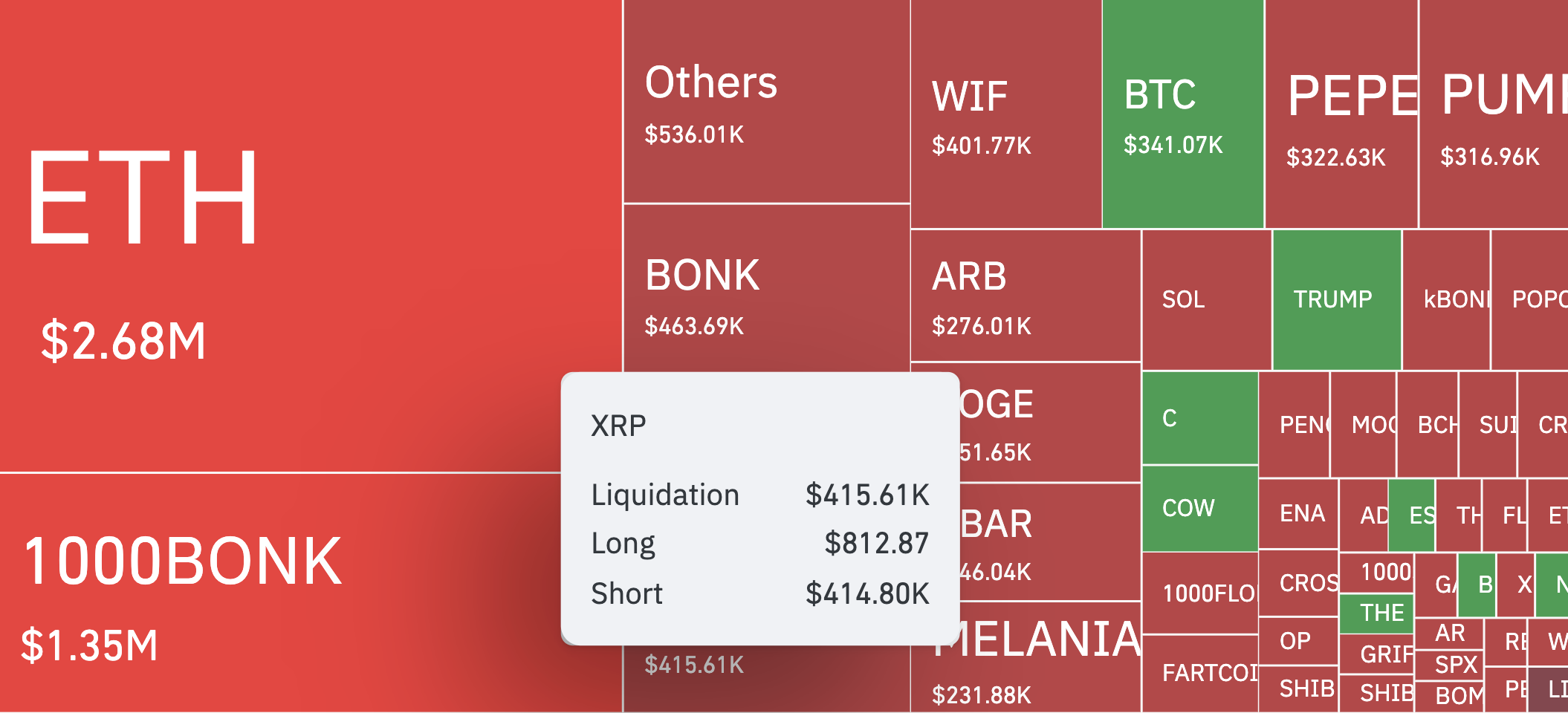

In one of the most startling moments recently observed in cryptocurrency trading, over $337 million in total asset liquidations took place, based on information from CoinGlass. However, XRP stood out dramatically with a liquidation value of $415,610 in just a single hour. What makes this particularly noteworthy is how heavily tilted the impact was towards short positions.

According to live data, long positions in XRP remained largely unaffected, accounting for merely $812.87 in liquidations. In contrast, bears were crushed under losses totaling approximately $414,800. This creates an unprecedented liquidation ratio that surpasses 51,000%, a signal that suggests forced closures at fragile resistance levels due to unexpected bullish momentum.

As this lopsided liquidation unfolded, XRP simultaneously rallied, reclaiming the $2.98 mark after briefly dipping below $2.95. The move appeared deliberate and efficient on spot charts, showing minimal slippage during its ascent. Such clean upward movement suggests a tightly fought breakout rather than a random price pump.

This liquidation anomaly suggests that many traders were bracing for a downturn that never came. Instead, the swift upward move likely triggered a domino effect of stop-loss activations, forcing a reshuffle of trading positions. With mainstream attention still largely focused on major players like Bitcoin and Ethereum, XRP’s rally quietly carved its path—at least for now.

In a broader context, Ethereum, for example, saw a total liquidation of $2.68 million, but this was more balanced across both long and short positions, implying a more predictable trading environment versus XRP’s unexpectedly skewed outcome. Tokens like BONK also showed symmetrical behavior, unlike XRP’s imbalance.

The question now becomes whether this event signals a deeper shift in XRP’s market dynamics. The asymmetric liquidation may be indicating a clean technical reset, presenting traders and analysts with a fresh chart below the $3.00 threshold. With such a strong fundamental shake-up and decreased overhead resistance from short positions, XRP may be staging a more sustained move or volatile pivot in coming sessions.

Related: XRP Price: $12M Max Pain for Bears

This development also emphasizes the need for close monitoring of positions in the volatile crypto derivative space, highlighting just how quickly narratives shift in digital asset markets. XRP’s stunning liquidation event has become a crucial reminder of the unpredictable nature of cryptocurrency trading, particularly when technical patterns collide with large leveraged positions.

Quick Summary

XRP has become the centerpiece of market drama following an extraordinary liquidation event that sent shockwaves through the crypto community. The digital asset, associated with Ripple, witnessed an eye-popping 51,209% liquidation imbalance, catching bears completely off guard and raising eyebrows across derivatives platforms.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.