XRP made waves in the crypto market following a breakout rally that ignited a staggering $18.89 million liquidation imbalance. This surge came as short positions were overwhelmed by a rapid price escalation, disrupting the usual equilibrium in derivatives trading.

XRP made waves in the crypto market following a breakout rally that ignited a staggering $18.89 million liquidation imbalance. This surge came as short positions were overwhelmed by a rapid price escalation, disrupting the usual equilibrium in derivatives trading.

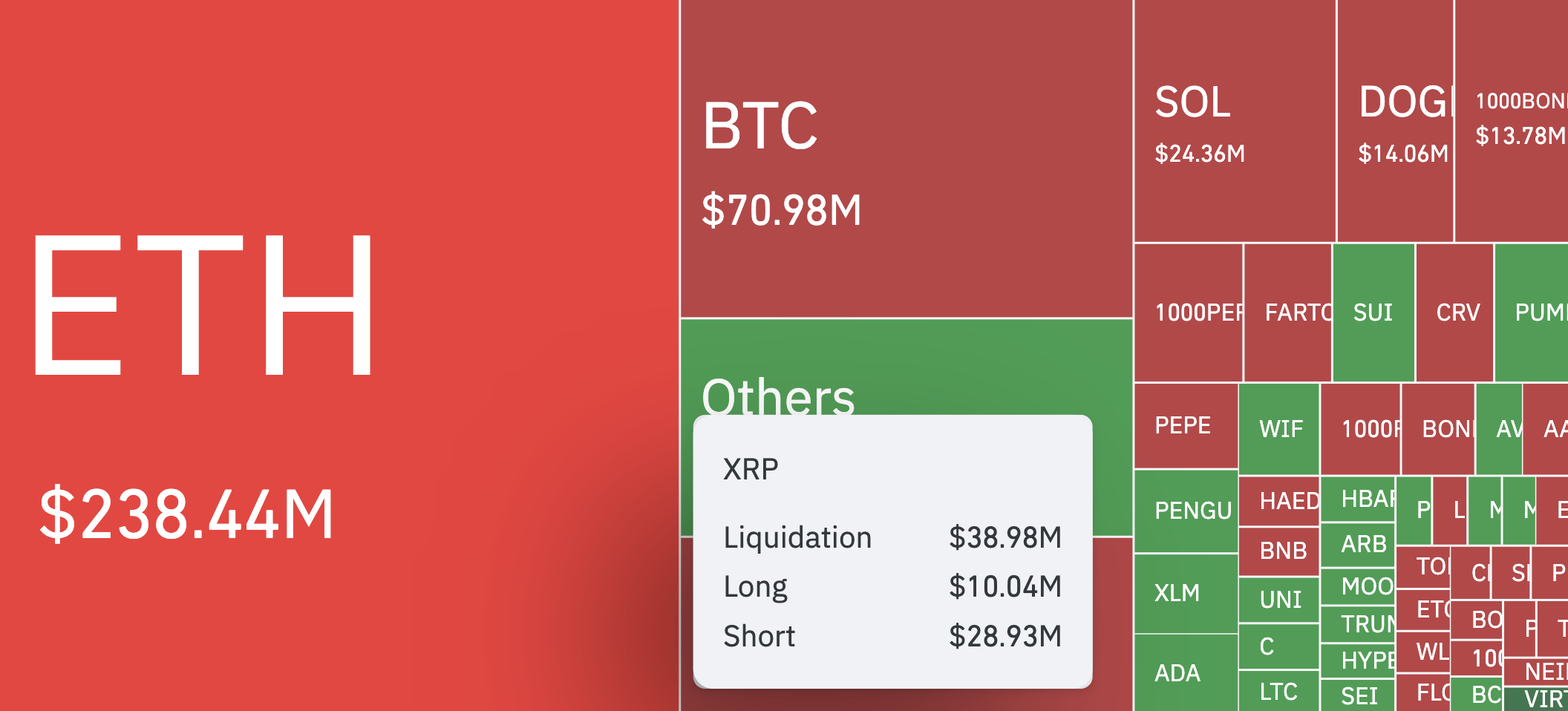

The digital asset experienced a sharp price climb from approximately $2.92 to over $3.30 within a single session, eventually stabilizing near $3.24. This price action triggered a flood of liquidations, primarily impacting traders who had bet against the asset. While long positions saw liquidations totaling $10.04 million, shorts were crushed by a far more severe $28.93 million, according to CoinGlass, resulting in a highly unusual skew of nearly $18.89 million in the liquidation balance.

Interestingly, this scenario followed a structured build-up in Asian trading hours, followed by an aggressive rally during early U.S. market activity. Analysts observed it was a textbook display of trend-based momentum, with technical positioning playing heavily into the outcome. Many short positions were blindsided by the upward breakout, failing to adjust to the shifting momentum in time.

What made the XRP liquidation event even more notable was its one-sidedness. Throughout just a four-hour window, shorts faced $15.36 million in liquidations—more than ten times the $1.44 million evacuated from long positions during the same period. This level of disparity is rarely seen, suggesting a significant misalignment in market sentiment versus price trajectory.

In a broader market context, XRP still trailed Bitcoin and Ethereum in overall liquidation volume. Ethereum dominated the session with $238.44 million in total liquidations, while Bitcoin saw $70.98 million. XRP’s contribution to the market disruption was a hefty $38.98 million, primarily from over-exposed short positions. Taken together, the crypto market saw a collective $557.7 million cleared in total liquidations across all assets, affecting nearly 148,000 positions.

Despite the chaos, XRP’s movement wasn’t erratic or driven by a sudden news flash. Instead, the price pattern followed a clean and relatively predictable trend line, reinforcing the idea that many traders were simply on the wrong side of a technical breakout. The rally highlighted the vulnerability of short positions in a tightly coiled, bullish setup, particularly when those positions fail to adapt to early indicators of a reversal.

This development stands as a stark reminder of the risks involved in derivatives trading within the crypto space. It emphasizes how leverage and timing can rapidly undo even well-constructed positions when price moves with speed and conviction. XRP’s sudden rally and the resulting imbalance demonstrate the powerful impact of momentum-driven moves on market mechanics.

Related: XRP Price: $12M Max Pain for Bears

As the market continues to evolve, XRP remains a focal point for traders seeking high volatility and responsive price structures. Events like this underline the importance of adaptive strategies and real-time risk management in such a dynamic environment.

Quick Summary

XRP made waves in the crypto market following a breakout rally that ignited a staggering $18.89 million liquidation imbalance. This surge came as short positions were overwhelmed by a rapid price escalation, disrupting the usual equilibrium in derivatives trading.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.