XRP is under the spotlight as Ripple navigates fresh momentum while market participants face macroeconomic uncertainty. The cryptocurrency has experienced a moderate decline to $3.18, a shift catalyzed by anticipation around upcoming U.S. inflation data releases that could influence broader digital asset sentiment.

XRP is under the spotlight as Ripple navigates fresh momentum while market participants face macroeconomic uncertainty. The cryptocurrency has experienced a moderate decline to $3.18, a shift catalyzed by anticipation around upcoming U.S. inflation data releases that could influence broader digital asset sentiment.

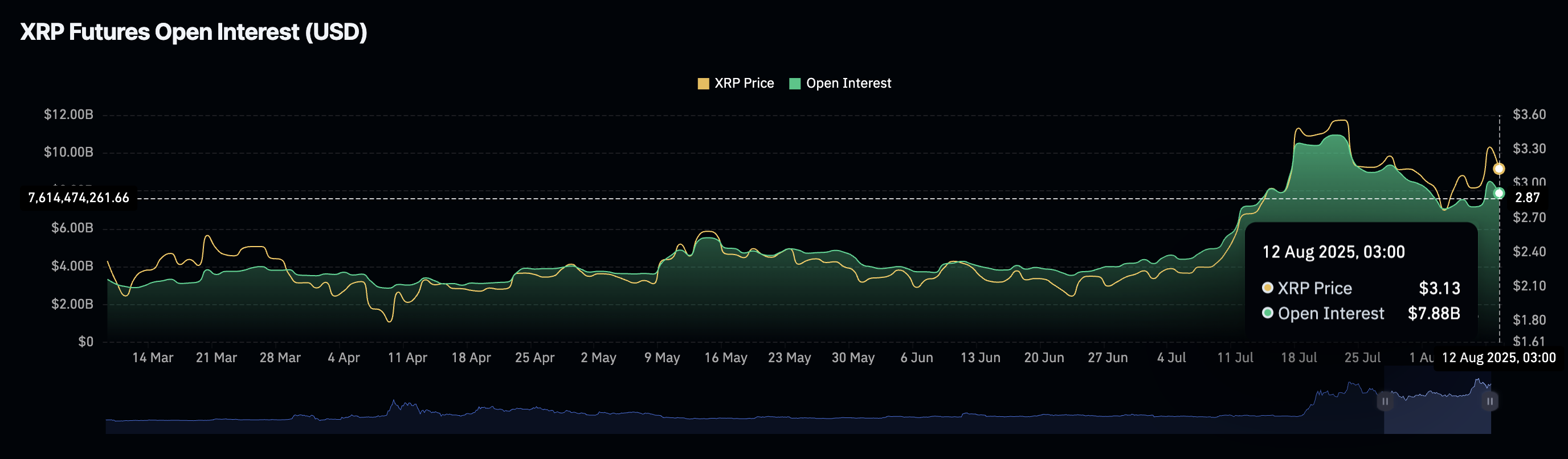

Following a run that brought XRP to a high of $3.66 in mid-July, current prices show a contraction of nearly 15% from those levels. With interest in XRP derivatives softening, the possibility of further downside below the crucial $3.00 threshold remains elevated, should buying support continue to weaken.

SEC Transitions from Litigation to Regulation

The Securities and Exchange Commission (SEC) in the United States has entered a new phase with respect to Ripple. After settling its long-standing lawsuit against the blockchain firm, SEC Chair Paul Atkins indicated that the agency is pivoting its focus toward the development of regulatory frameworks for digital assets. This sentiment was echoed by Commissioner Hester Peirce, who noted that resources previously directed at litigation will now be utilized to establish a clearer rulebook for the crypto sector.

As part of this regulatory evolution, the SEC recently dismissed all remaining appeals in its legal battle with Ripple. This decision accompanied a joint filing and a confirmed $50 million settlement, clearing the path for Ripple to operate with greater freedom. The lawsuit, initiated in 2020, alleged that Ripple’s XRP token constituted an unregistered security offering. However, in 2023, a partial court ruling determined that XRP sales through platforms like Coinbase and Binance did not violate securities laws, though Ripple was held accountable for direct institutional transactions.

This legal resolution catalyzed a notable increase in XRP’s value, lifting it from $3.00 support to just under the $3.40 resistance level. The resistance line held firm, however, pausing further upward momentum at least temporarily.

Ripple Builds Out XRP Utility and Infrastructure

With its regulatory cloud now largely cleared, Ripple is moving forward on multiple fronts. The organization is investing heavily in infrastructure targeting the tokenization of tangible assets, stablecoin payments via RLUSD, and expanding the utility of XRP through flagship services like On Demand Liquidity (ODL) and Ripple Payments. These initiatives are critical for building real-world use cases that drive adoption and utility of the XRP token.

In tandem with the macro environment, Ripple aims to strengthen the XRP ecosystem amid expectations of a shifting U.S. monetary policy landscape, particularly regarding potential interest rate cuts as inflation data becomes available.

XRP Technical Picture: Support Holds Despite Market Headwinds

XRP remains positioned just above its key support at $3.00 ahead of critical U.S. Consumer Price Index (CPI) readings. Market participants are bracing for potential volatility, as inflation updates could have a strong impact on crypto assets, including XRP. If the figures meet or undercut expectations, the chances improve for the Federal Reserve to begin easing rates, possibly as early as September. This could offer relief to crypto markets and support a reversal in the ongoing correction.

On the derivatives side, XRP futures Open Interest (OI) slipped to about $7.9 billion after a lift to $8.5 billion late last week. This decline implies waning speculative activity, indicating that fewer traders are maintaining leveraged positions. Without renewed interest, any sustainable price rebound for XRP could face challenges.

From a technical perspective, XRP retains a bullish trajectory supported by key moving averages: the 50-day EMA at $2.89, 100-day at $2.67, and 200-day at $2.40. These indicators serve as buffers against deep downside extensions and could aid in halting further declines, especially if prices breach sub-$3.00 territory.

Related: XRP Price: $12M Max Pain for Bears

Looking ahead, XRP needs to contend with resistance at the $3.40 mark, while the record high remains locked at $3.66. A sustained break above these thresholds would signal a firm continuation of the prior bullish trend. On the other hand, increased downside risk persists should macroeconomic pressures intensify.

Quick Summary

XRP is under the spotlight as Ripple navigates fresh momentum while market participants face macroeconomic uncertainty. The cryptocurrency has experienced a moderate decline to $3.18, a shift catalyzed by anticipation around upcoming U.S. inflation data releases that could influence broader digital asset sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.