XRP has drawn strong attention in recent days as it rebounded impressively from the crucial $3 mark, backed by a surge in trading activity and investor interest. This resurgence hints at a potential climb toward $4, supported by momentum and developments within the Ripple ecosystem.

XRP has drawn strong attention in recent days as it rebounded impressively from the crucial $3 mark, backed by a surge in trading activity and investor interest. This resurgence hints at a potential climb toward $4, supported by momentum and developments within the Ripple ecosystem.

The past week has seen XRP decline for four consecutive days, largely due to intensified selling pressure near the $3.5 resistance zone. However, prices recently reversed course from $3.05—an area that has served as a robust support level in XRP’s past technical behavior. Notably, trading volumes spiked by 30%, reaching approximately $12 billion, amounting to nearly 7% of the total circulating supply.

Average volumes over the past three sessions consistently exceeded $8 billion, far above the typical $5 billion daily average. This indicates elevated market interest at the current price zone, as both buying and selling activity intensified around the $3 threshold. The price level has emerged as a key battleground between bulls and bears.

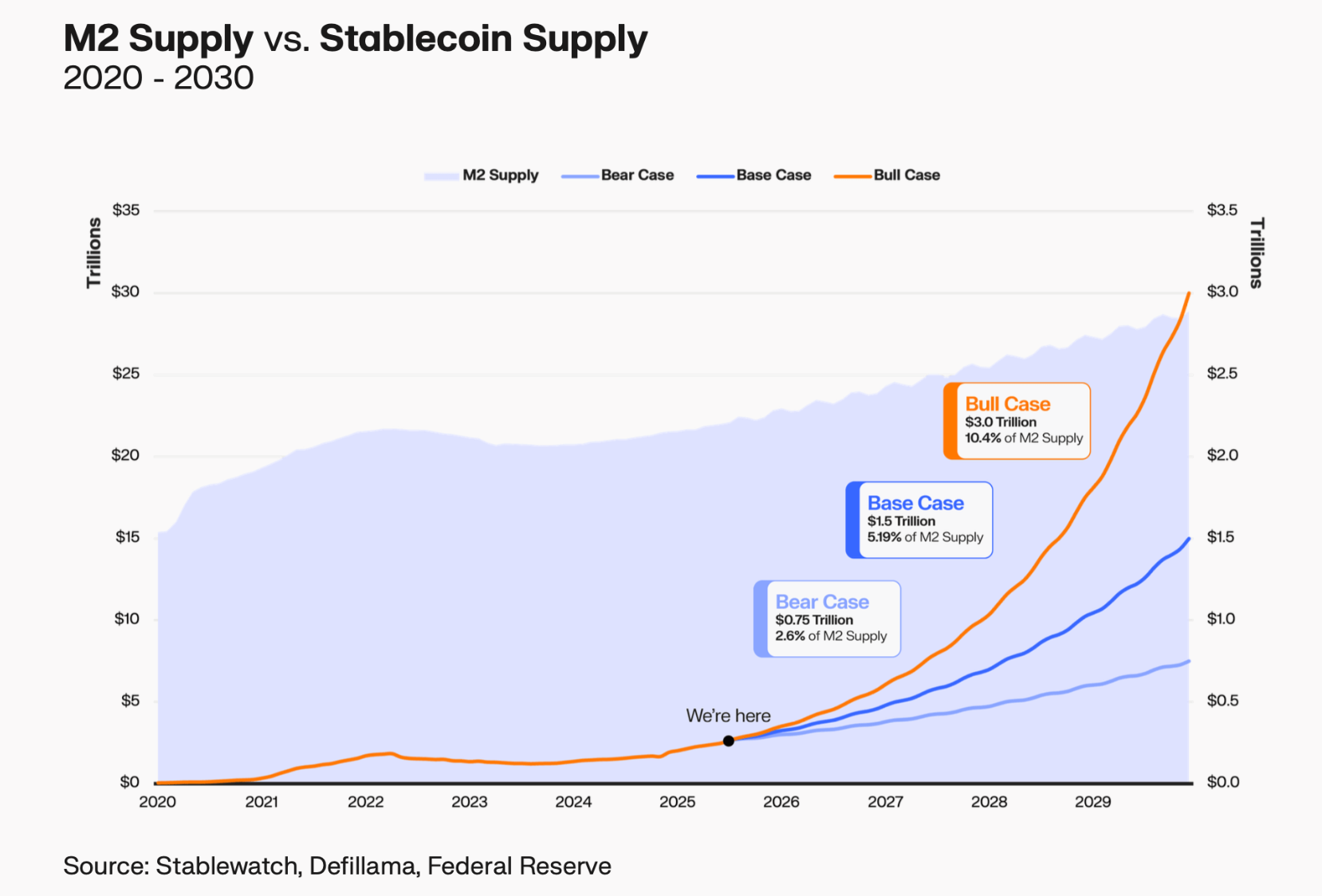

Recent research from crypto market maker Keyrock suggests the stablecoin sector could expand its collective market capitalization by up to 500% over the next five years—reaching an estimated $3 trillion. This projection would make up around 10% of the U.S. M2 money supply.

This bullish outlook reinforces the significance of Ripple’s recent launch of RLUSD, a USD-pegged stablecoin. With its efficient network design, Ripple is strategically positioned to absorb a share of the anticipated growth in stable assets. RLUSD presents an efficient alternative for global remittances—something Ripple has long targeted. Increased network usage stemming from RLUSD transactions directly fuels demand for XRP, as it functions as the native asset responsible for processing fees.

While RLUSD remains modest in scale with a market cap around $600 million, Ripple’s expanding influence, especially in regions like the U.S. and Middle East, sets the stage for broader institutional adoption. These developments underscore the company’s long-term prospects in reshaping digital cross-border payments.

Added to this momentum is the recent resolution of Ripple’s legal battle with the U.S. Securities and Exchange Commission. With the SEC having officially ended its appeal, Ripple is now in a favorable position to introduce new innovations, including further integrations of RLUSD and advancements in XRP functionality.

Technical chart analysis on the 4-hour timeframe points to a solid price floor at $3. This level also aligns with XRP’s 200-period exponential moving average, bolstering its case as a strategic bounce area. With volumes rising sharply at this price, signs point toward increased buyer commitment.

If the current uptrend sustains, XRP may revisit the $3.4 resistance region. Several sell orders around that level have likely been absorbed during recent sessions, which may pave the way for an extended rally. A bullish breakout from this consolidation corridor could push XRP toward the widely anticipated $4 mark.

Adding fuel to the bullish narrative is market speculation around the possible launch of a spot exchange-traded fund (ETF) tied to XRP. Given the SEC’s recent approval of the Solana-based SSK ETF, many analysts argue that a similar product for XRP is no longer a question of “if” but “when.” Such an offering would expose the token to new investor classes and introduce fresh capital into the ecosystem.

Related: XRP Price: $12M Max Pain for Bears

Altogether, XRP finds itself at an inflection point. With increasing trading activity, a clear support range, and ecosystem growth via RLUSD, the token appears poised for continued upward momentum. As the global digital payments space evolves, XRP remains one of the standout contenders in shaping its future.

Quick Summary

XRP has drawn strong attention in recent days as it rebounded impressively from the crucial $3 mark, backed by a surge in trading activity and investor interest. This resurgence hints at a potential climb toward $4, supported by momentum and developments within the Ripple ecosystem.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.