Ether market activity is drawing close attention as investor sentiment turns cautious, with the focus keyword Ether market appearing at the core of the latest volatility concerns.

Ether market activity is drawing close attention as investor sentiment turns cautious, with the focus keyword Ether market appearing at the core of the latest volatility concerns.

Why a Drop Below $4,200 Matters for Traders

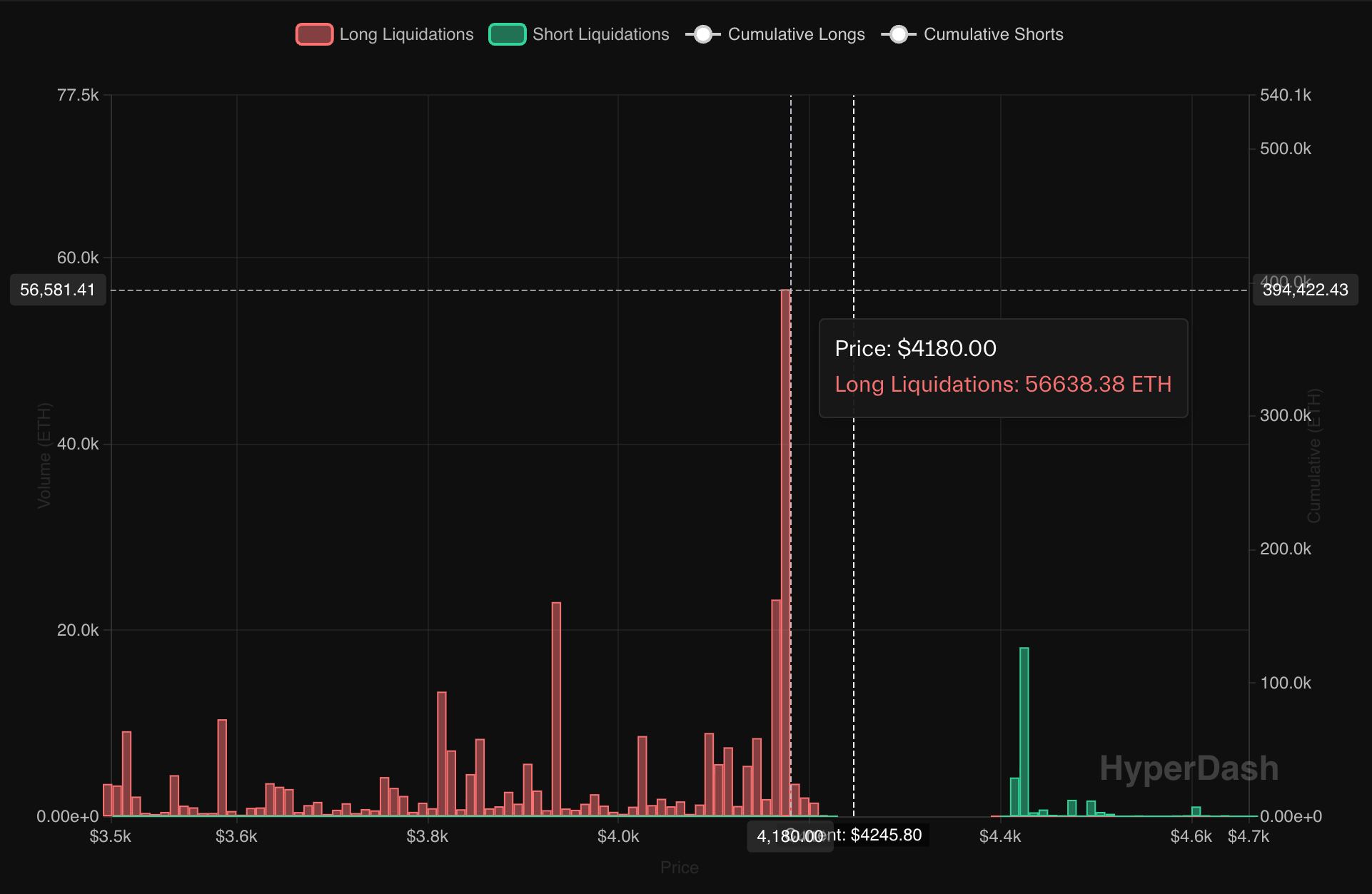

Market observers are closely monitoring ether (ETH), particularly if its value dips below the $4,200 level. Many analysts believe this price point could act as a trigger for mass long position liquidations—adding increased turbulence to the Ether market.

According to recent metrics from Hyperdash, a descent to $4,170 could lead to forced closure of over 56,638 ETH in bullish leveraged trades, equating to about $236 million on Hyperliquid, a decentralized perpetual contracts exchange.

Major Liquidation Risk Zones Identified

Data highlights that risk intensifies significantly around price zones of $3,940 and even more so around the $2,150 to $2,160 range. At the time of reporting, ether was trading at approximately $4,260, already reflecting a downturn of nearly 5% over the day, per CoinDesk’s data.

Market Experts Warn of Further Decline

Andrew Kang, a prominent figure in the crypto venture capital arena and founder of Mechanism Capital, took to X (formerly Twitter) to comment on the mounting risks in the Ether market. He opined that a cascade of long position closures could drag ETH’s price down to the $3,600 mark.

“[I] would estimate we’re about to hit $5b in ETH liquidations across exchanges, taking us down to $3.2k – $3.6k,” Kang noted, underscoring the potential scale of downside pressure facing traders.

This ETH liquidation map from Hyperliquid visualizes key zones vulnerable to forced closures if the Ether market dips further.

Understanding How Liquidations Fuel Volatility

In leveraged trading, liquidations occur when a trader’s equity falls below the margin maintenance threshold. At that point, exchanges automatically close the position to limit losses, ensuring any borrowed capital is recovered.

These forced sell-offs often inject a surge of downward pressure into the market. A large wave of long liquidations can spiral into a self-reinforcing downturn, where each closure lowers the price further and triggers additional liquidations. This looping mechanism not only drives prices down rapidly but also creates sharp swings in volatility.

Wider Market Impact and Related Events

This tightening liquidity environment for ether is reflective of broader movements in the crypto ecosystem. For instance, unexpected market news or cross-asset volatility—such as those involving altcoins—can amplify reactions across multiple trading pairs.

Related: Cardano Bull Setup Points to December Rally

Dogecoin Sellers in Control as Monero Attacker Votes to Target DOGE; Bitcoin Below $116K

Quick Summary

Ether market activity is drawing close attention as investor sentiment turns cautious, with the focus keyword Ether market appearing at the core of the latest volatility concerns. Why a Drop Below $4,200 Matters for Traders Market observers are closely monitoring ether (ETH), particularly if its value dips below the $4,200 level.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.