XRP’s market momentum appears steady while other assets show volatility, as the latest CoinDesk 20 update reveals critical shifts across the index. The CoinDesk 20 Index, designed to track the top digital assets across liquidity and trading volume, saw a decline of 1.6% to reach 4068.44 as of 4 p.m.

XRP’s market momentum appears steady while other assets show volatility, as the latest CoinDesk 20 update reveals critical shifts across the index. The CoinDesk 20 Index, designed to track the top digital assets across liquidity and trading volume, saw a decline of 1.6% to reach 4068.44 as of 4 p.m. ET on the previous trading day.

Mixed Market Movement Across the CoinDesk 20

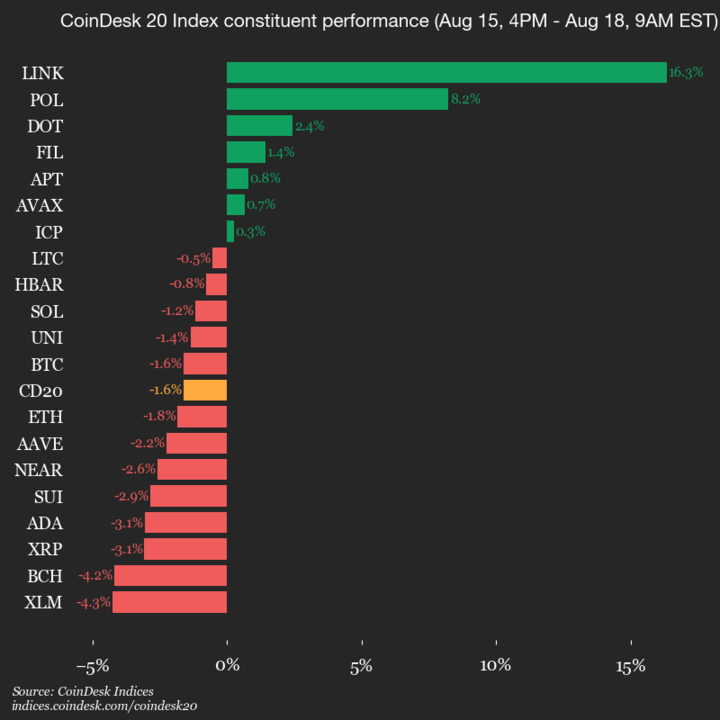

Despite broader market weaknesses, seven of the twenty assets in the CoinDesk 20 Index managed gains. In this backdrop, some coins emerged as top performers while others lagged behind, dragging the overall index lower.

Leading the gains was Chainlink (LINK) with an impressive increase of 16.3%, followed by Polygon (POL) which rose 8.2%. These positive moves indicate selective investor interest despite general downward pressure on the market.

XLM and Other Declining Assets Pull Index Down

Stellar (XLM) led the underperformers, falling 4.3%. This sharp decline contributed significantly to the overall dip in the index. Bitcoin Cash (BCH) followed closely, declining 4.2%. As two of the more prominent constituents, their performance had a notable impact on the day’s index trajectory.

CoinDesk 20 Index update from August 18, 2025 shows top gainers and losers.

Understanding the CoinDesk 20 Index Framework

The CoinDesk 20 serves as a barometer for digital asset market activity. It comprises 20 of the most traded and liquid cryptocurrencies. As the index operates across several platforms and regions, it provides a holistic view of market trends and investor sentiment.

The index not only tracks performance metrics but helps investors understand broader movements across the crypto sector. Sudden shifts like those seen with XLM or the rally by LINK help signal where capital is flowing—and where it’s retreating.

Strategic Implications for XRP and Investors

Although XRP was not among the day’s biggest gainers or losers, the broader dynamics within the CoinDesk 20 Index still offer cues. Volatility from assets like XLM, POL, and LINK shapes sentiment and technical trends that ripple across the ecosystem—including those around XRP and other top tokens.

Whether you’re holding XRP, trading on near-term opportunities, or observing institutional asset flows, updates like these offer valuable context. Prioritizing awareness of daily index shifts allows smarter reaction to both micro trends and macro developments.

Related: XRP Price: $12M Max Pain for Bears

To continue monitoring evolving market narratives, check the latest updates on the CoinDesk Indices platform.

Quick Summary

XRP’s market momentum appears steady while other assets show volatility, as the latest CoinDesk 20 update reveals critical shifts across the index. The CoinDesk 20 Index, designed to track the top digital assets across liquidity and trading volume, saw a decline of 1.6% to reach 4068.44 as of 4 p.m.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.