XRP continues to struggle gaining traction among retail traders even as institutions hold strong, highlighting a growing divide in crypto investment strategies this August.

XRP continues to struggle gaining traction among retail traders even as institutions hold strong, highlighting a growing divide in crypto investment strategies this August.

Markets Open Lower as XRP and Other Altcoins Struggle

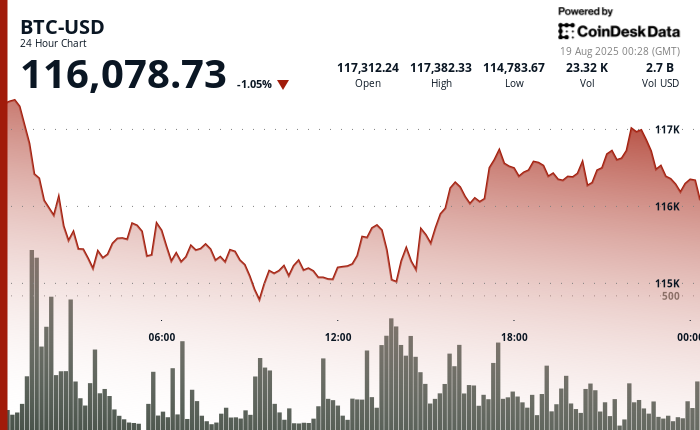

As the Asian trading day kicks off, Bitcoin (BTC) is priced at $116,263, down 1.1% for the day and 2% for the week, based on CoinDesk’s latest market figures. Ethereum (ETH) is also taking a hit, dropping 3.8% in the last 24 hours to $4,322, although it still shows a weekly gain of 2.6%. The CoinDesk 20 Index (CD20), which tracks the top 20 crypto assets, has slipped by 2.4%.

According to Polymarket, the probability of BTC ending August below $111,000 currently stands at 34%, signaling a bearish outlook among traders. ETH’s most likely outcome appears to be a close near $4,800, with 43% odds.

Institutional Strength vs. Retail Slump

Enflux, a Singapore-based market maker, noted that market sentiment remains conflicted. On one hand, institutional commitment is reinforced by Strategy Inc.’s recent purchase of 430 BTC and an ongoing transformation in crypto financing structures. On the other, retail investors are showing decreased activity, especially around assets like XRP and DOGE.

QCP’s market commentary reveals that perpetual funding rates turned negative over the weekend—a scenario that has previously preceded market retreats. Currently, options markets show a preference for protective puts, suggesting risk aversion despite long-term bullish setups.

VanEck’s consistent forecast of a $180,000 year-end BTC target offers reassurance to institutions. However, XRP, once a retail favorite, is seeing weaker momentum due to ongoing delays in ETF approvals by the SEC. These regulatory hindrances are stalling its upward movement despite growing institutional interest in other tokens.

Markets kicked off lower in Asia with BTC and ETH both posting early losses.

Spotlight on Solana and Cautious Trading Patterns

Unlike XRP and DOGE, Solana has shown quiet resilience. According to Enflux, its continued dominance in USDC stablecoin transfers and usage in new token issuance via platforms like PumpFun demonstrates buyer-side strength.

Still, broader trading metrics remain cautious. The setup heading into Thursday’s Jackson Hole symposium is tactically defensive, with the market preparing for remarks from Fed Chair Jerome Powell. Recent data showing rising inflation, along with political pressure from the White House on central bank independence, adds uncertainty to Powell’s address.

Macro Events Weigh on Sentiment

On August 18, BTC fluctuated between $114,993 and $117,620, with higher-than-usual trading volumes. Market participants are digesting U.S. Treasury Secretary Scott Bessent’s announcement that the country’s strategic crypto reserves will be expanded using budget-neutral mechanisms rather than outright government purchases.

ETH dropped to $4,330.61 due to strong resistance near its historical highs. Although U.S. spot ETFs welcomed $3.71 billion in inflows recently, this institutional enthusiasm hasn’t translated into retail enthusiasm—particularly where XRP and other altcoins are concerned.

More Developments in the Crypto Space

Other highlights include: the U.S. Treasury’s active development of the GENIUS Act aimed at tackling illicit activity in crypto (read more); Qubic turning its focus to DOGE after critiquing Monero (Decrypt); and Michael Saylor relaxing stock sale restrictions in response to a decline in the Bitcoin premium (Bloomberg).

Meanwhile, retail search interest in crypto has hit a four-year high, suggesting curious eyes are watching, even if those fingers aren’t yet pulling the buy trigger on tokens like XRP.

Related: XRP Price: $12M Max Pain for Bears

What Traders Should Watch Next

As the week unfolds, all eyes will be on Jerome Powell’s commentary at Jackson Hole. Insights into future rate policy could shift momentum for both institutional and retail holders, and potentially unlock more upside—if regulatory clarity and macroeconomic signals align. For XRP, that means any movement on ETF approvals or legal clarity could ignite activity where it’s currently missing.

Quick Summary

XRP continues to struggle gaining traction among retail traders even as institutions hold strong, highlighting a growing divide in crypto investment strategies this August.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.