XRP is back in the spotlight as Ripple steps up its financial involvement in the crypto ecosystem, extending a significant $75 million credit facility to Gemini in an ambitious move that supports the exchange’s IPO aspirations.

XRP is back in the spotlight as Ripple steps up its financial involvement in the crypto ecosystem, extending a significant $75 million credit facility to Gemini in an ambitious move that supports the exchange’s IPO aspirations. This development highlights Ripple’s ongoing strategy to position XRP not just as a token, but as a critical liquidity vehicle in broader financial operations.

Ripple and Gemini Forge Financial Alliance

According to Gemini’s recent S-1 IPO filing, Ripple has granted the crypto exchange a $75 million credit line. The deal arrives as Gemini prepares to become the third crypto exchange to file for a public listing in the U.S. This partnership underscores the increasing convergence of traditional finance and crypto-native firms, especially as exchanges face tighter liquidity and heightened regulatory scrutiny.

Ripple’s decision to funnel such capital into Gemini could boost XRP’s utility. Credit lines like this are typically used to smooth out operational expenses or fuel growth. For Ripple, it’s a clear indication that XRP continues to be utilized beyond speculation—as an asset that powers real-time liquidity solutions.

How the Market Is Reacting

Despite this positive development for XRP, the broader crypto market is showing mixed signals. Bitcoin remains under downward pressure after breaching a major bullish trendline from April, hovering around $114,600. Market data reveals that first-time buyers have increased their holdings, suggesting some renewed confidence, while loss sellers—those selling below cost—have surged by nearly 38%, according to CryptoQuant.

This data points to a bifurcated market sentiment. On one hand, short-term traders are exiting positions, likely spooked by the recent price dip. On the other, long-term holders are stepping in, seeing potential value in the downturn. How well the market absorbs these outflows could dictate whether a rebound materializes or broader weakness sets in.

Ethereum Tests Key Levels

On the Ethereum front, the price is retracing with a test of support near the critical $4,100 level. As FxPro’s Alex Kuptsikevich notes, maintaining levels above this former resistance could signal a shift in market dynamics, hinting at new bullish momentum. Ethereum’s long-term sustainability largely depends on whether capital inflows continue to support this trend.

Macro Trends and Regulatory Watch

The Ripple-Gemini deal also comes amid broader macroeconomic and regulatory developments. Upcoming economic data and commentary from Federal Reserve officials could influence financial markets beyond the crypto sector. Meanwhile, events like the CoinDesk Policy & Regulation conference on September 10 will shape the regulatory environment these firms operate within.

Gemini’s IPO push, fueled by Ripple’s backing, sends a strong message to policymakers: that crypto entities want to play by the rules and expand through regulated channels. This could bolster industry credibility, especially with more crypto-native companies considering public listings.

Market Implications for XRP

XRP remains central to Ripple’s tactical moves, and its use in real-time payments is only becoming more relevant. While volatility persists across cryptocurrencies, Ripple’s investment strategy continues to reaffirm its long-standing vision: to make XRP a go-to asset for liquidity provisioning in traditional and digital finance alike.

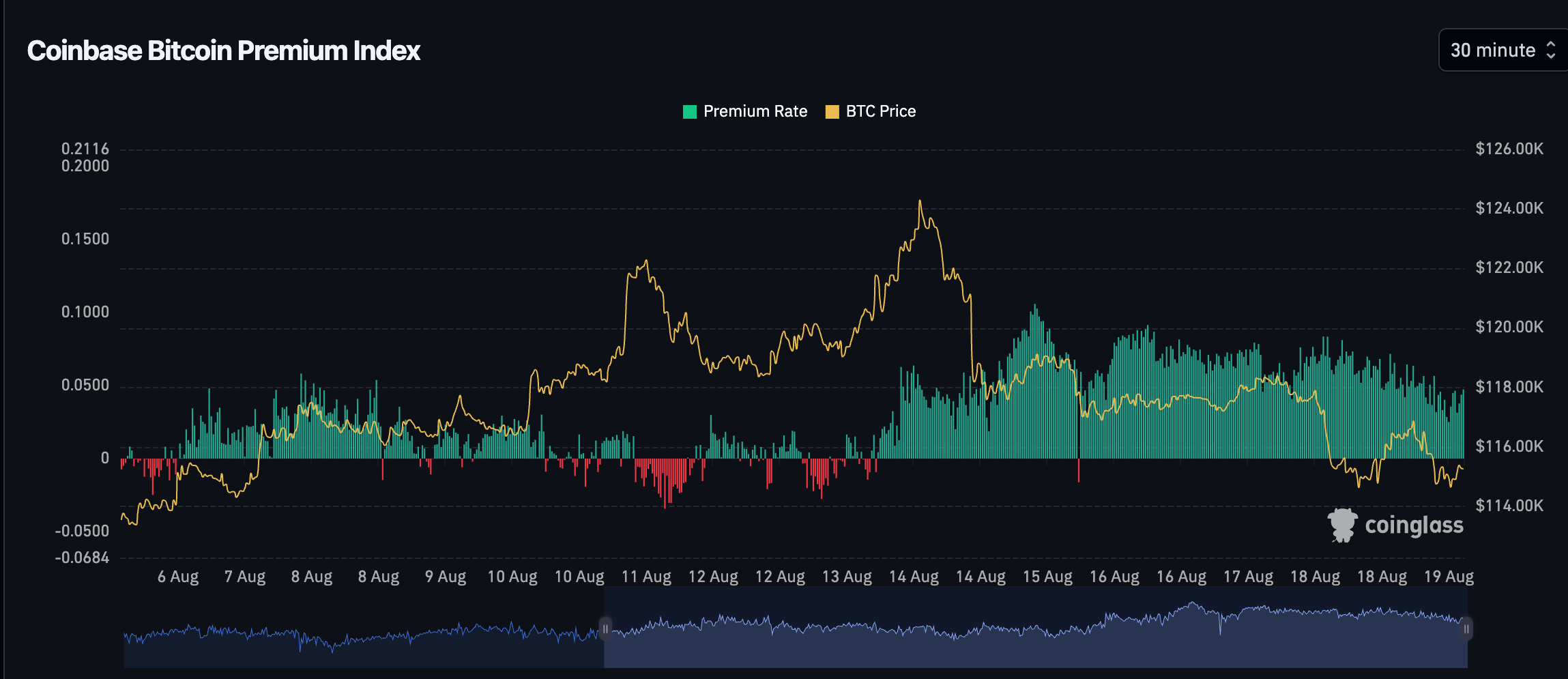

The Coinbase premium has remained positive, signaling solid demand from American investors relative to offshore exchanges.

Related: XRP Price: $12M Max Pain for Bears

With positive activities like the Gemini credit facility and institutional investor interest gradually returning, XRP could find itself benefiting even in a mixed broader market environment. Long-term, Ripple’s moves suggest a well-capitalized and strategically positioned ecosystem—signaling that despite near-term volatility, stability and utility continue to be XRP’s fundamental narrative.

Quick Summary

XRP is back in the spotlight as Ripple steps up its financial involvement in the crypto ecosystem, extending a significant $75 million credit facility to Gemini in an ambitious move that supports the exchange’s IPO aspirations.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.