XRP options activity is heating up, as a massive block trade involving $4 strike call options made headlines this week despite the cryptocurrency’s falling value.

XRP options activity is heating up, as a massive block trade involving $4 strike call options made headlines this week despite the cryptocurrency’s falling value.

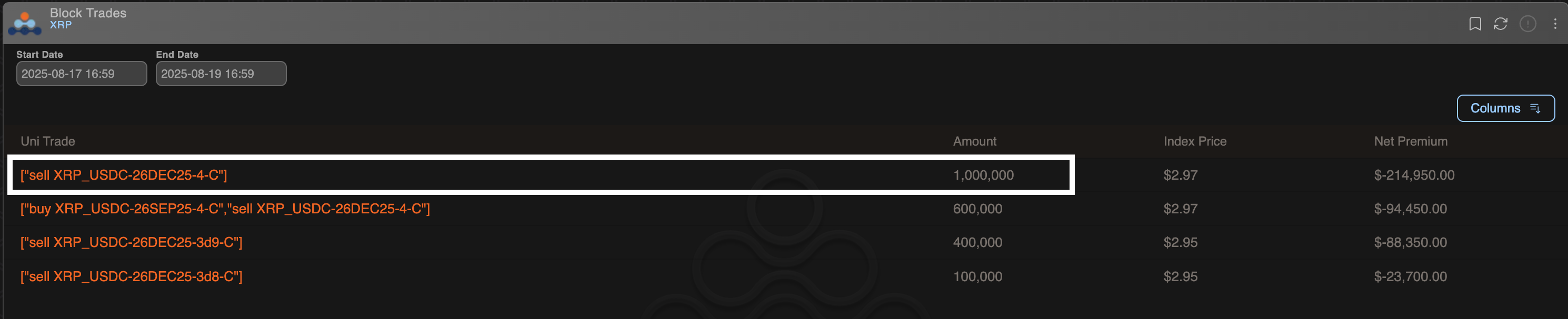

According to data from Amberdata, a million contracts of $4 strike XRP calls set to expire on December 26 were traded in a single over-the-counter transaction earlier this week. Each Deribit contract represents 1,000 units of XRP, making this trade one of the largest of its kind on record.

How the XRP Block Trade Points to Covered Call Strategy

Though on the surface this trade may seem like an optimistic bet on XRP hitting $4 by year-end, market analysts suggest otherwise. The trade is likely part of a “covered call” strategy, where an investor already holding XRP writes higher strike options to generate extra income while capping future upside.

“I would guess some big holder was doing covered calls,” said Lin Chen, Head of Asia Business Development at Deribit, in a statement to CoinDesk.

This means the trader selling the options may not be anticipating a breakout in XRP’s price, but rather is seeking to earn a premium while waiting for renewed momentum in the market. Market makers are presumed to be the buyers, absorbing the trade in order to maintain liquidity and balance their exposure.

Chart illustrating large block flows in XRP call options, indicating strategic trading activity. (Amberdata)

What the Covered Call Strategy Means for XRP Investors

Covered calls involve selling out-of-the-money (OTM) options on assets already held. This strategy is a common income-generating tool among investors, particularly in scenarios where they expect sideways or modestly bullish price movement. The premium received acts as a form of yield, but it does limit profit potential if the underlying asset surges.

This strategy has gained traction not just in XRP, but traditionally with Bitcoin holders. Over the last two years, widespread use of covered calls has been linked to a drop in implied volatility, as these trades help stabilize expectations around future price movement.

XRP Market Price Trends Amid Strategy Deployments

XRP’s spot price dipped to $2.94 earlier this week, mirroring the broader downturn across the crypto asset class. The coin has since rebounded slightly, now trading just over $3, according to CoinDesk data. In contrast, XRP reached all-time highs of more than $2.60 just last month, showing rapid market fluctuation that’s becoming the norm in volatile crypto environments.

Despite these price swings, strategic moves like the recent block trade signal sophisticated investors’ ongoing engagement with XRP. These market participants are increasingly turning to structured options strategies to navigate uncertain short-term outlooks while maximizing returns on their holdings.

Related: XRP Price: $12M Max Pain for Bears

With XRP call option flows gaining such scale and strategic nuance, it’s clear that derivatives play a significant role in shaping price behavior and investor sentiment in the evolving crypto finance landscape.

Quick Summary

XRP options activity is heating up, as a massive block trade involving $4 strike call options made headlines this week despite the cryptocurrency’s falling value. According to data from Amberdata, a million contracts of $4 strike XRP calls set to expire on December 26 were traded in a single over-the-counter transaction earlier this week.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.