The ETF outflows in the cryptocurrency space are signaling increased investor caution as traders brace for Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole.

The ETF outflows in the cryptocurrency space are signaling increased investor caution as traders brace for Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole. This development suggests that risk appetite is waning across digital assets, spurred by uncertainty in broader economic data and central bank policy direction.

Bitcoin and Ethereum Rebound Slightly Amid Market Weakness

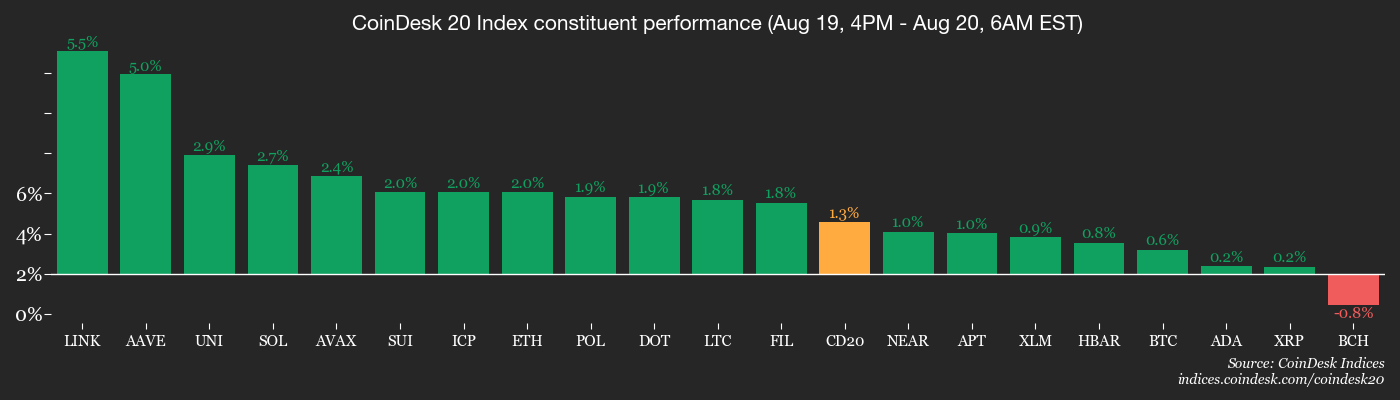

Bitcoin (BTC) and Ethereum (ETH) have posted modest recoveries from Tuesday’s lows, yet both assets remain weaker over a 24-hour window, according to major indexes such as the CoinDesk 20 and CoinDesk 80. ALT coins show mixed performance, with only OKB and Chainlink (LINK) achieving gains over 3% in the top 100 list.

Market participants have turned their attention to Powell’s upcoming remarks, anticipating clarity on future U.S. monetary policy. According to QCP Capital, the recent wave of selling implies a fragile short-term investor position, leaving the crypto market vulnerable to sharp movements, particularly if Powell adopts a hawkish stance or upcoming economic indicators—like labor or inflation data—surprise traders.

ETF Outflows Show Risk-Off Shift

One notable indicator of investor nervousness is the near $1 billion net outflow from spot bitcoin and ether exchange-traded funds. On Tuesday alone, spot Bitcoin ETFs experienced net withdrawals totaling $523.3 million, while spot Ether ETFs saw $422.2 million in outflows, according to data from Farside Investors.

These outflows suggest traders are offloading riskier assets as they await Powell’s comments. Nicolai Sondergaard, a research analyst at Nansen, observed that the market has largely priced in upcoming rate cuts. However, if Powell’s statements merely confirm existing expectations, it might lead to a muted or bearish reaction—typical of a “sell the news” scenario. On the contrary, expectations could shift bullish if deeper or faster interest rate reductions are signaled.

Derivative and Futures Activity Reflects Market Realignment

Derivatives market data shows that $448 million worth of leveraged crypto positions, primarily long bets, were liquidated over a 24-hour stretch. Despite this, open interest in BTC, DOGE, and XRP has dipped, reflecting a contraction in market enthusiasm rather than a rush to short positions.

Coinglass data highlights a rise in open interest for LINK, HYPE, and SUI, while ETH’s positioning remains stable. Funding rates for major tokens continue to edge mildly positive, although ADA and XMR present a contrarian trend with negative bias.

Meanwhile, CME’s Solana futures remain active around record-high levels, with open interest exceeding 4.6 million SOL. Premiums have climbed to 16%, marking robust capital inflows into SOL-based derivatives.

Institutional Footprint Expands in Ethereum Options

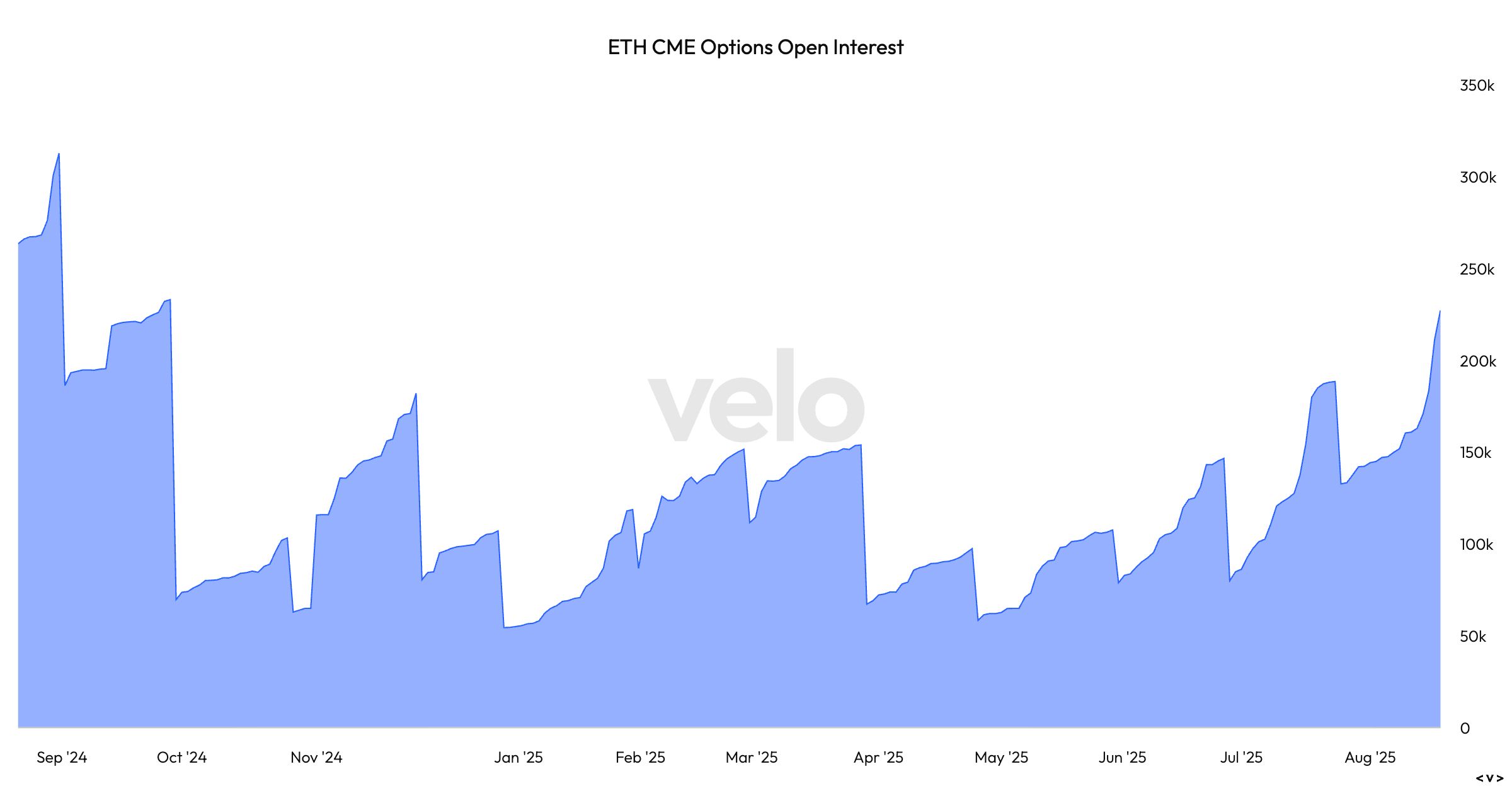

Chart displaying the surge in open interest for Ethereum options on CME, reflecting rising institutional hedging activity.

Open interest on Ethereum options listed on the CME has soared to 226.9K ETH—its highest level since September. This uptick suggests growing institutional demand for hedging exposure to Ethereum’s price volatility.

Market Sentiment: Profit-Taking, Flat Futures, and Cautious Bulls

Data from on-chain analytics firm CryptoQuant reveals that the recent decline in Bitcoin prices correlates with profit-taking by wallets holding BTC for fewer than 155 days. Historically, such behavior has preceded major pullbacks, like those seen earlier in the year.

Currently, BTC is trading 0.4% higher at $113,757.49, and ETH is up 1.55% at $4,217.10. However, both assets are still down over the past 24 hours. The CoinDesk 20 index shows a 2.26% decline, adding to the bearish undertone.

Visual representation of CD20 performance hints at broader market correction trends.

Technical Readings Suggest Weak Bullish Momentum

While the S&P 500 and Nasdaq have broken through their early-year highs, the Dow Jones Industrial Average has lagged behind. Technical charts indicate that DJIA is struggling to gain ground above a trendline formed by its December–February peak range.

Dow Jones Industrial Average technical analysis showing resistance at prior highs.

This underperformance is significant, as the DJIA often acts as a barometer for market risk appetite. If this index rolls over, it might further dampen sentiment across risk-on sectors including crypto.

Conclusion: Market on Edge Ahead of Fed Signal

The crypto space is clearly in a state of heightened sensitivity as ETF outflows spike and leverage gets flushed from futures markets. With Powell’s highly anticipated speech at the Jackson Hole symposium mere hours away, traders are weighing every signal for clues on the interest rate path forward.

Related: XRP Price: $12M Max Pain for Bears

Whether Powell confirms market expectations or surprises with a hawkish pivot will likely determine whether digital assets stabilize or continue their recent slide. Either way, all eyes remain on the Fed as crypto braces for its next big catalyst.

Quick Summary

The ETF outflows in the cryptocurrency space are signaling increased investor caution as traders brace for Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole. This development suggests that risk appetite is waning across digital assets, spurred by uncertainty in broader economic data and central bank policy direction.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.