Bitcoin market structure continues to exhibit signs of strength and long-term resilience, despite the cryptocurrency currently trading nearly $11,000 below its August 14 high of $124,481, as reported by CoinDesk.

Bitcoin market structure continues to exhibit signs of strength and long-term resilience, despite the cryptocurrency currently trading nearly $11,000 below its August 14 high of $124,481, as reported by CoinDesk.

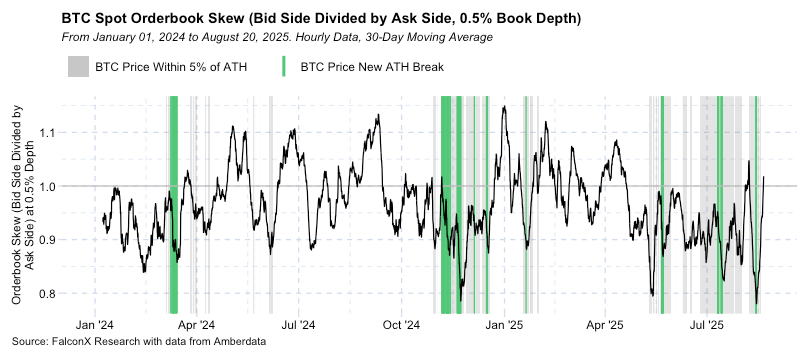

David Lawant, Head of Research at FalconX, believes the internal health of the market remains “extremely bullish.” Through a recent post on X, he outlined how the dynamics within the bitcoin order book are providing bullish signals when price pullbacks occur.

Understanding the Bullish Flip in the Order Book

Lawant explained that when bitcoin experiences a slight decline, sell orders quickly disappear while buy orders flood the market. This transition, often referred to as the order book “flipping,” signals that demand is persistently active and ready to absorb downward movements.

In practical terms, this means that selling pressure is shallow—sellers retreat quickly after small dips, allowing buyers to step in aggressively. According to Lawant, this behavior is often driven by institutional investors and well-funded market participants who use these brief pullbacks as entry points.

Chart illustrating how Bitcoin buy orders outpace sell orders during market dips, indicating institutional demand.

The chart Lawant shared visually confirms this market behavior. Following minor pullbacks, there is a noticeable surge in buy-side activity, replacing the sell-side dominance. This switch is a hallmark of bullish market structure — a sign of strong demand patiently waiting to capitalize on any selling activity.

For market participants, this can be interpreted as a sign of continued confidence. The absence of follow-through selling combined with an uptick in buying interest shows that the market is upheld by foundational strength rather than speculative spikes.

Technical Indicators Reinforcing Bullish Sentiment

Data from CoinDesk Research’s technical analysis model between August 19 at 17:00 UTC and August 20 at 16:00 UTC further supports the bullish case. During this window, bitcoin traded within a $1,899.78 range, dipping to a low of $112,437.99 and reaching a high at $114,337.77.

The most notable movement occurred around 13:00 UTC on August 20, when bitcoin dropped to $112,652.09 amid brief liquidation pressures. However, the market rebounded with strength, highlighted by significant trading volumes—14,643 BTC exchanged hands compared to the 24-hour average of just 9,356 BTC.

This activity marked the zone between $112,400 and $112,650 as a vital support area, backed by volume. In the final hour of that analysis period (15:47–16:46 UTC), bitcoin climbed from $113,863.05 to $114,302.43 before closing at $113,983.06.

This surge shattered multiple layers of resistance—at $113,500, $113,650, and $114,000—fueled by high-volume buying above 250 BTC per minute. Analysts see this rally as the opening move of a new short-term uptrend.

Why Institutional Confidence Drives Market Strength

What makes this bullish structure significant is the quality of the buyers. The pattern suggests that sophisticated institutions and large funds are driving this demand. These players are less likely to dump assets quickly and tend to have longer investment horizons, further adding to market stability.

This behavior stands in contrast to retail-driven markets, which are often more prone to volatility due to emotional reactions and quick exits during downturns. The current dynamics underscore the growing maturity of the bitcoin market, with deep-pocketed participants treating temporary price dips as buying windows rather than warning signs.

As bitcoin remains below its August 14 record, bullish sentiment among analysts like Lawant persists. Their optimism isn’t rooted in price alone but in the consistent behavior of supply and demand observed in recent trading activity. Ultimately, this structural integrity points to a resilient bitcoin market, well-positioned for future growth.

Related: Cardano Bull Setup Points to December Rally

Parts of this article were generated with the help of AI toolsets and reviewed to meet editorial standards. See CoinDesk’s AI policy for full details.

Quick Summary

Bitcoin market structure continues to exhibit signs of strength and long-term resilience, despite the cryptocurrency currently trading nearly $11,000 below its August 14 high of $124,481, as reported by CoinDesk.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.