Bitcoin experienced a dramatic flash crash following earlier gains sparked by Fed Chair Jerome Powell, a move that indicates deep unease in the options market despite initial optimism.

Bitcoin experienced a dramatic flash crash following earlier gains sparked by Fed Chair Jerome Powell, a move that signals deep unease in the options market despite initial optimism. The leading cryptocurrency fell sharply below $111,000 in under ten minutes early Monday, rapidly reversing the positive momentum from Powell’s dovish remarks last Friday.

Massive Whale Selloff Triggers Flash Crash

Between 07:30 and 07:40 UTC, Bitcoin’s price tanked from $114,666 to $112,546—a drop of more than 2%—according to blockchain trackers. The sudden plunge was triggered by a sizable whale offloading 24,000 BTC, valued at over $300 million, amid thin liquidity.

This major sell-off was confirmed by Timechainindex.com researcher Sani, who noted that the entire 24,000 BTC balance was sent to Hyperunite, with 12,000 BTC sold on Monday alone. The selling appears to be ongoing, contributing to downward pressure in the market.

Interestingly, blockchain data reveals that these funds originated from HTX nearly six years ago and remained dormant until now. The active address, once holding approximately 24,000 BTC, is linked to a much larger holding—152,874 BTC across various associated wallets, including one still carrying 5,266 BTC.

After hitting an intraday low below $111,000, Bitcoin prices only partly recovered, trading at around $112,800 at the time of writing, according to CoinDesk’s real-time data.

Powell’s Dovish Tone Fails to Hold Momentum

Last Friday, Powell’s remarks at the annual Jackson Hole symposium fueled a surge across risk assets. He suggested that the Federal Reserve could pivot toward interest rate cuts, playing down inflationary risks tied to President Trump’s tariff strategy.

This perceived dovishness sent BTC soaring nearly 4% from $112,500 to $116,900. U.S. equity markets also rallied, and the dollar index dropped, reinforcing risk-on sentiment.

Over the weekend, numerous analysts continued expressing confidence in the likelihood of a rate cut by September, adding to bullish expectations for both Bitcoin and Ether to reach new highs.

Options Market Remains Cautious

Despite the apparent shift in macro policy tone, the Bitcoin options market paints a more cautious picture. Data from Amberdata shows that risk perceptions among traders remain elevated.

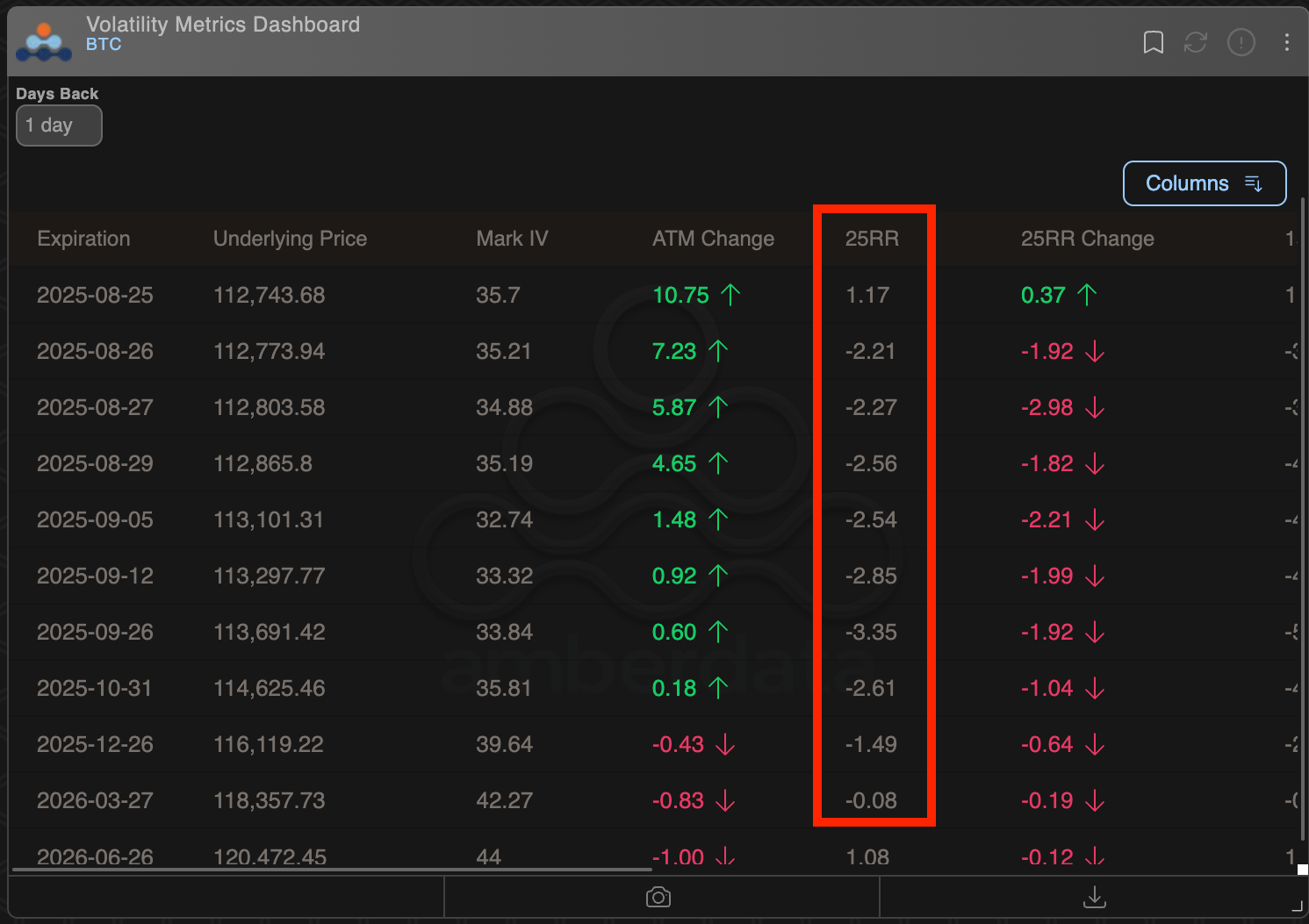

The 25-delta risk reversals—a measure comparing the pricing of call and put options—remain in negative territory through December’s expiry. This indicates that investors are paying a premium for put options, which protect against price declines, signaling prevailing bearish sentiment.

Essentially, options traders are not fully buying into the Fed’s dovish tilt. Their hedging behavior reflects ongoing concerns about Bitcoin’s volatility and the potential for further downside movements.

A chart showing BTC’s bearish options skew through year-end, suggesting continued trader caution.

Read more: Asia Morning Briefing: Bitcoin’s ETFs Kill the Transaction Fees, Punishing the Miners More

Quick Summary

Bitcoin experienced a dramatic flash crash following earlier gains sparked by Fed Chair Jerome Powell, a move that signals deep unease in the options market despite initial optimism. The leading cryptocurrency fell sharply below $111,000 in under ten minutes early Monday, rapidly reversing the positive momentum from Powell’s dovish remarks last Friday.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.