Bitcoin’s recent flash crash has triggered speculation that an altcoin season may be on the horizon. As Bitcoin (BTC) slides back to its pre-Powell rally levels, liquidity appears to be migrating toward altcoins, particularly Ethereum.

Bitcoin’s recent flash crash has triggered speculation that an altcoin season may be on the horizon. As Bitcoin (BTC) slides back to its pre-Powell rally levels, liquidity appears to be migrating toward altcoins, particularly Ethereum.

Following a short-lived surge powered by Federal Reserve Chair Jerome Powell’s dovish commentary, the value of BTC pulled back sharply, weakening its upward momentum. This move led to synchronized losses in Ethereum and altcoins like Solana, dampening recent bullish sentiment across the broader crypto market.

Altcoin Momentum Rises as Bitcoin Retreats

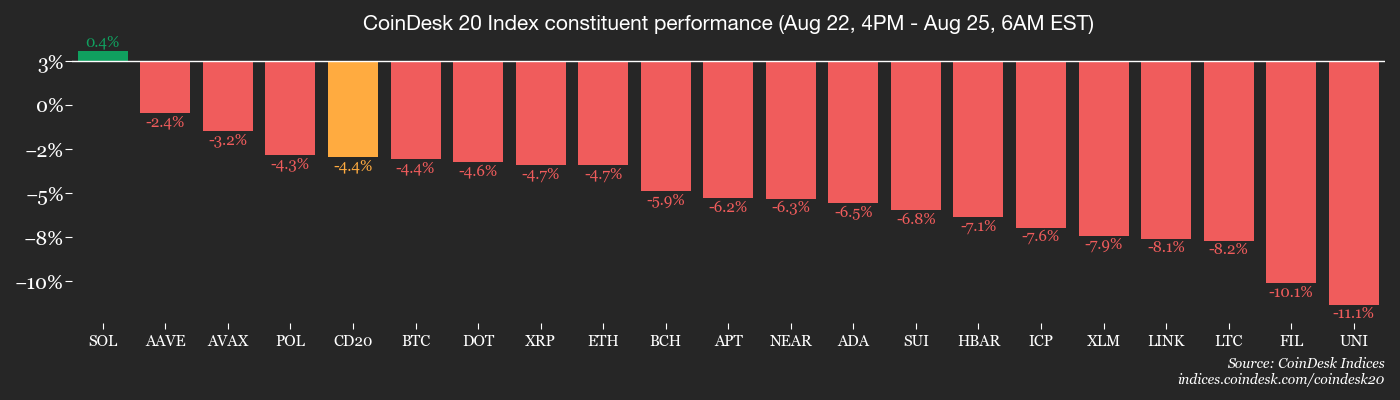

The CoinDesk 20 Index (CD20) and the broader CoinDesk 80 (CD80) Index dropped 3% and 3.74% respectively in 24 hours. According to FxPro’s Alex Kuptsikevich, BTC dropped to $110,000—marking its lowest level since early July—and now trades around $112,000. He observes that liquidity is shifting from BTC toward altcoins, suggesting the potential onset of a “sell-on-rise” phase that could extend beyond Bitcoin.

Fueling this narrative, blockchain analytics firm Lookonchain reported that a seasoned Bitcoin whale has started diversifying holdings into Ethereum.

Institutional Buyers See Opportunity

Despite short-term volatility, QCP Capital maintains a positive long-term outlook for Bitcoin. They point to July’s institutional absorption of nearly 80,000 BTC and anticipate continued strategic dip-buying from large investors. Reinforcing this trend, Tokyo-listed Metaplanet acquired another 103 BTC, citing support from Japan’s Finance Minister who views crypto as a valid asset class for portfolio diversification.

Rise of Decentralized Trading Platforms

Perpetual futures platform Hyperliquid reported a record-breaking daily spot volume of $3.4 billion, fueled by BTC and ETH inflows. With $1.5 billion in BTC volume, Hyperliquid now ranks as the second-largest spot trading venue in both centralized and decentralized segments. This performance highlights the growing relevance of on-chain trading ecosystems.

CoinDesk 20 Index drops amid BTC’s volatility, reflecting wider crypto market weakness.

Trading Outlook on XRP and Altcoins

XRP’s current positioning within the Ichimoku cloud underscores an uncertain trend. Key technical signals suggest that a fall below the cloud could lead to continued bearish action. Last month’s peak at $3.65 formed a classic tweezer top chart pattern, often viewed as a bearish reversal indicator.

XRP trades within the Ichimoku cloud, signaling market indecision and potential for trend reversal.

Derivatives Data Reveal Investor Sentiment

Futures markets reflect BTC’s cautious sentiment. Open interest (OI) has risen despite price drops, commonly seen as confirmation of a downward trend. Altcoin OI added a staggering $9.2 billion in just one day, pushing combined OI to a historic $61.7 billion. This uptick suggests traders are placing high-leverage bets on altcoins, intensifying market volatility.

CME Ether options mirrored this shift as their notional OI exceeded $1 billion—a record high. BTC options OI also reached its highest level since April, signaling strong institutional hedging. Deribit data revealed longer-term BTC put preference while ETH calls led slightly, showcasing sentiment divergence.

Broader Market Themes and Events

Traditional markets showed mixed signals. The U.S. Dollar Index edged slightly higher, while major indices like the S&P 500 and Nasdaq saw minor declines. Gold and silver prices remained soft. Meanwhile, Japan’s Finance Minister reiterated crypto’s value in balanced investment portfolios—a statement likely to fuel more institutional participation.

Other upcoming events include the launch of token listings such as DNA, KEK, and CUDIS across various exchanges. The Mantle Network will activate its mainnet upgrade supporting Ethereum’s Prague update, while Supra will host a community call for governance updates.

Tech Infrastructure and Trading Ecosystems

Hyperliquid’s growing presence in the DeFi sector is notable. Its Layer-1 protocol, HyperCore, offers high throughput and sub-second finality, making it compatible with both high-frequency traders and dApps. With roughly 60–70% dominance in the DEX perpetuals space, Hyperliquid stands out by linking token performance (HYPE) directly to platform usage through buybacks funded by trading fees.

Conclusion: Is Altcoin Season Starting?

The current sentiment across markets suggests BTC may be entering a distribution phase, prompting capital flows into altcoins. This setup, combined with institutional activity, strong derivatives figures, and increasing retail engagement on decentralized platforms, may pave the way for an extended period of altcoin leadership.

Related: Cardano Bull Setup Points to December Rally

While the situation remains fluid, all signs indicate that savvy investors should keep a close watch on altcoin performance for potential upside as Bitcoin enters a consolidation phase.

Quick Summary

Bitcoin’s recent flash crash has triggered speculation that an altcoin season may be on the horizon. As Bitcoin (BTC) slides back to its pre-Powell rally levels, liquidity appears to be migrating toward altcoins, particularly Ethereum.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.