XRP MACD bearish indicators are raising caution signs for investors as broader market conditions pivot around key economic events like upcoming Federal Reserve comments and the release of PCE inflation data.

XRP MACD bearish indicators are raising caution signs for investors as broader market conditions pivot around key economic events like upcoming Federal Reserve comments and the release of PCE inflation data.

Dollar Strength Weighs on Crypto Markets

Despite the Federal Reserve initiating its first interest rate cut since December, the U.S. Dollar Index (DXY) exhibited strength last week by closing with a dragonfly doji pattern. This classic bullish reversal pattern—characterized by its long lower wick and T-shaped structure—suggests potential for a stronger dollar ahead.

The DXY briefly dipped below support at 96.37 following the Fed news but rebounded sharply to close near 97.65. This resilience, bolstered by steady U.S. Treasury yields, adds weight to the pattern’s implications of a possible trend reversal upward.

Generally, a strengthening dollar puts downward pressure on crypto and other risk-sensitive assets, making this week critical for monitoring the ripple effects across digital currencies.

Visual comparison of the dollar’s performance alongside Bitcoin’s resistance zone.

Bitcoin Faces Key Resistance Levels

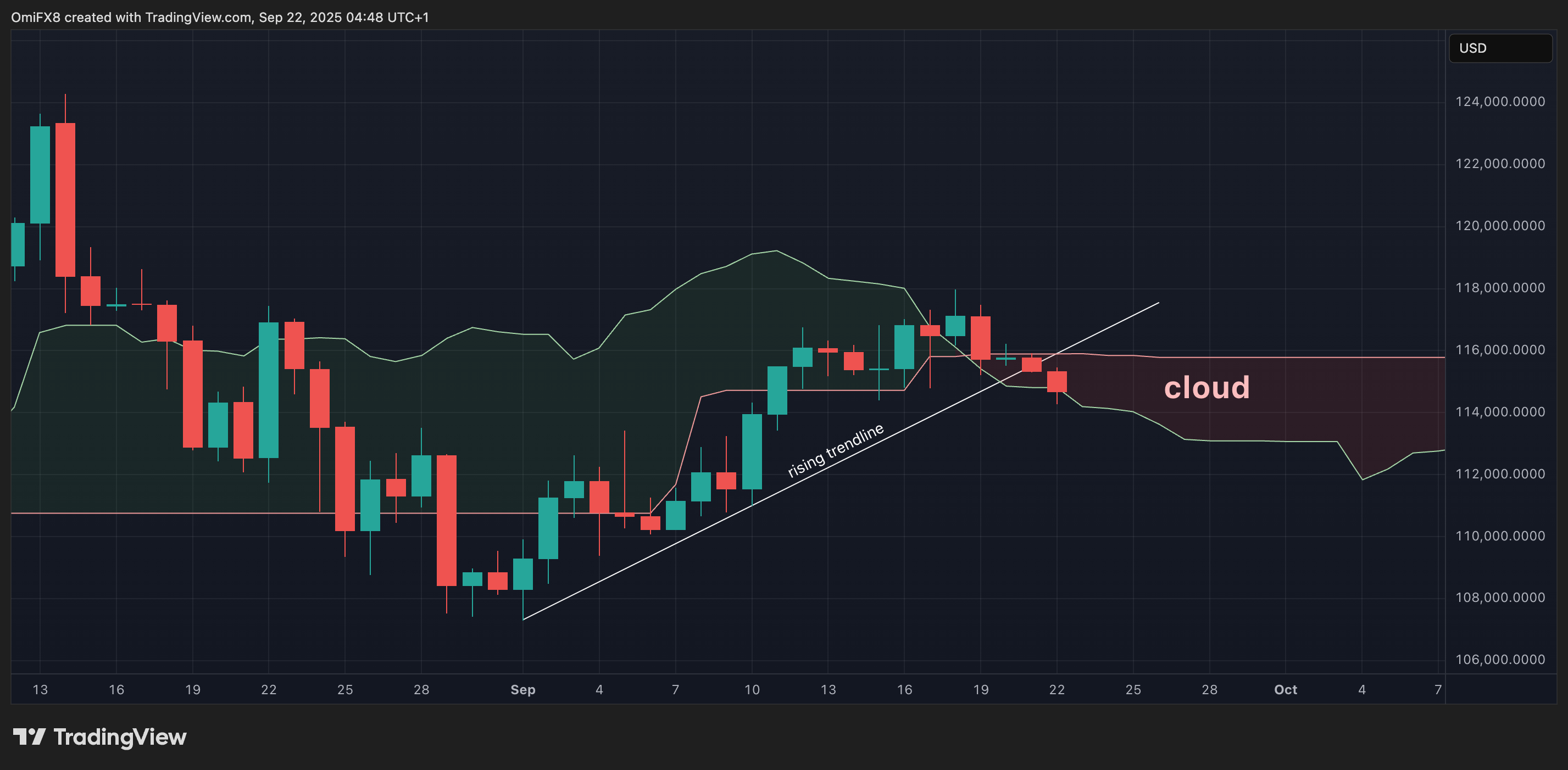

Bitcoin painted a neutral Doji candle last week as it approached a critical long-term resistance defined by peaks from the 2017 and 2021 rallies. This formation signals hesitancy among buyers, especially near levels where selling previously intensified.

On the daily chart, Bitcoin appears weak, as recent price action breached a trendline originating from the September 1 low. Additionally, the cryptocurrency is hovering below the Ichimoku cloud—often a marker of bearish momentum if confirmed further.

Key support lies near $114,473, representing the 50-day SMA, and $107,300 from the earlier September low. On the upside, Bitcoin must surpass $118,000 to disrupt the current bearish narrative.

Bearish chart signals suggest Bitcoin could see further downside.

Ethereum Breaks Below Key Pattern

Ethereum is undergoing its own technical challenges, having dropped under the lower boundary of a contracting triangle on the daily chart. This breakdown implies growing selling pressure, which may open the doors for deeper price declines.

Focus now shifts towards $4,062—its August 20 low—as the next technical support, with psychological backing at $4,000. Bulls, on the other hand, would need to recapture $4,458 to reassert control and temper current bearish themes.

Ethereum breaks out of triangle pattern to the downside, exposing further risks.

XRP’s Technicals Flash Bearish Despite ETF Launch

Turning to XRP, technical signals are worsening despite bullish news earlier in the week. The U.S. launch of an XRP-linked ETF failed to energize the market, with the Moving Average Convergence Divergence (MACD) indicator turning bearish on the weekly chart.

XRP prices appear to be retracting toward the upper trendline of a descending triangle—a signal that the recent breakout lacked the strength needed for a continued rally. The failure to hold above this level has made traders wary as momentum fades.

XRP pulls back despite ETF news; MACD turns negative.

Upcoming Events: Fed Speak and PCE Inflation

This week’s focus will revolve around comments from Federal Reserve Chairman Jerome Powell and other Fed officials. Despite the recent rate cut, Powell emphasized a data-driven approach during his speech, muting expectations for aggressive easing in the months ahead.

Another Fed member, Stephen Miran—who dissented in favor of a deeper 50 basis point cut—is also set to speak. Market participants will parse these comments for insight into the Fed’s evolving policy direction.

Related: XRP Price: $12M Max Pain for Bears

In addition, Friday’s release of the U.S. core Personal Consumption Expenditures (PCE) index—a key inflation marker the Fed monitors—is anticipated to show an annual rise of 2.7%, with August’s core figure seen increasing by 2.9% according to Amberdata. Any surprise inflation uptick could sway market sentiment further, particularly in crypto markets already showing weakness.

Quick Summary

XRP MACD bearish indicators are raising caution signs for investors as broader market conditions pivot around key economic events like upcoming Federal Reserve comments and the release of PCE inflation data. Dollar Strength Weighs on Crypto Markets Despite the Federal Reserve initiating its first interest rate cut since December, the U.S.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.