Stablecoins have exceeded a $300 billion market cap, indicating a solid adoption trend. The stablecoin market is poised to surpass 2024’s pace with heightened competition and new launches in 2025. Key players in 2025’s stablecoin growth have been Tether USDt, Circle’s USDC, and Ethena Labs’ USDe.

What to Know:

- Stablecoins have exceeded a $300 billion market cap, indicating a solid adoption trend.

- The stablecoin market is poised to surpass 2024’s pace with heightened competition and new launches in 2025.

- Key players in 2025’s stablecoin growth have been Tether USDt, Circle’s USDC, and Ethena Labs’ USDe.

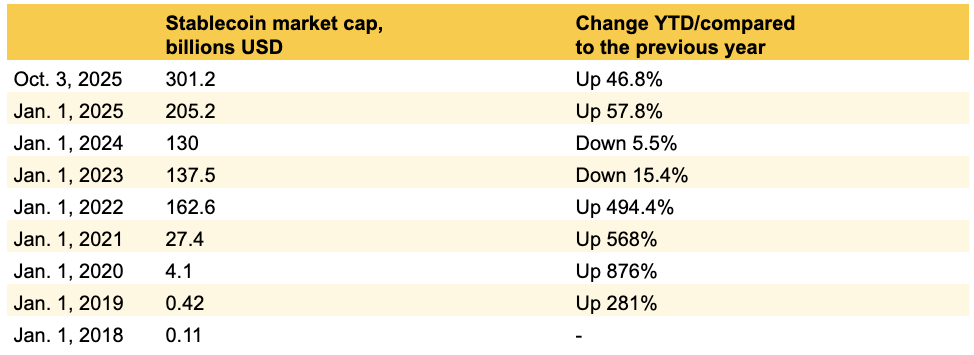

Riding the wave of intense competition and new launches this year, the stablecoin market, cryptocurrencies tethered to fiat currencies or commodities, has hit a milestone by exceeding a $300 billion market cap for the first time. Open-source aggregator DefiLlama data reveals this achievement was reached on Oct. 3, 2025, marking a 46.8% growth year-to-date.

Crossing the $300 billion threshold positions the stablecoin market on track to surpass the previous year’s pace. Lorenzo R, the co-founder of USDT0, emphasizes the importance of this milestone, stating that the current market infrastructure should be scalable to accommodate the market’s trillion-dollar trajectory.

To replicate the same 58% growth witnessed last year, the stablecoin market would need to gain an additional $23 billion by the year’s end. Considering the $40 billion added in the third quarter alone, market analysts suggest that this is achievable. However, the 58% increase would not be the highest historically, as the market cap for stablecoins surged by 876% in 2019, rising from around $400 million to $4.1 billion within a year.

The stablecoin market continued to thrive during the pandemic era, expanding by 568% in 2020 and 494% in 2021, before experiencing its first major contractions in 2022 and 2023.

Stablecoin growth in 2025 has largely been propelled by Tether USDt, Circle’s USDC, and Ethena Labs’ yield-bearing stablecoin USDe. Despite the dominance of USDT and USDC in stablecoin inflows and market cap, Ethena’s USDe saw the largest spike in market share growth, surging more than 150% from around $6 billion in January to nearly $15 billion by October.

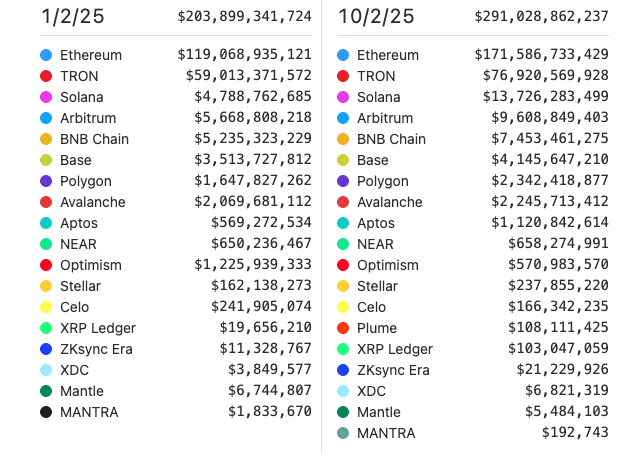

Meanwhile, Ethereum continues to rule the stablecoin industry, boasting a circulating stablecoin supply of $171 billion. Stablecoins on Ethereum have risen by around 44% in 2025, while Solana-based stablecoins surged nearly 70% from $4.8 billion to $13.7 billion.

The stablecoin circulation supply has also seen substantial growth on Arbitrum and Aptos, surging by around 70% and 96%, respectively.

EarnOS founder Phil George posits that while the $300 billion milestone is crucial, the unfolding trend is even more significant. He anticipates supply doubling again to $600 billion next year, spurred by more stablecoin launches by payment giants like Visa and the rise of transaction volume to $100 trillion.

Aryan Sheikhalian, head of research at CMT Digital, shares this bullish outlook, predicting mainstream integration at the $500 billion mark and a likely $1 trillion by the decade’s end as stablecoins permeate corporate treasuries and consumer payments.

“Longer term, if corporations like Amazon or Walmart issue their own tokens or adopt stablecoins at checkout, that’s the moment the rails of consumer finance will have fundamentally shifted.”

In conclusion, the stablecoin market’s meteoric rise to a $300 billion market cap symbolizes a significant stride towards mainstream adoption. The continued growth and competition in this space, coupled with institutional interest, suggest that stablecoins could become a cornerstone of the crypto market and consumer finance.

Quick Summary

Stablecoins have exceeded a $300 billion market cap, indicating a solid adoption trend. The stablecoin market is poised to surpass 2024’s pace with heightened competition and new launches in 2025. Key players in 2025’s stablecoin growth have been Tether USDt, Circle’s USDC, and Ethena Labs’ USDe.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.