Ripple co-founder Chris Larsen has realized substantial profits from XRP sales since 2018. XRP needs to overcome the $2.60 mark to reverse its current downtrend. Key technical indicators suggest a potential bullish reversal for XRP.

What to Know:

- Ripple co-founder Chris Larsen has realized substantial profits from XRP sales since 2018.

- XRP needs to overcome the $2.60 mark to reverse its current downtrend.

- Key technical indicators suggest a potential bullish reversal for XRP.

XRP’s price action is under scrutiny as Ripple’s co-founder, Chris Larsen, has reportedly realized significant profits from his XRP holdings since 2018. This activity has sparked discussions among investors about potential impacts on XRP’s price recovery. The focus remains on key price levels and market indicators that could signal a shift in momentum.

Larsen’s realized profits from XRP sales have reached $764.2 million since January 2018, according to CryptoQuant data. While some view this as standard profit-taking, others suggest it contributes to downward pressure on XRP, especially near local highs. Regardless, Larsen’s remaining XRP holdings could continue to influence market dynamics.

Congrats @ashgoblue and the @evernorthxrp team on today’s launch! Evernorth fills the missing link today in XRP capital markets, and XRP usage in DeFi products. I’m proud to invest 50M XRP in the firm (you may see some wallet movement on this). https://t.co/AAbkO6WlZe

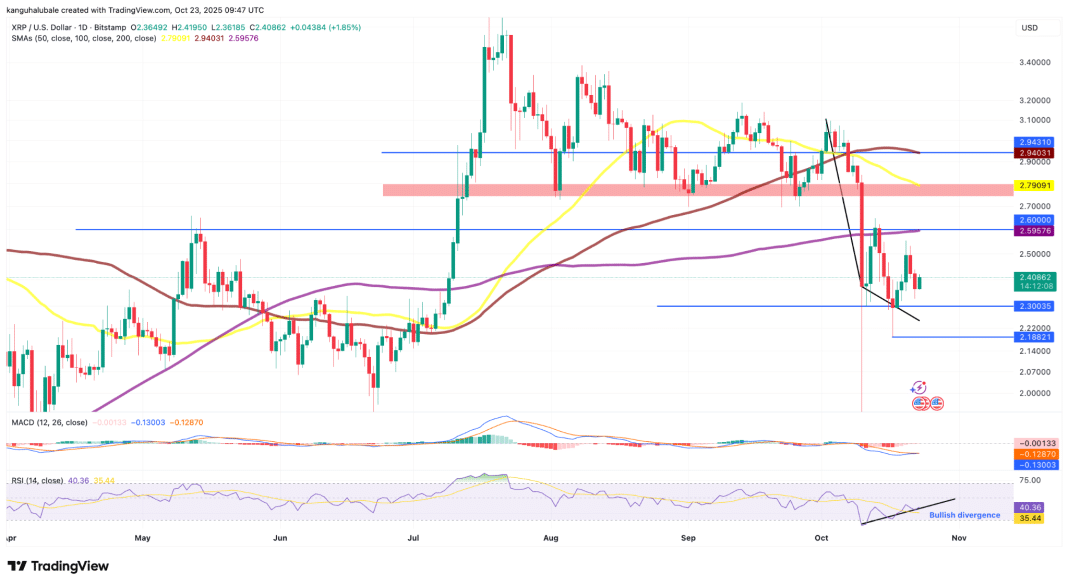

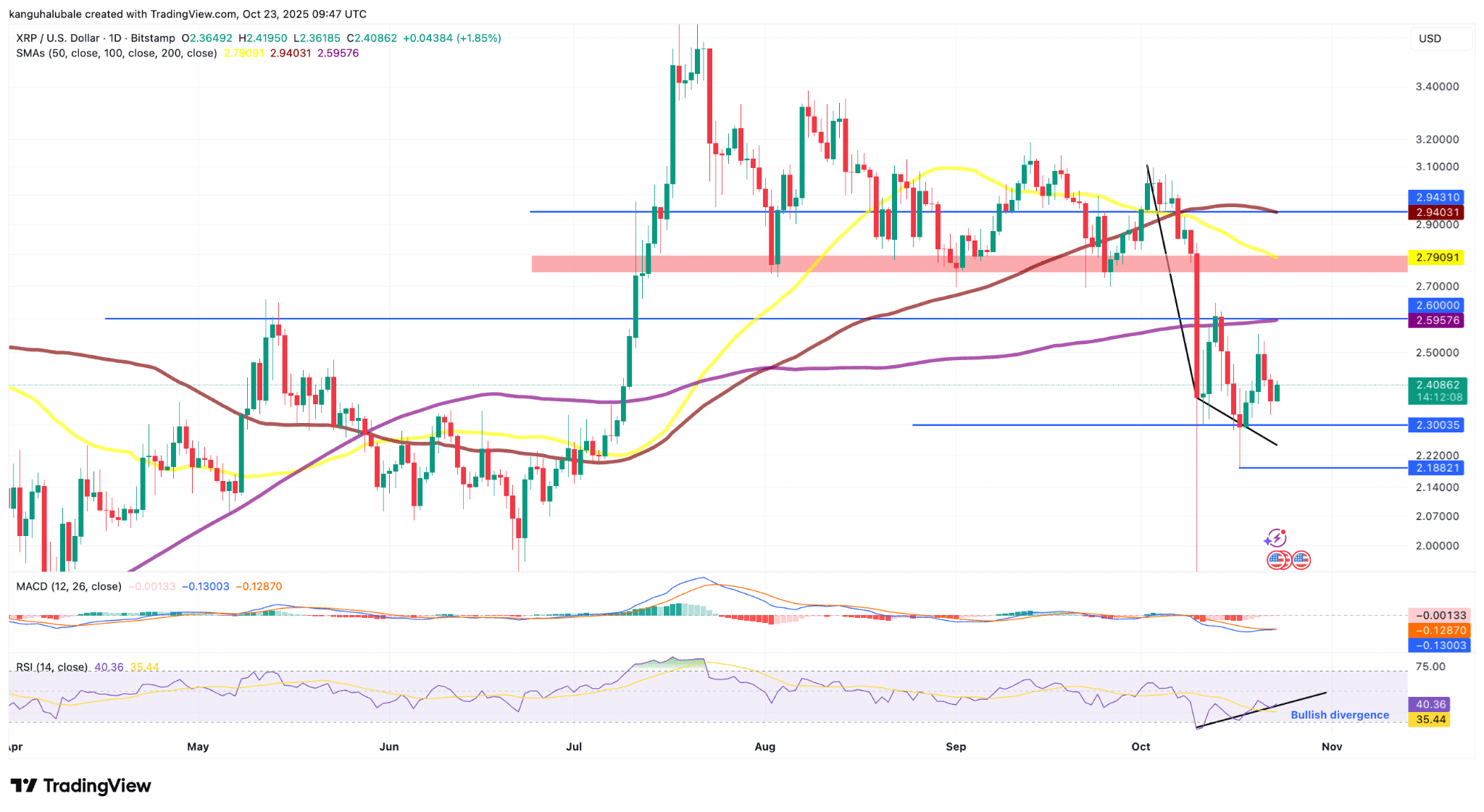

Technically, XRP needs to reclaim the 200-day simple moving average (SMA) at $2.60 to aim for higher targets above $3.00. Overcoming this level has historically preceded notable recoveries in XRP’s price. Subsequent resistance levels to watch include the 50-day SMA at $2.74-$2.80 and the 100-day SMA at $2.94, with a break above the latter potentially confirming the end of the downtrend.

Despite concerns, a bullish divergence between falling prices and a rising Relative Strength Index (RSI) hints at potential weakness in the current downtrend. This divergence, combined with a possible bullish moving average convergence divergence (MACD) crossover, could inject positive momentum into XRP’s price. Overcoming the 20-day exponential moving average (EMA) at $2.55 would further validate a potential comeback.

XRP faces a critical juncture as it navigates profit-taking activities and key technical resistance levels. Bullish signals from technical indicators suggest a potential shift in momentum, warranting close observation by traders and investors. Should XRP overcome these hurdles, it could pave the way for a more sustained recovery.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Ripple co-founder Chris Larsen has realized substantial profits from XRP sales since 2018. XRP needs to overcome the $2.60 mark to reverse its current downtrend. Key technical indicators suggest a potential bullish reversal for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.