Bitcoin’s recovery faces potential resistance around $118,000, but a breakthrough could lead to retesting its all-time high of $126,199. Several altcoins have rebounded from strong support levels, though they may encounter selling pressure at higher price points.

What to Know:

- Bitcoin’s recovery faces potential resistance around $118,000, but a breakthrough could lead to retesting its all-time high of $126,199.

- Several altcoins have rebounded from strong support levels, though they may encounter selling pressure at higher price points.

- Analyzing key price levels of Bitcoin, Ether, XRP, and other altcoins can provide insights into potential buying or selling opportunities.

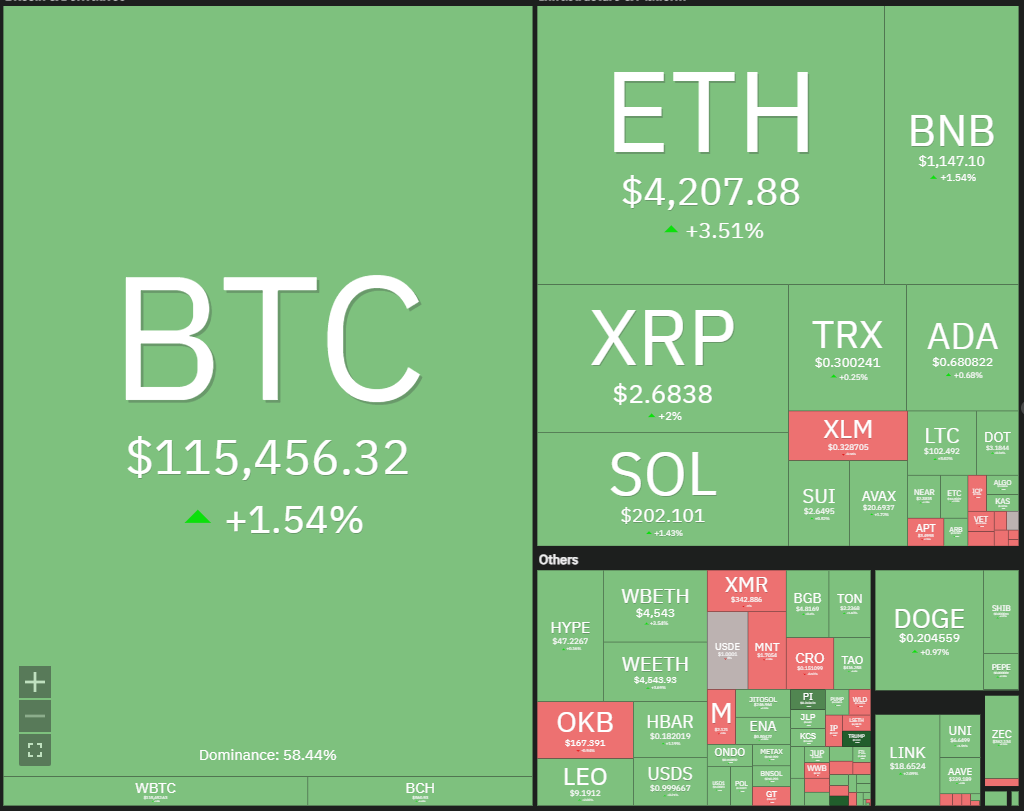

Bitcoin (BTC) is showing signs of a strong recovery, alongside several major altcoins, signaling renewed interest from buyers. Fueled by positive sentiment and potentially a U.S.-China trade deal, the crypto market is attempting to overcome recent headwinds. Investors are watching closely to see if this rally can sustain momentum or if resistance levels will trigger another pullback.

A key observation is Bitcoin’s consolidation near its all-time high, suggesting that many bulls are holding their positions, anticipating further gains. According to Galaxy Digital’s head of research Alex Thorn, maintaining above $100,000 is crucial for the structural bull market, indicating a critical level to watch. Overcoming the $118,000 resistance could set the stage for retesting the all-time high at $126,199.

XRP is also demonstrating recovery, surpassing its 20-day EMA, signaling a potential shift in momentum. A successful break above the downtrend line could confirm a trend reversal, opening the door for further upside. Conversely, a failure to hold above the 20-day EMA could lead to a retest of the $2.32 support level.

Glassnode said in an X post that the negative sentiment and selling pressure seem to have peaked, suggesting a possible trend reversal.

As Bitcoin and altcoins attempt to sustain their recoveries, traders should remain vigilant, recognizing that higher levels may attract sellers. Monitoring key support and resistance levels, as well as overall market sentiment, will be crucial for navigating potential volatility. The interplay between Bitcoin, altcoins like XRP, and broader economic factors will likely shape the market’s trajectory in the coming weeks.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s recovery faces potential resistance around $118,000, but a breakthrough could lead to retesting its all-time high of $126,199. Several altcoins have rebounded from strong support levels, though they may encounter selling pressure at higher price points.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.