Institutional investment in crypto continues to grow despite market fluctuations. Stablecoins are emerging as a key bridge connecting internet-native communities with digital currencies.

What to Know:

- Institutional investment in crypto continues to grow despite market fluctuations.

- Stablecoins are emerging as a key bridge connecting internet-native communities with digital currencies.

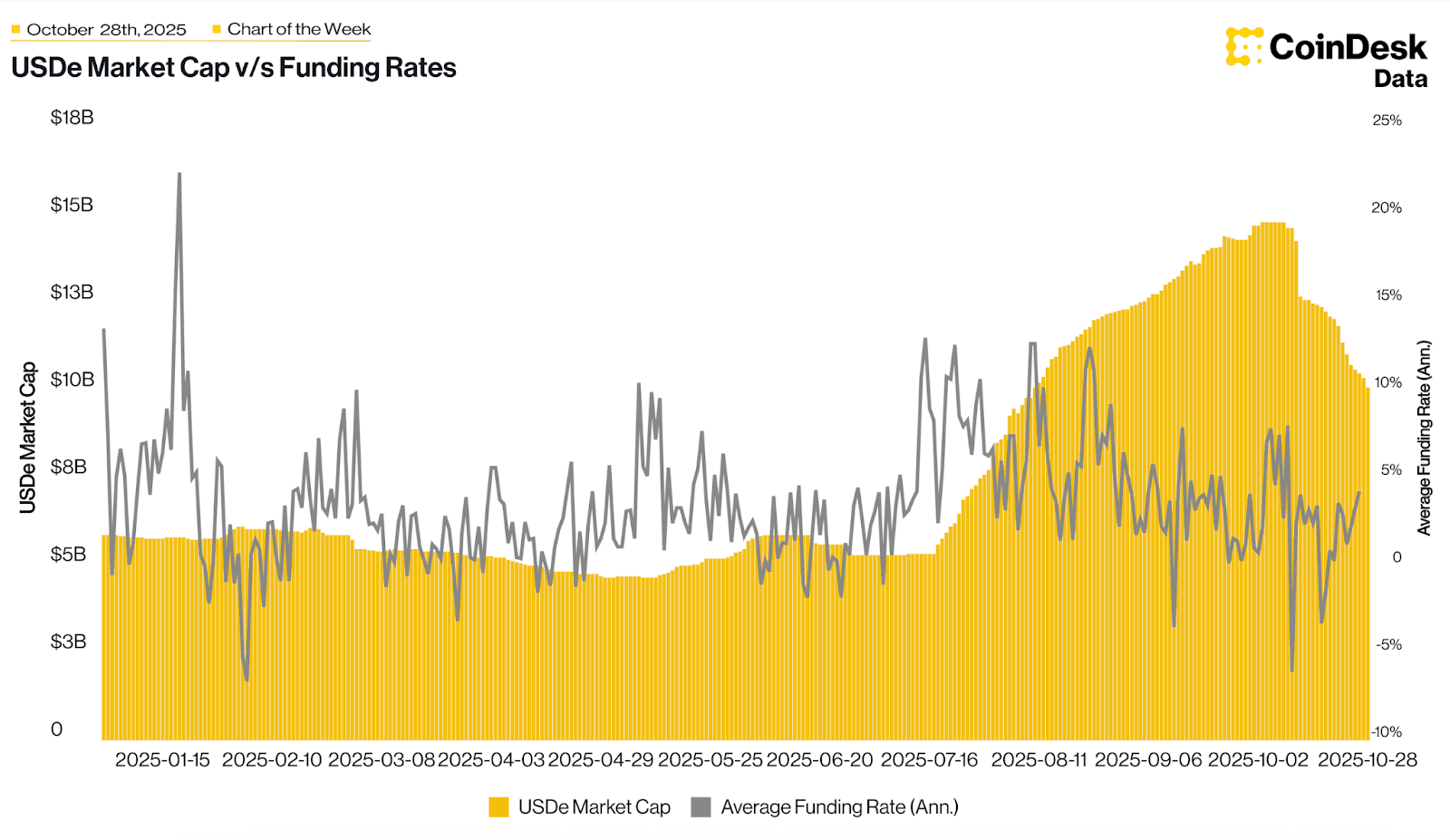

- Recent market corrections, like the one seen with Ethena’s USDe, highlight the importance of understanding underlying yield mechanisms.

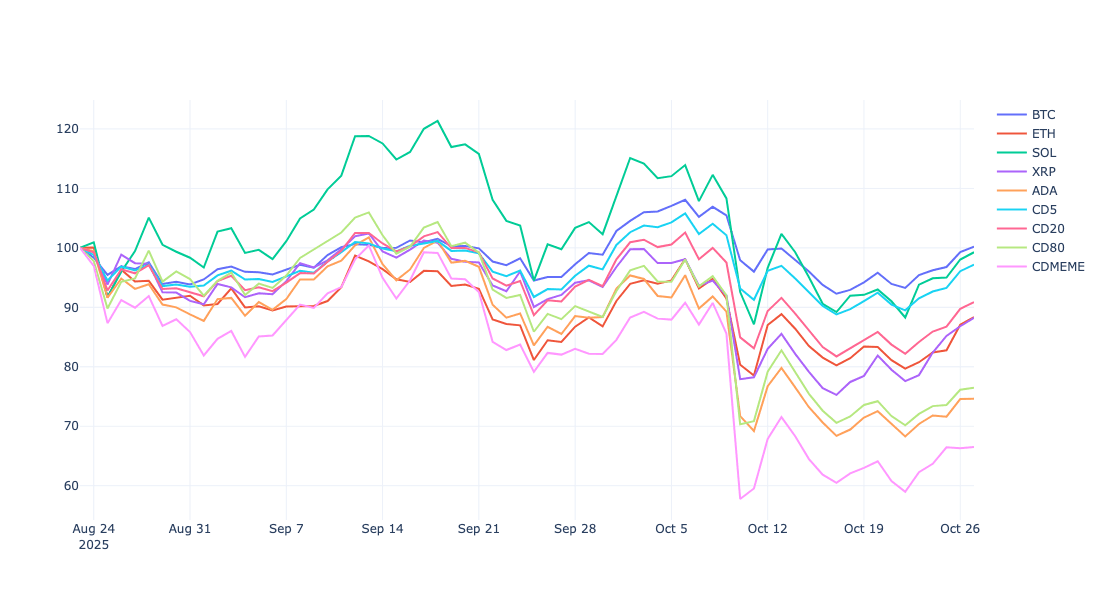

The cryptocurrency market is witnessing a dynamic interplay between fast money traders and slow money institutional investors. Recent developments suggest that while short-term volatility persists, long-term adoption and integration of crypto assets are steadily advancing. This trend is particularly evident in the growing interest in Bitcoin ETFs and the evolving regulatory landscape.

Mergers and acquisitions activity remains robust, signaling confidence in the future of the crypto industry. Coinbase’s acquisition of Echo and Ripple’s acquisition of Hidden Road, rebranded as Ripple Prime, demonstrate strategic moves to expand capabilities and market presence. These actions reflect a broader trend of consolidation and maturation within the crypto space.

Regulatory advancements, such as the SEC’s approval of generic listing standards, are streamlining the path for crypto ETFs. The approval of GDLC, the first U.S. crypto ETF to track a market index, marks a significant milestone for accessibility and mainstream adoption. These regulatory tailwinds are expected to further legitimize and integrate digital assets into traditional financial portfolios.

Vice is 31 years old.

The Sims is 25.

Facebook is 21.

Roblox is 19.

Minecraft is 16.

Instagram is 15.All but two of those existed before Bitcoin.

Stablecoins are increasingly recognized as a critical component of the digital economy, bridging the gap between traditional finance and internet-native communities. As digital natives gain more spending power and investment experience, the demand for internet-native currencies is naturally increasing. Stablecoins are well-positioned to capture this generational shift and facilitate broader adoption.

The recent fluctuation in Ethena’s USDe, dropping from $14 billion to $10 billion, underscores the sensitivity of stablecoins to market dynamics. This decline was primarily driven by compression in USDe’s yield, influenced by Bitcoin and Ethereum perpetual funding rates. As funding rates recover, USDe’s yield proposition is expected to improve, potentially reversing the recent downward trend.

In conclusion, the crypto market is maturing, driven by both institutional investment and the increasing adoption of stablecoins. While market corrections and volatility are inevitable, the underlying trend indicates a growing integration of digital assets into the global financial system. Investors should remain vigilant, staying informed about regulatory developments and market dynamics to navigate this evolving landscape successfully.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Institutional investment in crypto continues to grow despite market fluctuations. Stablecoins are emerging as a key bridge connecting internet-native communities with digital currencies. Recent market corrections, like the one seen with Ethena’s USDe, highlight the importance of understanding underlying yield mechanisms.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.