Canary Capital is poised to launch the first US-based XRP ETF that directly holds the token, pending final regulatory approvals. The SEC filing indicates a potential launch as early as Thursday, making it a significant milestone for XRP investment products.

What to Know:

- Canary Capital is poised to launch the first US-based XRP ETF that directly holds the token, pending final regulatory approvals.

- The SEC filing indicates a potential launch as early as Thursday, marking a significant milestone for XRP investment products.

- Several other firms, including 21Shares and Franklin Templeton, have spot XRP ETFs waiting for approval, signaling growing institutional interest.

Canary Capital’s XRP ETF is on track to become the first US-based fund to directly hold the token, pending final SEC approval. This move signifies growing institutional interest in XRP and could pave the way for increased accessibility for investors. The potential launch of this ETF marks a key development in the evolving landscape of cryptocurrency investment products.

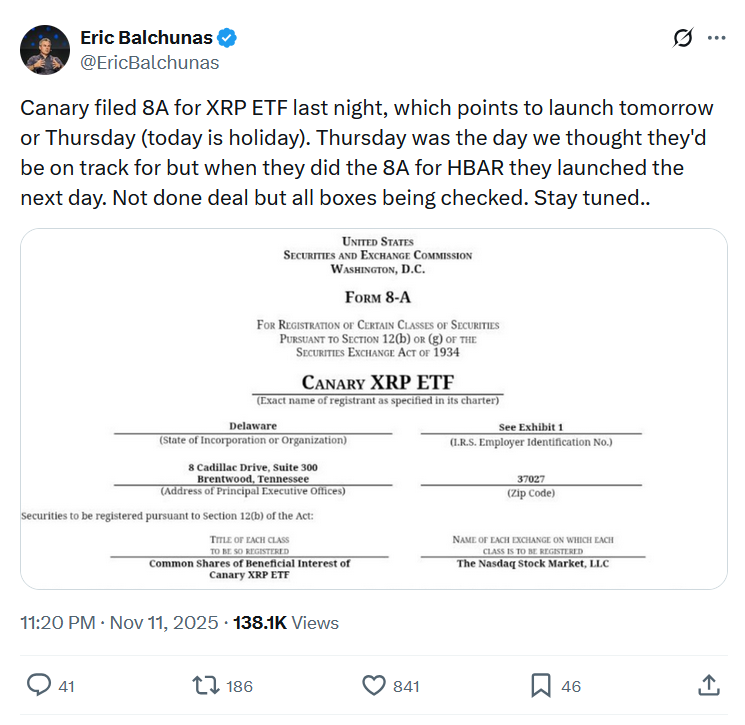

Bloomberg senior ETF analyst Eric Balchunas noted that Canary Capital filed a critical Form 8A with the SEC, a necessary step before securities can be offered on an exchange. This filing suggests a possible launch as early as Thursday, mirroring the timeline observed with previous Hedera (HBAR) ETF launches. Market participants are closely watching for the final confirmation, as this signals that all regulatory boxes are being checked.

Bloomberg senior ETF analyst Eric Balchunas said on Tuesday that Canary had filed a Form 8A with the Securities and Exchange Commission on Monday night, which must be lodged before securities are offered on an exchange.

Balchunas said the filing “points to launch tomorrow or Thursday” as Form 8A filings for Hedera (HBAR) ETFs saw those funds launch the next day.

“Not [a] done deal but all boxes being checked,” Balchunas added. “Stay tuned.”

While other XRP exchange-traded products exist, Canary’s ETF distinguishes itself by being filed under the Securities Act of 1933. This allows the fund to directly hold XRP, unlike others that invest in offshore entities holding the cryptocurrency. This structural difference could provide investors with a more direct and transparent exposure to XRP.

The anticipation within the XRP community has been building, particularly as regulatory processes resume. Alongside Canary, the DTCC lists several other spot XRP ETFs from firms like 21Shares, ProShares, and Franklin Templeton, indicating a broad interest in offering XRP investment products. As the regulatory landscape becomes clearer, these ETFs could potentially reshape how investors access XRP.

The potential launch of a spot XRP ETF represents a significant step forward for the cryptocurrency market, offering new avenues for investment and increased legitimacy. As the regulatory environment evolves, these developments could pave the way for further innovation and adoption in the digital asset space.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Canary Capital is poised to launch the first US-based XRP ETF that directly holds the token, pending final regulatory approvals. The SEC filing indicates a potential launch as early as Thursday, marking a significant milestone for XRP investment products.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.