Canary Capital’s XRP ETF had a record-breaking debut, outperforming all other ETF launches of 2025. The ETF’s success is attributed to its in-kind creation model, allowing shares to be exchanged for XRP tokens.

What to Know:

- Canary Capital’s XRP ETF had a record-breaking debut, outperforming all other ETF launches of 2025.

- The ETF’s success is attributed to its in-kind creation model, allowing shares to be exchanged for XRP tokens.

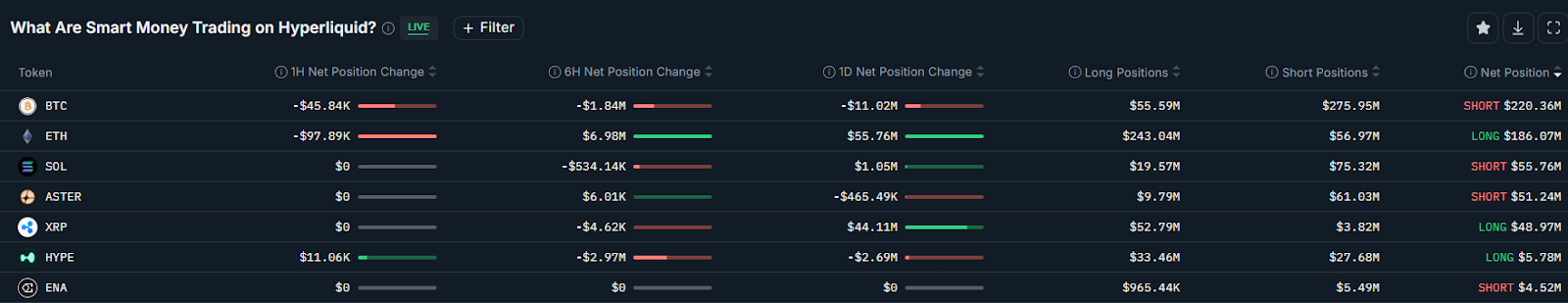

- Smart money traders are increasing their long positions in XRP, signaling confidence in its potential upside.

The launch of Canary Capital’s XRP ETF has sparked renewed interest in altcoins, marking a significant milestone in the digital asset space. The ETF’s impressive debut signals growing acceptance and demand for XRP as an investment vehicle. This could pave the way for further institutional adoption and increased liquidity for XRP.

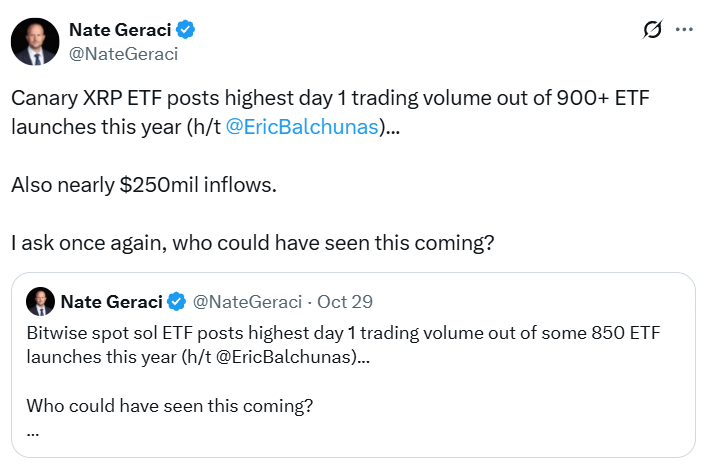

Canary Capital’s XRP ETF achieved a record-breaking first day, closing with $58 million in trading volume and over $250 million in inflows. This performance surpassed all other ETFs launched in 2025, highlighting strong investor interest in XRP. The ETF’s in-kind creation model, which allows for the exchange of ETF shares for XRP tokens, contributed to its successful launch.

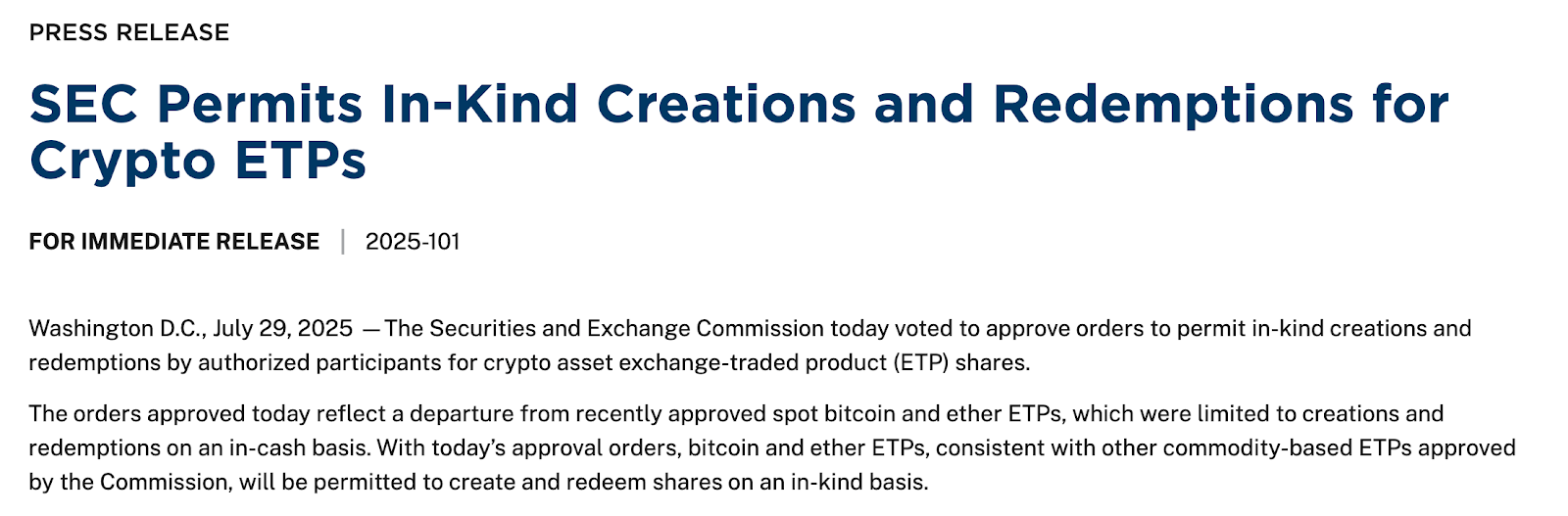

The SEC’s approval of in-kind creation and redemption for cryptocurrency ETFs has opened new doors for institutional investors. This regulatory clarity is fostering a more mature and accessible market for digital assets. As regulations evolve, more crypto ETFs could emerge, offering diverse investment opportunities.

Following the ETF launch, “smart money” traders have increased their net long positions in XRP by $44 million. This indicates a growing expectation of upward price movement for the token. The shift in sentiment among experienced traders could influence broader market trends and investor confidence.

Despite some negative outflows in spot Bitcoin ETFs, the overall outlook for the crypto market remains positive. The introduction of new investment products like the XRP ETF broadens market access and diversifies investment strategies. These developments underscore the evolving landscape of digital asset investments.

The successful launch of Canary Capital’s XRP ETF and the positive response from smart money traders suggest a promising future for XRP. As regulatory frameworks become clearer and institutional interest grows, XRP and other altcoins are poised for further adoption and integration into mainstream financial systems.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Canary Capital’s XRP ETF had a record-breaking debut, outperforming all other ETF launches of 2025. The ETF’s success is attributed to its in-kind creation model, allowing shares to be exchanged for XRP tokens. Smart money traders are increasing their long positions in XRP, signaling confidence in its potential upside.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.