XRP experienced a sharp V-shaped recovery after hitting key support levels, indicating potential exhaustion of selling pressure. The launch of a U.S. spot XRP ETF saw strong initial trading volume, but failed to stabilize XRP amidst broader market uncertainty.

What to Know:

- XRP experienced a sharp V-shaped recovery after hitting key support levels, indicating potential exhaustion of selling pressure.

- The launch of a U.S. spot XRP ETF saw strong initial trading volume, but failed to stabilize XRP amidst broader market uncertainty.

- Traders should watch critical support and resistance levels, ETF flows, and volume confirmations to gauge XRP’s next move.

XRP recently weathered intense selling pressure before staging a dramatic V-shaped reversal, signaling a possible shift in momentum. This price action occurred amid mixed signals from institutional investors and persistent macroeconomic uncertainty affecting the broader crypto market. The short-term relief rally presents traders with key levels to monitor closely.

The launch of Canary Capital’s U.S. spot XRP ETF (XRPC) generated significant buzz, recording $58.6 million in first-day trading volume, exceeding expectations. Despite this positive development, XRP faced headwinds as derivatives markets showed signs of stress, with substantial liquidations impacting leveraged positions. This highlights the complex interplay between institutional interest and prevailing risk-off sentiment.

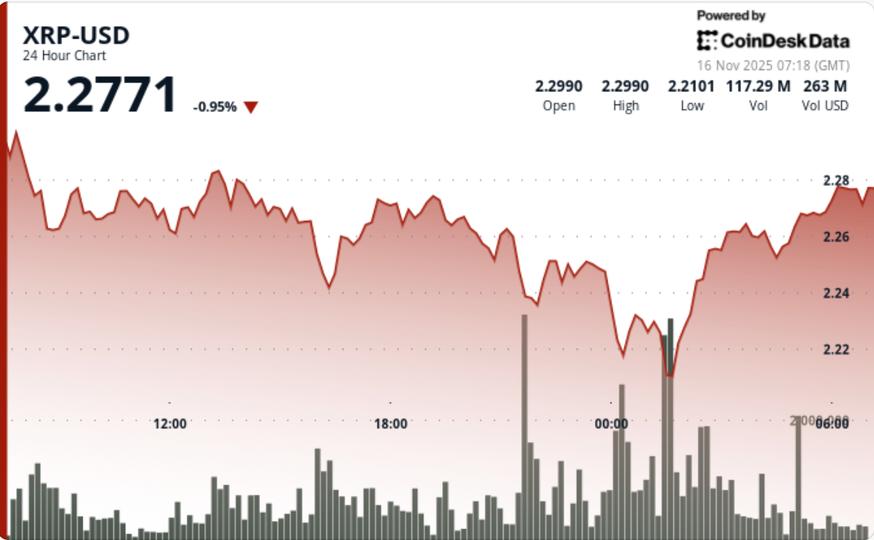

XRP dropped 4.3% from $2.31 to $2.22 during the 24-hour session ending November 16 at 02:00 UTC. The decline carved a $0.10 range with a clear sequence of lower highs confirming bearish structure.

Technical analysis reveals that holding the $2.22 support level is crucial for XRP. Failure to maintain this level could trigger a further decline towards $2.16 and potentially $2.02–$1.88. Conversely, reclaiming $2.24, followed by $2.31, would be a positive sign, suggesting renewed bullish momentum.

The recent V-shaped rebound offers some respite, but significant resistance overhead may limit immediate upside potential. For a substantial trend shift, XRP needs to break above $2.48 to target higher levels around $2.60 and beyond. Monitoring XRP ETF flows and regulatory developments will provide additional insights into future price movements.

In conclusion, XRP’s recent price action underscores the importance of vigilance and strategic trading. While the ETF launch and V-shaped recovery offer glimmers of optimism, traders should remain aware of key support and resistance levels, volume confirmations, and broader market dynamics to navigate potential volatility.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP experienced a sharp V-shaped recovery after hitting key support levels, indicating potential exhaustion of selling pressure. The launch of a U.S. spot XRP ETF saw strong initial trading volume, but failed to stabilize XRP amidst broader market uncertainty.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.