Franklin XRP ETF: Official SEC Filing CONFIRMS What’s Coming Next The momentum behind XRP just hit another major milestone — and most people haven’t even noticed it yet. On November 18, 2025, Franklin Templeton officially filed its Form 8-A with the U.S.

Franklin XRP ETF: Official SEC Filing CONFIRMS What’s Coming Next

The momentum behind XRP just hit another major milestone — and most people haven’t even noticed it yet.

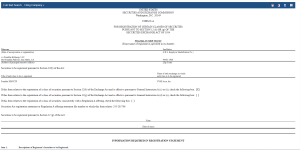

On November 18, 2025, Franklin Templeton officially filed its Form 8-A with the U.S. Securities and Exchange Commission, locking in the registration of the Franklin XRP ETF on NYSE Arca. This is the document that activates Section 12(b) registration and clears the way for the ETF to begin trading.

Why This Filing Is a Big Deal

Form 8-A isn’t hype. It’s the final step before a product goes live on a national exchange.

Once this form is filed and accepted, the SEC has effectively acknowledged:

- The product is approved for exchange listing

- The share class is registered under the Exchange Act

- The ETF is ready for operational launch

In simple terms: XRP is entering the same league as Bitcoin and Ethereum ETFs.

Institutional Money Is Now Inevitable

The filing references the corresponding S-1 registration (File No. 333-285706), which was last amended on November 4, 2025. The ETF structure is complete. The exchange is confirmed. The trust is registered.

This is the exact moment — historically — when Wall Street begins positioning ahead of launch.

ETFs attract pensions, asset managers, hedge funds, RIAs, sovereign money, and banks. These players can’t buy XRP on an exchange. They can buy a regulated ETF.

And once they do, liquidity snowballs fast.

XRP Supply Shock Is On Deck

Unlike Bitcoin ETFs, XRP ETFs are built on a digital asset with:

- A fixed supply

- High velocity use cases

- An institutional-grade settlement network

- Corporate and banking partnerships already in place

When ETF inflows start pulling XRP off the open market — daily, consistently — it creates the foundation for a massive supply crunch.

This 8-A filing is the final confirmation: XRP is about to enter a new phase of adoption that retail is not prepared for.

The Bull Case Just Became Impossible to Ignore

Franklin’s filing was signed by President & CEO David Mann, officially declaring the Franklin XRP Trust ready for exchange trading. There are no “ifs” or “maybes” here — it’s happening.

With multiple XRP ETFs lining up behind Canary, Bitwise, Grayscale, and now Franklin, the stage is set for an unprecedented battle for liquidity.

Every past XRP cycle looks tiny compared to what regulated institutional flows can trigger.

Final Thoughts

XRP is no longer following Bitcoin. It’s graduating into its own asset class with its own ETFs, its own liquidity base, and its own demand curve.

This Form 8-A isn’t just paperwork.

It’s the starting pistol for XRP’s next major move. And when it hits, it’s not going to be small.

Stay ready. The XRP era is just getting started. 🚀

http://edgar.secdatabase.com/2640/207184425000473/filing-main.htm

Related: XRP Price: $12M Max Pain for Bears

Quick Summary

Franklin XRP ETF: Official SEC Filing CONFIRMS What’s Coming Next The momentum behind XRP just hit another major milestone — and most people haven’t even noticed it yet. On November 18, 2025, Franklin Templeton officially filed its Form 8-A with the U.S.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.