XRP is experiencing renewed pressure, with profitability metrics declining to levels last seen in late 2024. Derivatives activity shows cautious sentiment, with XRP futures open interest collapsing from earlier highs.

What to Know:

- XRP is experiencing renewed pressure, with profitability metrics declining to levels last seen in late 2024.

- Derivatives activity shows cautious sentiment, with XRP futures open interest collapsing from earlier highs.

- Despite short-term weakness, XRP’s fundamentals remain strong due to Ripple’s developments and rising institutional interest, including new XRP ETFs.

XRP is facing headwinds as broader market conditions impact its profitability, pushing metrics back to levels observed in late 2024. Currently, only 58.5% of XRP’s circulating supply is in profit, a concerning dip from earlier this year. Despite its current price around $2.15, a significant 41.5% of circulating XRP, or about 26.5 billion tokens, are held at a realized loss.

XRP’s price has struggled since its post-election spike, trading sideways around $2.10, which has disappointed traders anticipating further upward movement. The decrease in open interest for XRP futures indicates weakening speculative demand and traders reducing directional bets. Data shows XRP has dropped 12% in the past six months and is trading 40% below its July peak of $3.65.

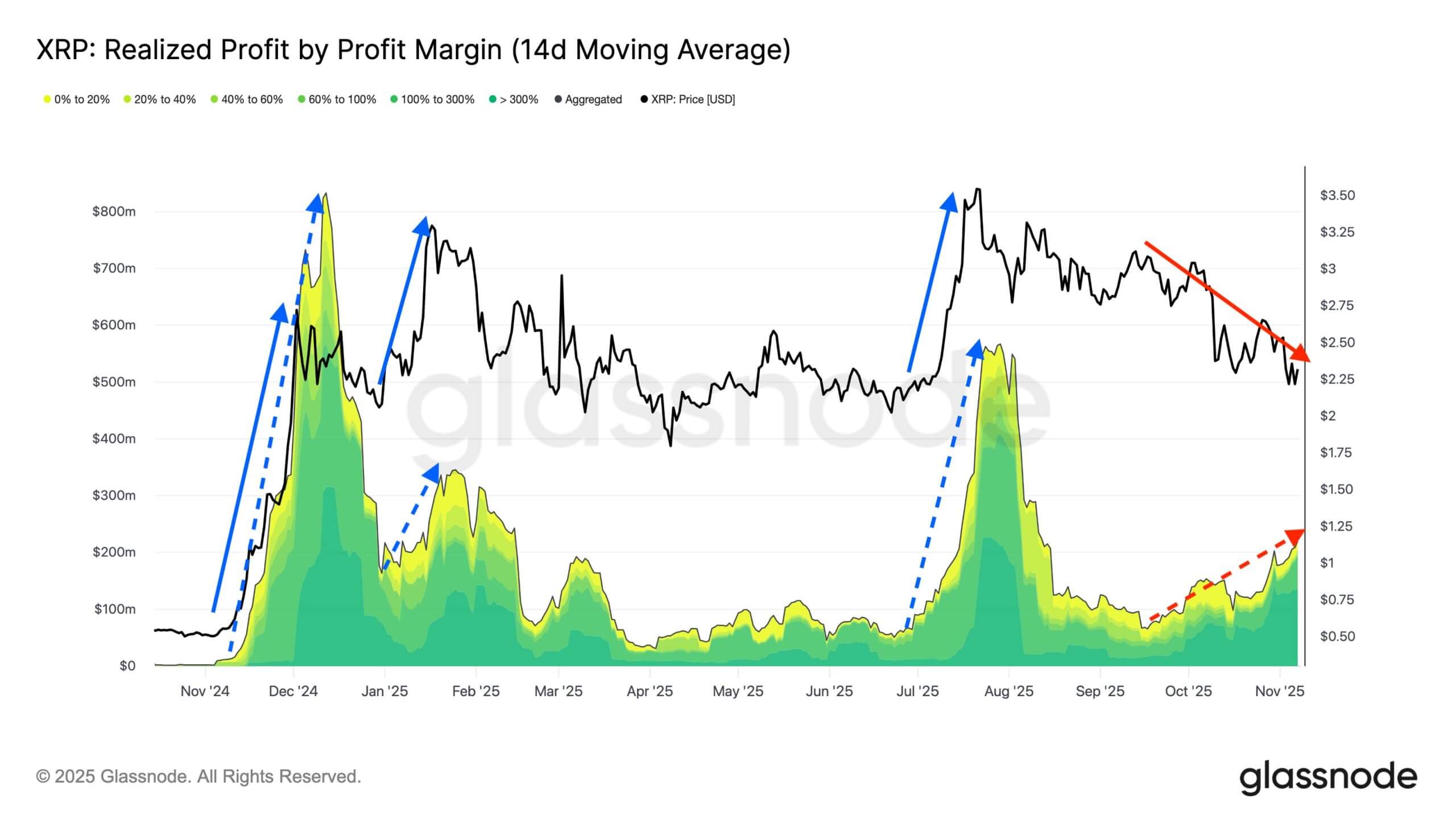

Long-term holders are taking profits, with investors who acquired XRP below $1 before the late-2024 surge now unwinding their positions. Profit-taking activity from this group has increased by 240% since September, rising from approximately $65 million to nearly $220 million daily. This profit-realization contributes to the current price pressure on XRP.

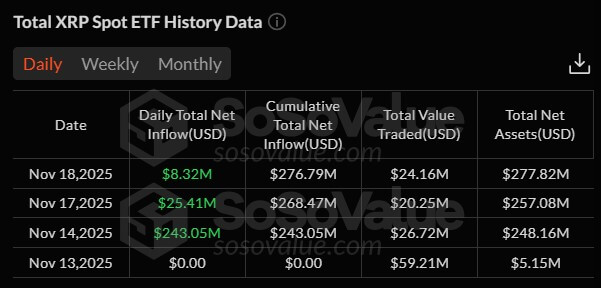

Ripple’s settlement with the SEC and strategic initiatives, including acquisitions and partnerships, support the asset’s long-term positioning. The launch of several spot XRP ETFs in November 2025, including products from Franklin Templeton and Bitwise, signals growing institutional interest. Canary Capital’s XRPC ETF has attracted nearly $278 million in early inflows.

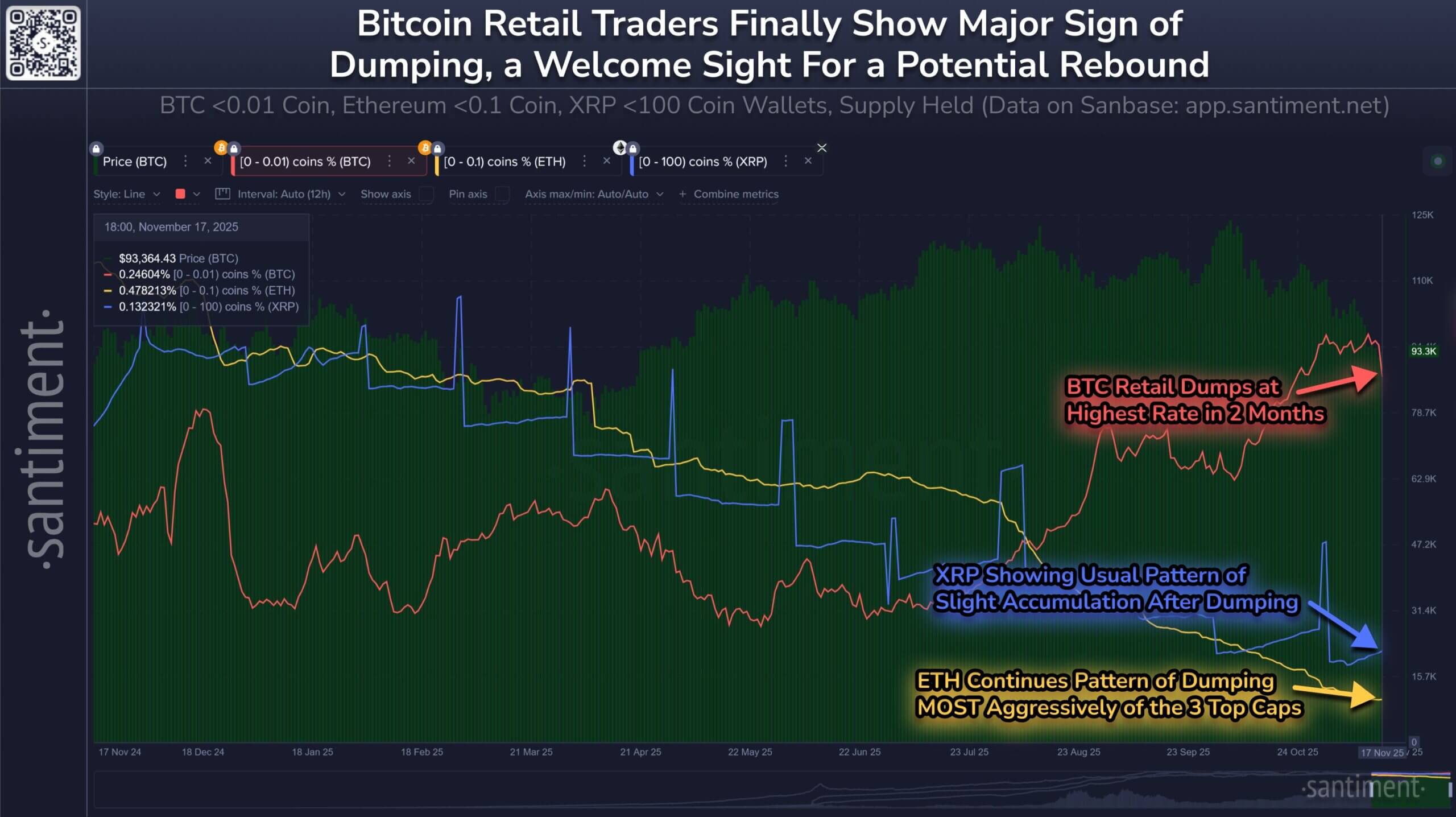

Despite the present challenges, XRP’s underlying fundamentals remain strong, supported by Ripple’s strategic moves and increasing institutional adoption. The launch of XRP ETFs and continued social media interest suggest a potential for future recovery, particularly as retail capitulation may precede market rebounds. Investors should monitor these developments closely as XRP navigates the evolving crypto landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is experiencing renewed pressure, with profitability metrics declining to levels last seen in late 2024. Derivatives activity shows cautious sentiment, with XRP futures open interest collapsing from earlier highs. Despite short-term weakness, XRP’s fundamentals remain strong due to Ripple’s developments and rising institutional interest, including new XRP ETFs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.