XRP’s weekly chart reveals a megaphone pattern, potentially targeting $0.88. Increased selling pressure may lead investors to sell XRP at a loss. Realized losses on XRP have reached levels not seen since April.

What to Know:

- XRP’s weekly chart reveals a megaphone pattern, potentially targeting $0.88.

- Increased selling pressure may lead investors to sell XRP at a loss.

- Realized losses on XRP have reached levels not seen since April.

XRP’s recent downturn has investors and traders closely monitoring its next move, especially as Bitcoin and Ethereum also face liquidations. The altcoin’s struggle to stay above $2 raises questions about its short-term recovery. Technical analysis suggests further declines could be on the horizon.

The formation of a megaphone pattern on XRP’s weekly chart indicates a possible correction. This pattern, characterized by higher highs and lower lows, typically precedes a sharp price decrease upon breaking its lower boundary, with a measured target of $0.88. Key support levels to watch include the 100-week simple moving average (SMA) at $1.60 and the 200-week SMA at $1.05.

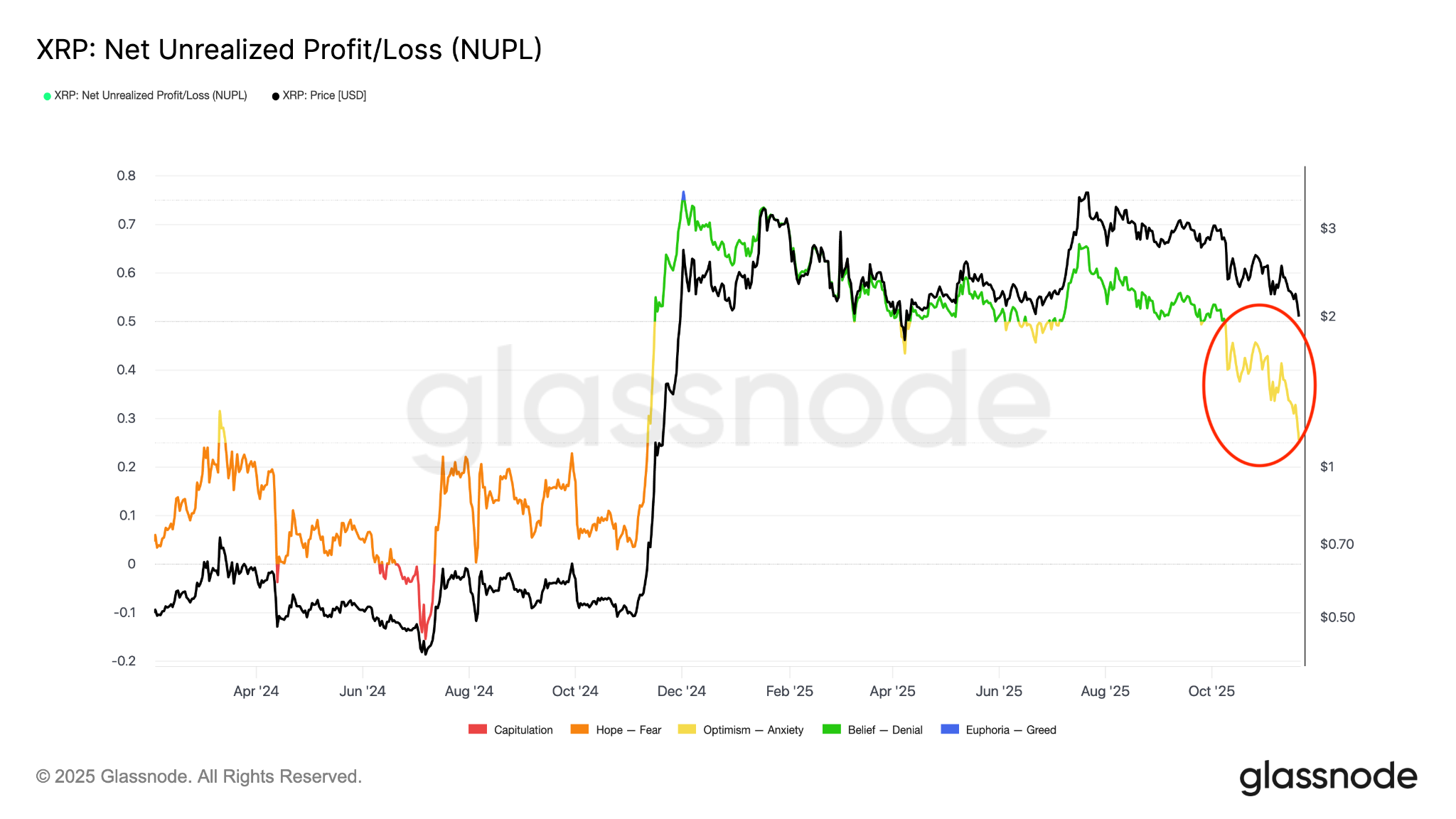

XRP’s Net Unrealized Profit/Loss (NUPL) metric reflects a shift from euphoria to anxiety among investors. With a significant percentage of XRP holders currently underwater, increased selling pressure is anticipated as investors manage their losses. Historical patterns suggest such conditions can lead to substantial corrections, warranting caution in the coming weeks.

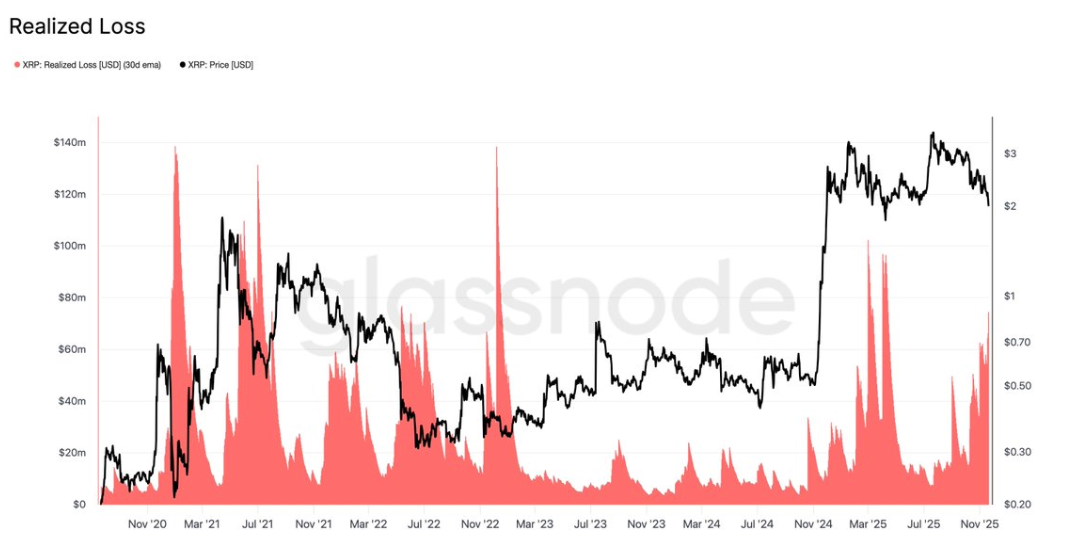

Realized losses on XRP have surged, reaching levels not seen since April, signaling increased investor capitulation. This surge in losses coincides with XRP dropping to around $1.81, a level unseen since April, highlighting the growing pressure on holders. Monitoring onchain demand and whale activity will be crucial in assessing potential sell-off risks.

As XRP navigates current market conditions, traders and investors should remain vigilant, closely monitoring key technical levels and onchain data. The potential for further downside exists, emphasizing the importance of informed decision-making amidst market volatility. Staying abreast of regulatory developments and broader crypto market trends will also be crucial for navigating XRP’s future trajectory.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP’s weekly chart reveals a megaphone pattern, potentially targeting $0.88. Increased selling pressure may lead investors to sell XRP at a loss. Realized losses on XRP have reached levels not seen since April.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.