Bitcoin is showing signs of recovery, nearing the $90,000 mark after a recent downturn. Altcoins like XRP, SOL, and ENA are outperforming Bitcoin with significant gains. The total crypto market capitalization has increased, reflecting renewed investor confidence.

What to Know:

- Bitcoin is showing signs of recovery, nearing the $90,000 mark after a recent downturn.

- Altcoins like XRP, SOL, and ENA are outperforming Bitcoin with significant gains.

- The total crypto market capitalization has increased, reflecting renewed investor confidence.

Bitcoin is gradually recovering from recent losses, testing the $89,000 level after a turbulent week. While Bitcoin stabilizes, several altcoins, including XRP, ENA, and HYPE, have demonstrated impressive gains, capturing investor attention. This resurgence highlights the dynamic nature of the cryptocurrency market amid evolving regulations and the potential impact of Bitcoin ETFs.

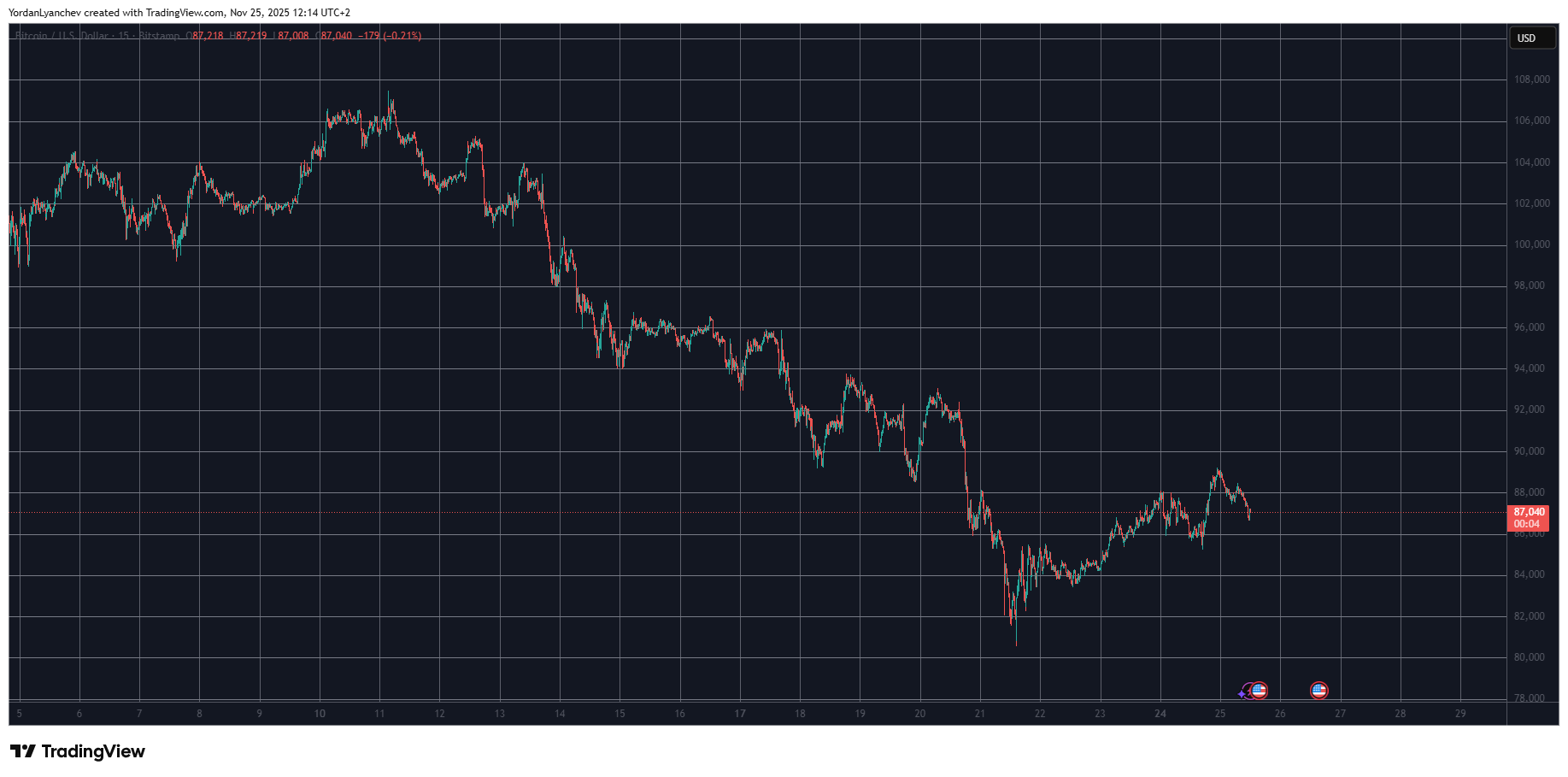

Last week, Bitcoin experienced a sharp decline, falling from over $96,000 to below $81,000, marking a 35% drop from its all-time high. This downturn tested market sentiment, but Bitcoin has since shown resilience, rebounding to around $87,000. The recovery suggests underlying strength and renewed interest from institutional and retail investors.

Ethereum has also seen positive movement, briefly surpassing $2,900, while altcoins like XRP and Solana (SOL) have led the charge with substantial gains. XRP’s 7% surge to $2.20 and SOL’s 5% increase to over $135 demonstrate strong market confidence in these specific altcoins. These gains reflect broader positive sentiment within the altcoin market, driven by innovation and adoption.

The overall crypto market capitalization has increased by over $60 billion, reaching $3.075 trillion, signaling a resurgence of investor confidence. This growth indicates a healthy appetite for digital assets and a positive outlook for the future of the crypto market. As regulations become clearer and institutional adoption grows, the market is poised for further expansion.

In conclusion, the cryptocurrency market is showing signs of recovery and growth, with Bitcoin leading the charge and altcoins demonstrating significant potential. As the market evolves, investors should remain informed and adaptable to capitalize on emerging opportunities.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin is showing signs of recovery, nearing the $90,000 mark after a recent downturn. Altcoins like XRP, SOL, and ENA are outperforming Bitcoin with significant gains. The total crypto market capitalization has increased, reflecting renewed investor confidence.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.