XRP ETFs are outpacing Solana ETFs in attracting investment. Aggressive fee waivers are driving institutional interest in XRP. XRP ETF inflows are fueling price breakouts, unlike Solana’s defensive accumulation.

What to Know:

- XRP ETFs are outpacing Solana ETFs in attracting investment.

- Aggressive fee waivers are driving institutional interest in XRP.

- XRP ETF inflows are fueling price breakouts, unlike Solana’s defensive accumulation.

XRP is emerging as a frontrunner in the US crypto ETF market, showcasing remarkable performance relative to other altcoins since last month. The new US spot XRP ETFs have rapidly accumulated approximately $587 million in inflows in under 10 trading days. This contrasts sharply with the roughly $568 million garnered by Solana ETFs over a longer period, signaling a shift in investor preference.

The early leader in the altcoin ETF race was Solana, with its ETFs achieving 20 consecutive days of net inflows, totaling around $568 million since their debut on Oct. 28. This influx propelled the funds’ total assets to $840 million, representing about 1% of Solana’s market capitalization.

However, XRP’s ascent has been notably swift, with US spot XRP products amassing $423 million by Nov. 21. The subsequent entry of major players like Grayscale and Franklin Templeton triggered a substantial capital injection, adding approximately $164 million in a single session on Nov. 24.

A key factor driving XRP’s rapid growth is the competitive pricing among ETF providers. Franklin Templeton, in particular, has set an aggressive benchmark with its XRPZ fund, featuring a 0.19% sponsor fee that is fully waived on the first $5 billion in assets through May 31, 2026.

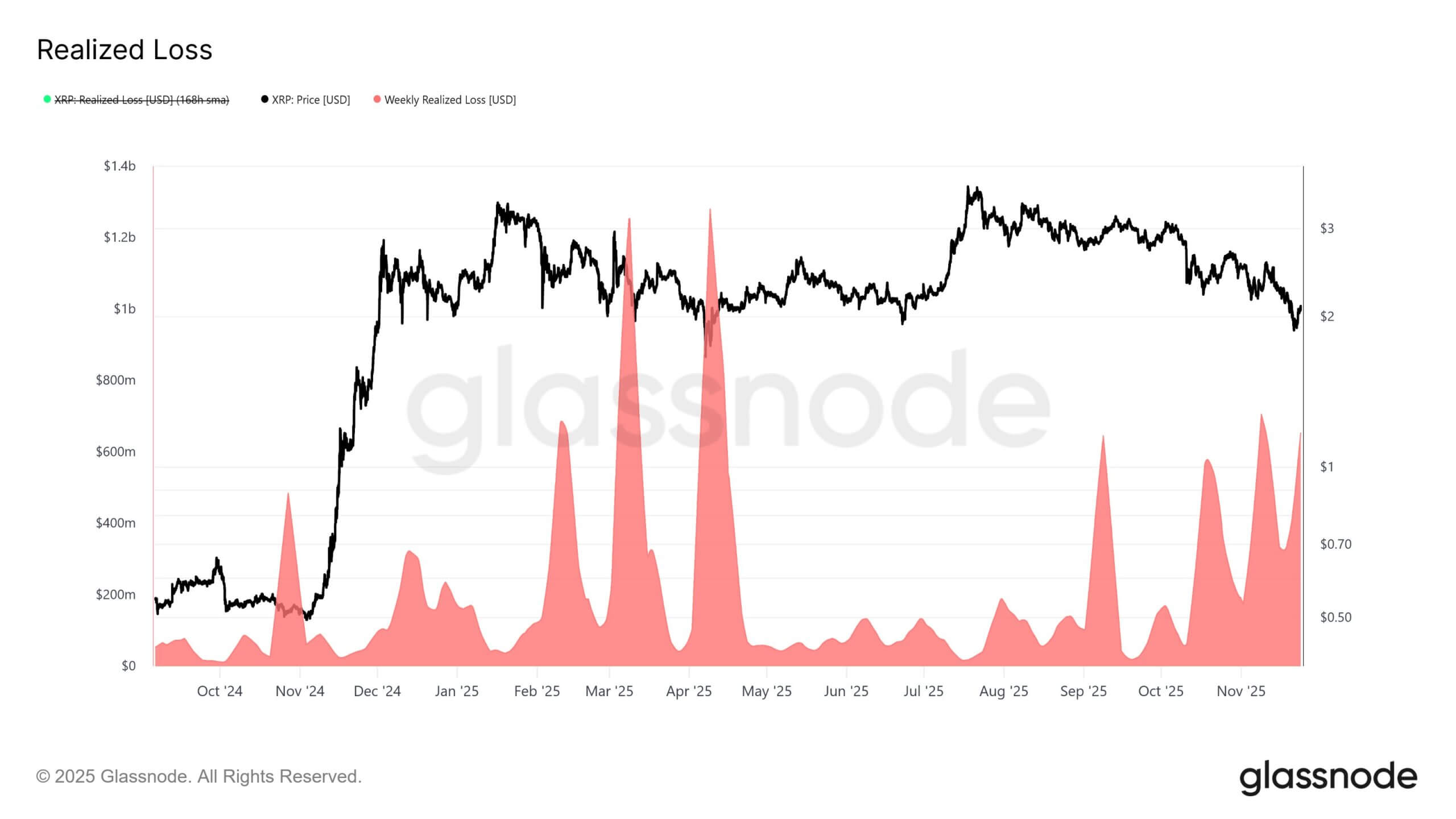

Unlike Solana, where ETF flows have acted as a buffer against price corrections, XRP flows are acting as a catalyst for price breakouts. While XRP had experienced a drawdown of around 17% in the last 30 days, it surged roughly 10% following the Nov. 24 session.

With XRP ETFs already surpassing the $500 million milestone in under 15 trading days, projections for year-end performance are being revised upward. If the current trend continues, XRP ETFs could potentially reach $1.5 billion in assets under management by the end of the year.

XRP’s impressive performance in the ETF market underscores the growing institutional interest in this cryptocurrency. The combination of aggressive fee waivers and positive price momentum positions XRP ETFs for continued growth and potential to reach $2 billion in AUM.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP ETFs are outpacing Solana ETFs in attracting investment. Aggressive fee waivers are driving institutional interest in XRP. XRP ETF inflows are fueling price breakouts, unlike Solana’s defensive accumulation. XRP is emerging as a frontrunner in the US crypto ETF market, showcasing remarkable performance relative to other altcoins since last month.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.