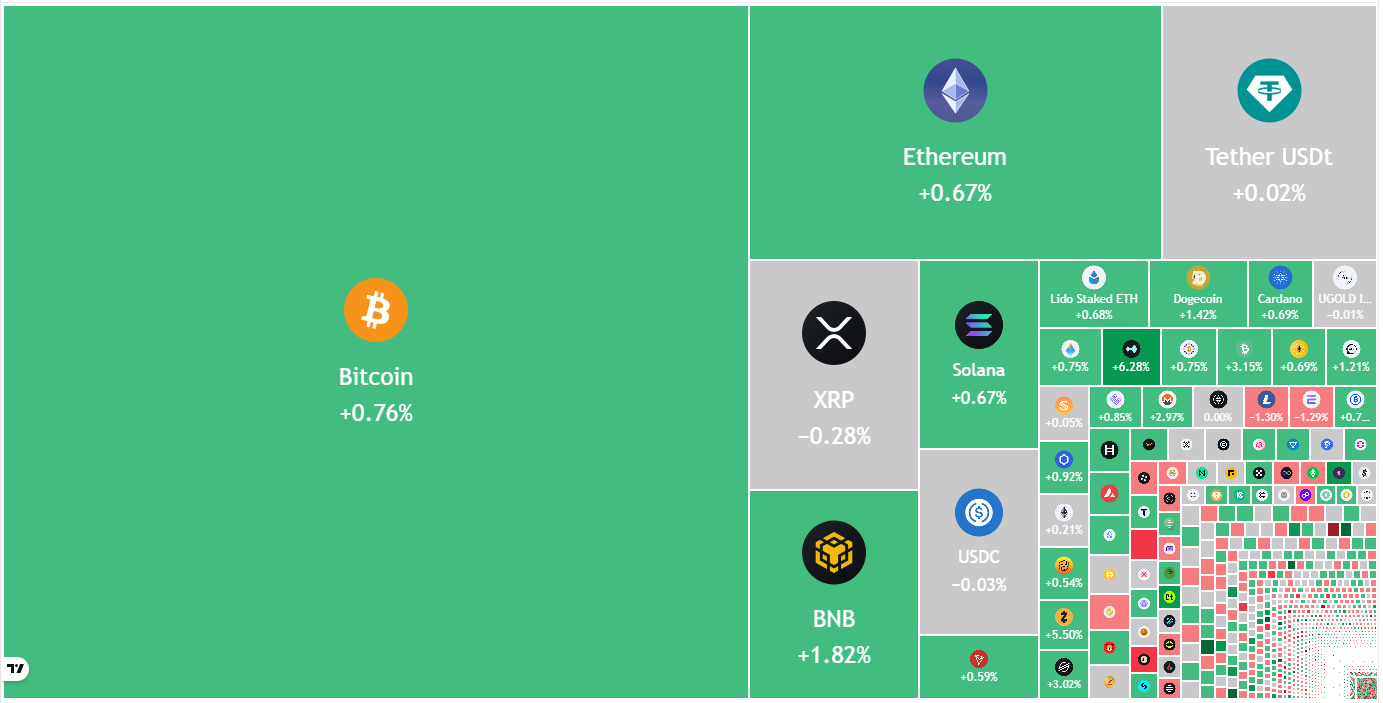

Bitcoin’s recovery is facing resistance around $89,000, suggesting a potential consolidation phase between $82,000 and $92,000. Ethereum and other major altcoins are showing signs of recovery but are likely to encounter selling pressure at key moving averages.

What to Know:

- Bitcoin’s recovery is facing resistance around $89,000, suggesting a potential consolidation phase between $82,000 and $92,000.

- Ethereum and other major altcoins are showing signs of recovery but are likely to encounter selling pressure at key moving averages.

- Technical analysis indicates crucial support and resistance levels for Bitcoin, Ether, XRP, BNB, Solana, Dogecoin, Cardano, Hyperliquid, Bitcoin Cash, and Chainlink.

Bitcoin’s recent price action is under scrutiny as it attempts to sustain a recovery above $88,000. Amidst mixed opinions from market commentators, Bitcoin’s trajectory remains uncertain, highlighting the inherent volatility and speculative nature of the crypto markets. For institutional investors, these fluctuations present both opportunities and risks, requiring a nuanced approach to portfolio management and risk mitigation.

Bitcoin’s immediate challenge lies in overcoming resistance at the 20-day exponential moving average (EMA) around $93,431. A failure to breach this level could signal continued bearish sentiment, potentially leading to a retest of the $80,600 support. Conversely, a successful breakout above the 20-day EMA could pave the way for a rally toward the psychological $100,000 mark. This tug-of-war between bulls and bears underscores the importance of technical analysis in identifying potential entry and exit points for active traders.

Ethereum’s recovery is similarly facing headwinds near the $3,000 level. While bulls have shown resilience in holding ground, the path to sustained upside momentum requires overcoming resistance at the 20-day EMA ($3,120) and the $3,350 breakdown level. A failure to do so could invite renewed selling pressure, potentially driving Ether back toward the $2,623 support. Institutional investors should monitor these levels closely, as they could influence strategic decisions regarding Ether exposure in their portfolios.

XRP’s recovery is encountering resistance at its 20-day EMA ($2.20), presenting a critical juncture for its short-term outlook. A decisive move above this level could signal a prolonged stay within its descending channel pattern, while a rejection could lead to a retest of the $1.61 support. The outcome of this battle will likely influence trader sentiment and could trigger significant price swings.

BNB is currently embroiled in a tug-of-war around the $860 breakdown level. A failure to overcome resistance at the 20-day EMA ($911) could embolden bears and increase the risk of a breakdown below $790, potentially leading to further declines. Conversely, a successful breakout above the 20-day EMA could signal a rejection of the breakdown and pave the way for a rally toward the 50-day simple moving average (SMA) at $1,034.

Solana is grappling with selling pressure near its 20-day EMA ($144), indicating that bears remain active at higher levels. A sustained move below the $126 support could trigger a plunge toward $110 and potentially $95. Bulls, however, will need to clear the 20-day EMA hurdle to regain control and initiate a rally toward the 50-day SMA ($170).

Dogecoin’s bounce off the $0.14 support is facing resistance at the 20-day EMA ($0.16), suggesting that bears are attempting to maintain control. A sharp rejection from this level could increase the risk of a breakdown below $0.14, potentially leading to a plunge toward $0.10. Conversely, a break and close above the 20-day EMA could signal a weakening bearish grip and pave the way for a rally toward the 50-day SMA ($0.18).

Cardano’s shallow bounce off the $0.38 level indicates a lack of strong buying interest. Bears will likely attempt to resume the downtrend by driving the price below $0.38, potentially leading to a collapse toward the October 10 low of $0.27. Bulls face an uphill battle, with any recovery attempts likely to encounter selling pressure at the $0.50 breakdown level.

Hyperliquid has recovered to the $35.50 breakdown level, where bears are expected to mount a strong defense. A sharp rejection from this level could confirm that the $35.50 level has been flipped into resistance, increasing the risk of a breakdown below $29.30. Buyers will need to drive and sustain the price above the 50-day SMA ($39.48) to signal a potential comeback.

Bitcoin Cash is attempting to hold above the resistance line, but bears continue to exert pressure. A dip below the moving averages could suggest that the break above the resistance line was a bull trap, potentially leading to a pullback toward the $443 support. Conversely, a strong bounce off the moving averages could signal renewed buying interest and increase the possibility of a breakout above $568.

Chainlink has risen close to the 20-day EMA ($13.88), where bears are expected to pose a strong challenge. A rejection from this level could lead to a pullback toward the $10.94 support. Conversely, a break and close above the 20-day EMA could signal reduced selling pressure and pave the way for a rally toward the 50-day SMA ($16.22).

In summary, the cryptocurrency market is currently navigating a period of consolidation and uncertainty, with Bitcoin and major altcoins facing key resistance levels. Technical analysis provides valuable insights into potential support and resistance levels, enabling institutional investors and active traders to make informed decisions. As the market continues to evolve, a disciplined approach to risk management and a keen understanding of market dynamics will be crucial for navigating the inherent volatility of the crypto space.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s recovery is facing resistance around $89,000, suggesting a potential consolidation phase between $82,000 and $92,000. Ethereum and other major altcoins are showing signs of recovery but are likely to encounter selling pressure at key moving averages.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.