Crypto markets rebounded strongly, driven by increased liquidity and renewed risk appetite. Institutional interest is shifting towards Ethereum ETFs, signaling a strategic repositioning. The sustainability of the rally hinges on macro factors and Bitcoin’s ability to hold key support levels.

What to Know:

- Crypto markets rebounded strongly, driven by increased liquidity and renewed risk appetite.

- Institutional interest is shifting towards Ethereum ETFs, signaling a strategic repositioning.

- The sustainability of the rally hinges on macro factors and Bitcoin’s ability to hold key support levels.

The crypto market experienced a notable resurgence, breaking a period of stagnation as liquidity returned to risk assets. Bitcoin surged, reclaiming the $90,000 level, while Ethereum surpassed $3,000 for the first time in a week. This rally offers a reprieve after a month of downward pressure, indicating a potential shift in market dynamics.

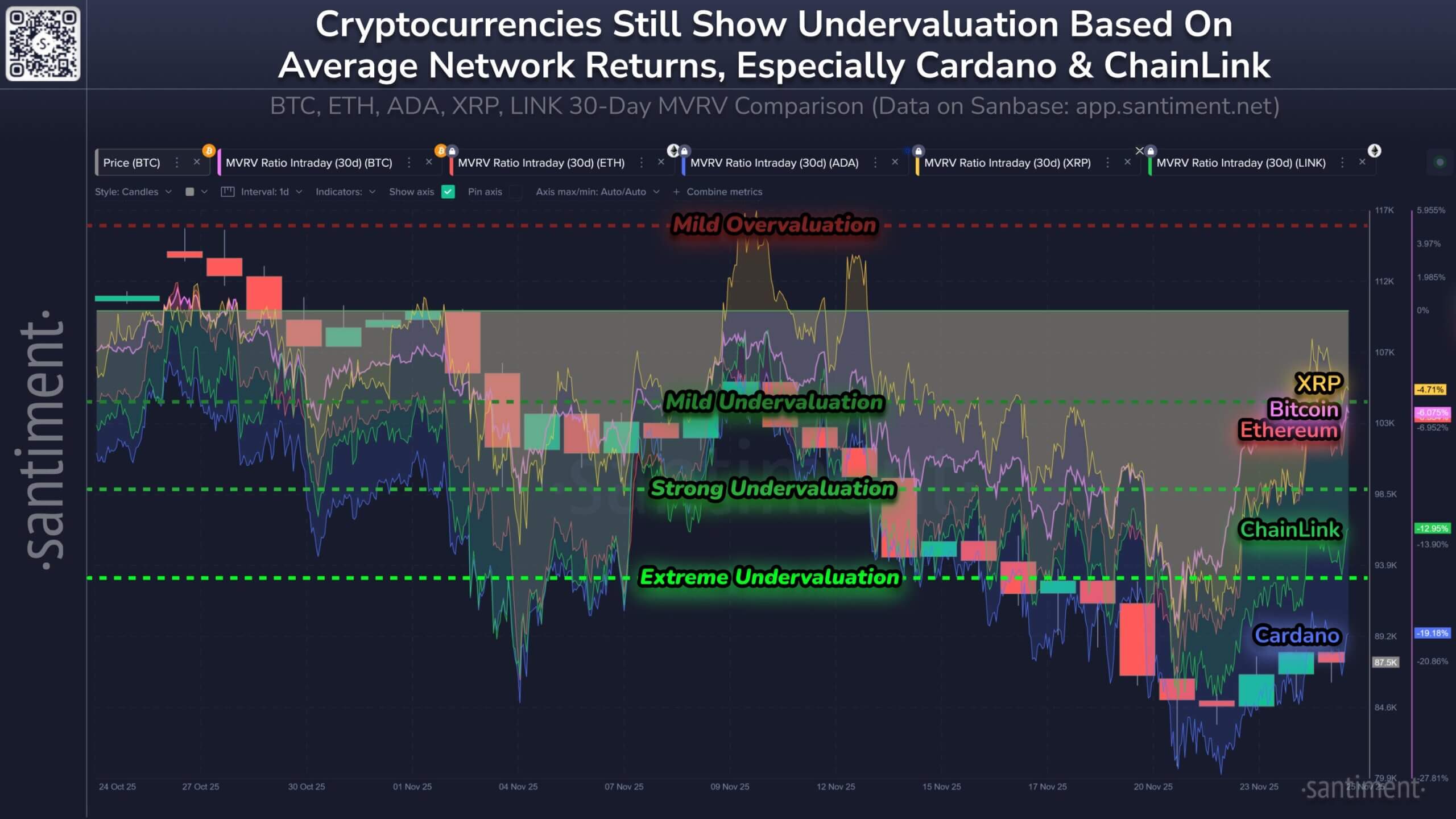

Recent data highlighted the extent of the previous downturn, with average wallet investments in major digital assets showing significant losses. Cardano investors saw an average value decrease of 19.2%, while Chainlink traders experienced a 13.0% drop; even Bitcoin and Ethereum showed losses of 6.1% and 6.3%, respectively. XRP performed slightly better but was still down 4.7%.

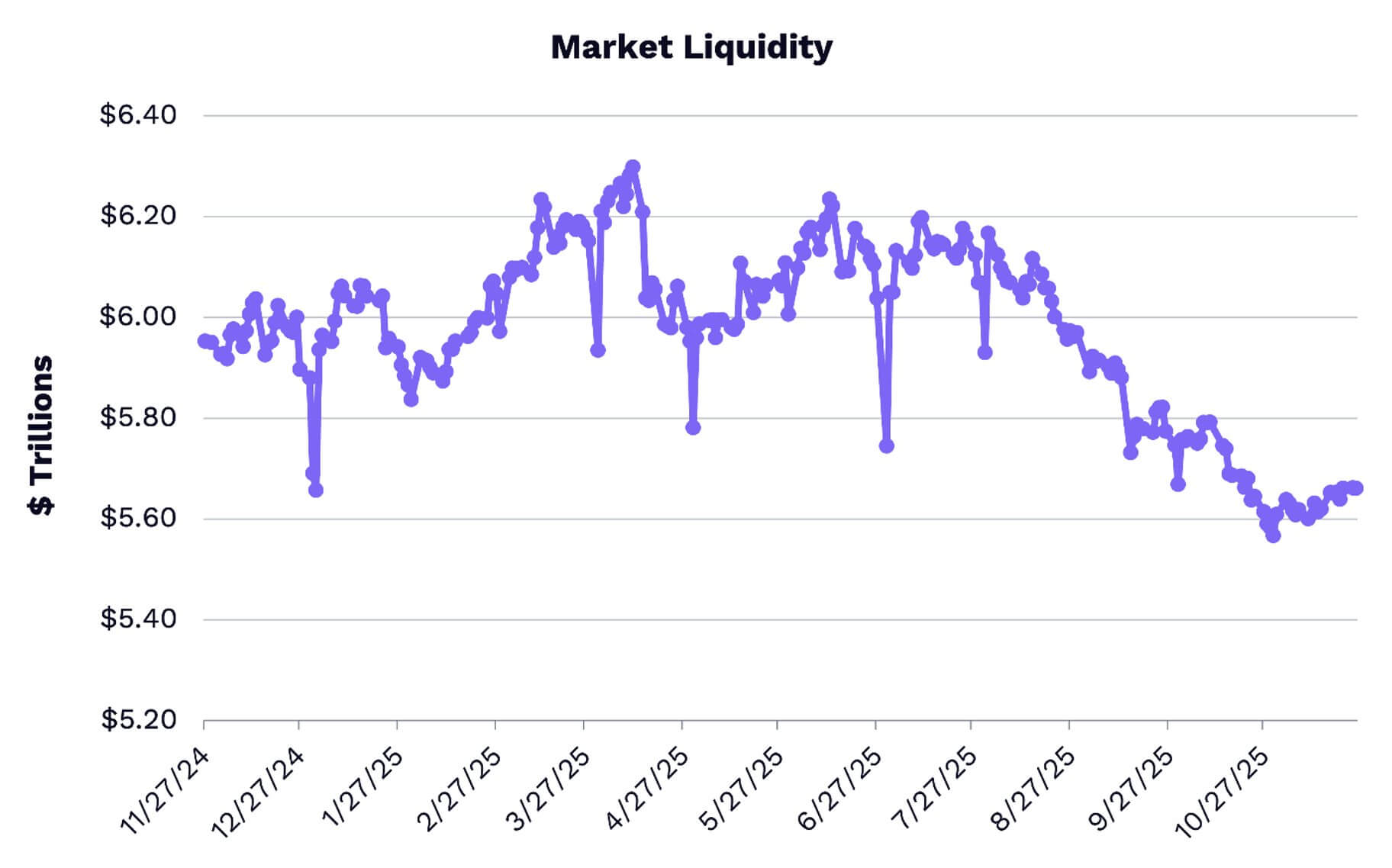

The recent increase in total crypto market capitalization appears to be fueled by a structural reopening of fiscal policy and a renewed risk appetite among institutional investors. The normalization of liquidity, following the end of a government shutdown, has played a crucial role in this recovery. This event had previously drained significant liquidity from the financial system.

The US Treasury’s balance sheet is a key factor in understanding the rally’s mechanics. The six-week government shutdown had siphoned approximately $621 billion in liquidity, causing markets to hit multi-year lows. However, the resumption of government operations is reversing this trend, with funds gradually returning to the system.

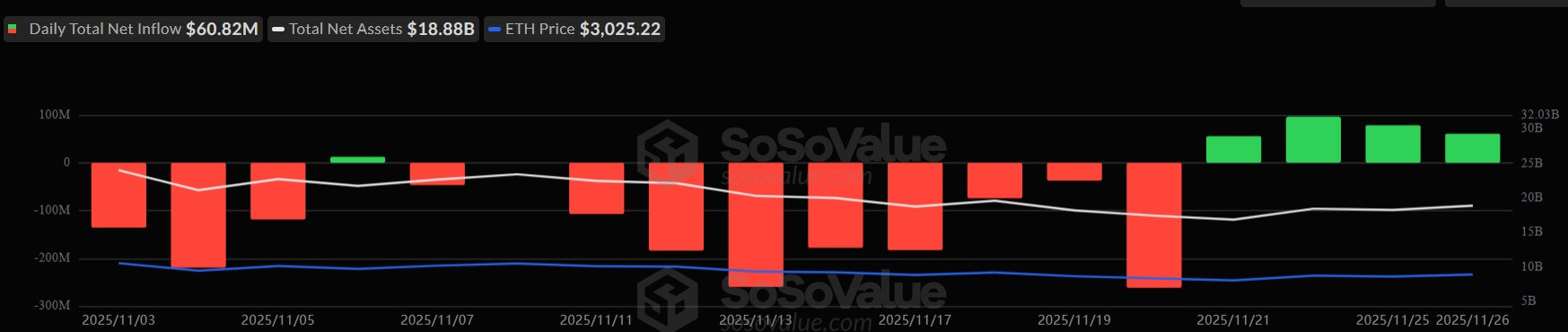

Institutional interest is showing a distinct rotation towards Ethereum, with ETH products attracting net inflows for the fourth consecutive session, totaling approximately $61 million. Bitcoin funds saw more modest inflows, while XRP investment vehicles also experienced gains. This flow profile suggests a market correction rather than a speculative surge.

Looking ahead, the sustainability of this rally depends on various factors, including macro conditions and Bitcoin’s ability to maintain key support levels. A potential resurgence of inflation could prompt the Federal Reserve to reverse its dovish stance, tightening market conditions once again. The holiday season’s lower liquidity could also amplify volatility.

In conclusion, the crypto market’s recent rebound is underpinned by improved liquidity and institutional interest, particularly in Ethereum ETFs. While positive, the market’s future trajectory will depend on broader economic factors and the ability of major cryptocurrencies like Bitcoin to hold critical price levels.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Crypto markets rebounded strongly, driven by increased liquidity and renewed risk appetite. Institutional interest is shifting towards Ethereum ETFs, signaling a strategic repositioning. The sustainability of the rally hinges on macro factors and Bitcoin’s ability to hold key support levels.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.