Digital asset investment products experienced a significant resurgence last week, with inflows totaling $1.07 billion, primarily driven by XRP. XRP recorded its largest weekly inflow ever, reaching $289 million, fueled by anticipation of new U.S. spot XRP ETFs.

What to Know:

- Digital asset investment products experienced a significant resurgence last week, with inflows totaling $1.07 billion, primarily driven by XRP.

- XRP recorded its largest weekly inflow ever, reaching $289 million, fueled by anticipation of new U.S. spot XRP ETFs.

- Bitcoin and Ethereum also saw substantial inflows, indicating a broader return of investor confidence in digital assets amidst speculation of potential Federal Reserve policy easing.

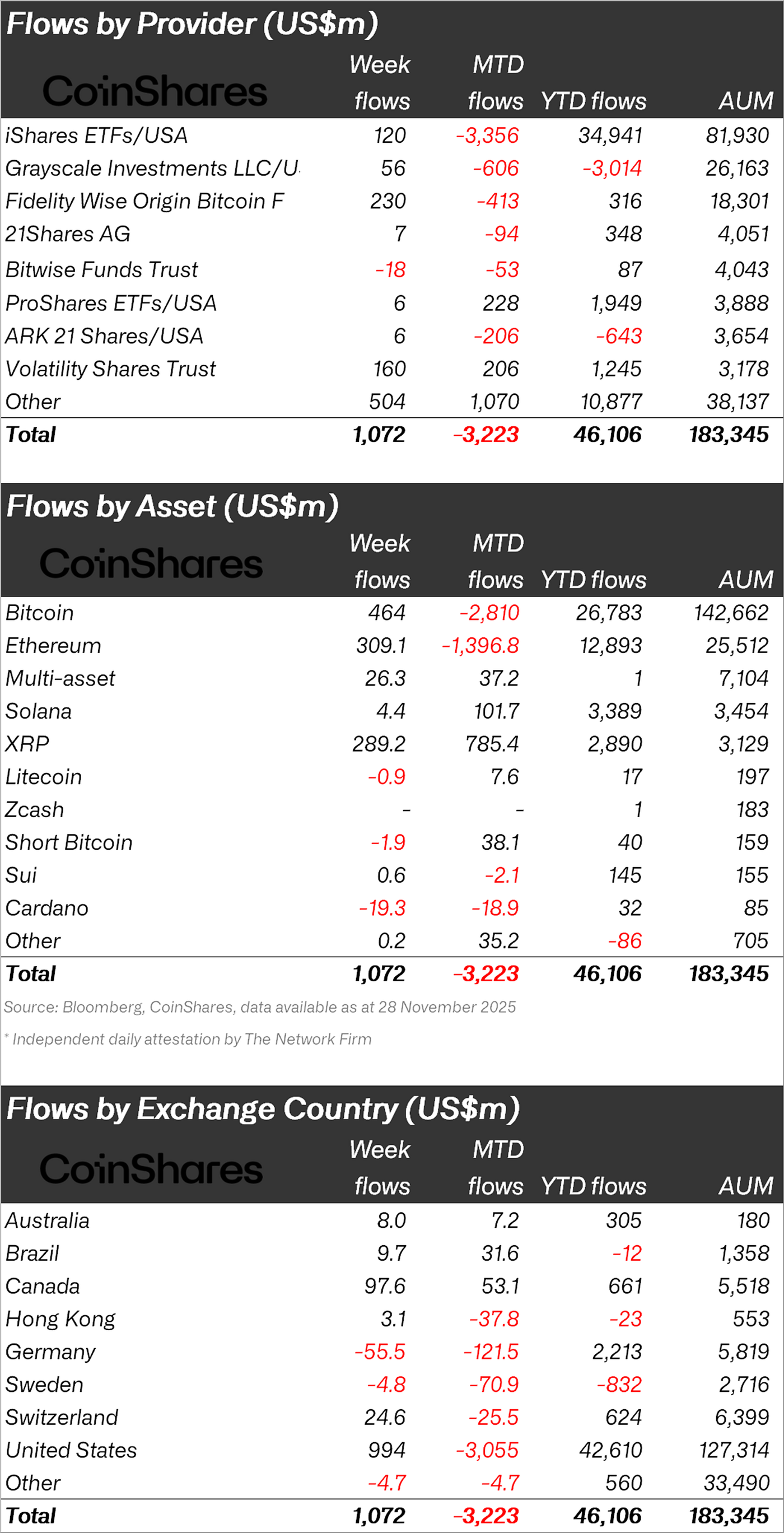

The digital asset market witnessed a notable shift in sentiment last week, with investment products attracting over a billion dollars in new capital. This reversal follows a period of substantial outflows, suggesting a renewed appetite among institutional and high-net-worth investors. XRP, in particular, has captured significant attention, experiencing record inflows amid growing expectations of spot ETF approvals, making it a focal point for those tracking regulatory developments and market structure.

XRP’s Record-Breaking Inflows

XRP led the charge with an unprecedented $289 million in weekly inflows. This surge is particularly noteworthy as it represents a substantial portion of XRP’s total assets under management, highlighting a concentrated bet by investors. The anticipation surrounding potential spot XRP ETFs in the U.S. appears to be a major catalyst, mirroring the dynamics observed prior to Bitcoin ETF approvals. This influx of capital suggests that institutional investors are positioning themselves to capitalize on the expected increase in liquidity and accessibility that ETFs typically bring.

Bitcoin and Ethereum Ride the Wave

Bitcoin, the bellwether of the crypto market, saw inflows of $461 million, signaling a broader return of confidence in digital assets. Concurrently, short-Bitcoin products experienced outflows, indicating a shift away from bearish sentiment. Ethereum followed suit, attracting $308 million in inflows, reflecting renewed investor interest after a period of relative weakness. These movements align with historical patterns where leading assets benefit from positive regulatory developments and broader market sentiment shifts, setting the stage for potential altcoin rallies.

Regional Investment Trends

The United States dominated global inflows, accounting for the lion’s share with $994 million, even during a holiday-shortened trading week. Canada and Switzerland also contributed positively, while Germany bucked the trend with outflows. These regional disparities underscore the varying levels of regulatory clarity and institutional adoption across different jurisdictions. The U.S.’s leading position reaffirms its pivotal role in driving digital asset investment, while contrasting flows in Europe highlight the impact of regulatory uncertainty and local market dynamics.

Altcoin Performance Divergence

While XRP enjoyed record inflows, other altcoins presented a mixed bag. Cardano (ADA) experienced significant outflows, contrasting sharply with XRP’s performance. This divergence underscores the selective nature of institutional investment in the altcoin space, where factors such as regulatory risk, technological advancements, and community support play crucial roles. The varying fortunes of altcoins highlight the importance of due diligence and risk management for investors navigating this rapidly evolving asset class.

Anticipating Fed Policy Shift

The resurgence in digital asset investment coincides with growing expectations of a potential shift in Federal Reserve policy. Remarks from FOMC members suggesting a possible easing of the current restrictive monetary policy have fueled speculation of future rate cuts. This anticipation has historically correlated with increased risk appetite and capital flows into alternative assets, including cryptocurrencies. Investors are seemingly positioning themselves for a more accommodative monetary environment, which could provide further tailwinds for digital asset valuations.

In conclusion, the recent surge in inflows into digital asset investment products, spearheaded by XRP, signals a potential turning point in market sentiment. The anticipation of spot XRP ETFs and a possible shift in Federal Reserve policy are key drivers behind this renewed investor interest. While challenges and uncertainties remain, the current market dynamics suggest a cautiously optimistic outlook for digital assets in the near term.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Digital asset investment products experienced a significant resurgence last week, with inflows totaling $1.07 billion, primarily driven by XRP. XRP recorded its largest weekly inflow ever, reaching $289 million, fueled by anticipation of new U.S. spot XRP ETFs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.