XRP experienced a notable price correction, reflecting broader market sentiment. Technical analysis suggests key support levels to watch for potential buying opportunities. Mid-term outlook remains uncertain, dependent on maintaining psychological support.

What to Know:

- XRP experienced a notable price correction, reflecting broader market sentiment.

- Technical analysis suggests key support levels to watch for potential buying opportunities.

- Mid-term outlook remains uncertain, dependent on maintaining psychological support.

XRP, like much of the crypto market, is currently navigating a period of price correction. As regulatory scrutiny intensifies and macro conditions remain uncertain, institutional investors are closely monitoring these developments. Understanding XRP’s price action, key support levels, and potential catalysts is crucial for informed decision-making in this evolving landscape.

Immediate Price Action

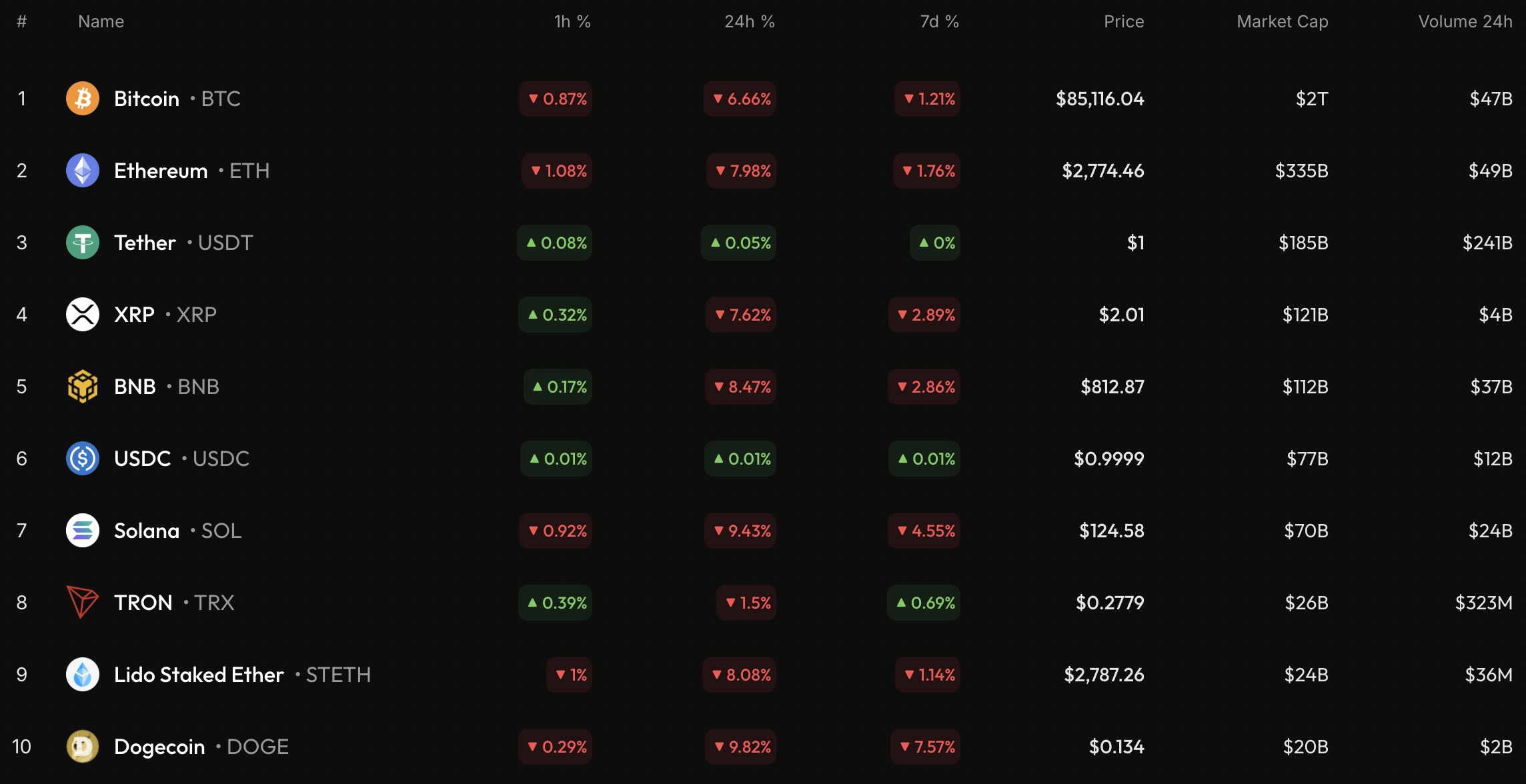

The recent 7.62% drop in XRP’s price underscores the inherent volatility of the crypto market. Such fluctuations are not uncommon, particularly in response to news events or shifts in market sentiment. For institutional investors, these dips can represent strategic entry points, provided they align with a well-defined investment thesis and risk management strategy. Monitoring order book depth and trading volumes around these levels can provide further insights into potential support and resistance areas.

Short-Term Technical Outlook

Technical analysis suggests that XRP is currently testing a local support level around $2. A break below this level could trigger further downside, potentially leading to a test of the $1.95 area. Traders often use such levels to set stop-loss orders or initiate short positions, which can exacerbate price movements. Conversely, a successful defense of this support could signal renewed buying interest and a potential rebound. The interplay between technical levels and market sentiment often dictates short-term price action.

Broader Timeframe Analysis

Zooming out to a longer timeframe reveals a more nuanced picture. XRP’s recent pullback follows a breakout above the $2.1482 level, suggesting an initial bullish impulse that has since faded. The daily bar’s closure is a key indicator to watch, as a close near the low could signal further weakness. This type of price action is reminiscent of previous failed breakouts in the crypto market, where initial enthusiasm is met with selling pressure, leading to a retracement.

Mid-Term Trajectory

From a mid-term perspective, the bulls’ inability to sustain upward momentum after a bullish weekly bar closure is concerning. The psychological $2 level is now a critical juncture. Should buyers fail to defend this level, a more significant drop towards the $1.50 zone could materialize by mid-December. This scenario would likely be driven by a combination of technical selling, reduced risk appetite, and potentially negative news flow. Institutional investors typically assess these scenarios by stress-testing their portfolios and adjusting their hedging strategies accordingly.

Market Sentiment and Catalysts

Beyond technical analysis, market sentiment and potential catalysts play a crucial role in shaping XRP’s price trajectory. Regulatory developments, Ripple’s ongoing legal battle with the SEC, and broader macroeconomic factors can all influence investor sentiment and trading activity. Positive regulatory clarity or a favorable legal outcome for Ripple could act as significant tailwinds, while adverse developments could trigger further selling pressure. Understanding these potential catalysts is essential for making informed investment decisions.

XRP and Institutional Adoption

XRP’s potential for institutional adoption hinges on several factors, including regulatory clarity, custody solutions, and the development of institutional-grade trading infrastructure. While XRP has made strides in these areas, it still faces challenges in gaining widespread acceptance among institutional investors. The launch of XRP-based ETFs, similar to those for Bitcoin and Ethereum, could significantly boost institutional participation by providing a more accessible and regulated investment vehicle.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP experienced a notable price correction, reflecting broader market sentiment. Technical analysis suggests key support levels to watch for potential buying opportunities. Mid-term outlook remains uncertain, dependent on maintaining psychological support. XRP, like much of the crypto market, is currently navigating a period of price correction.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.