Black Swan Capitalist founder Versan Aljarrah predicts XRP will eventually decouple from Bitcoin’s price action and broader crypto market cycles. Aljarrah argues that XRP’s utility in global settlements and liquidity management will drive its independent valuation.

What to Know:

- Black Swan Capitalist founder Versan Aljarrah predicts XRP will eventually decouple from Bitcoin’s price action and broader crypto market cycles.

- Aljarrah argues that XRP’s utility in global settlements and liquidity management will drive its independent valuation.

- Community sentiment reflects growing optimism that XRP is nearing a turning point where its intrinsic value will outweigh speculative pressures.

XRP, initially conceived to revolutionize cross-border payments, continues to navigate the complex dynamics of the digital asset market. While its utility in facilitating faster and cheaper transactions gains traction, XRP’s price often mirrors the movements of Bitcoin and the broader crypto market. This correlation raises questions about its true valuation and potential for independent growth, particularly as institutional adoption increases and regulatory clarity emerges.

Current Correlation and Market Influences

Despite increasing real-world use cases, XRP’s price remains correlated with Bitcoin and the overall crypto market sentiment. Recent market downturns, triggered by macro fears or regulatory concerns, have seen XRP decline alongside Bitcoin, suggesting that short-term speculation still heavily influences its price. This behavior is not unique to XRP; many altcoins exhibit similar patterns, especially during periods of heightened market volatility, reflecting the herd mentality often seen in nascent asset classes.

The implication here is that XRP, despite its unique technological advantages, is still viewed by many as a high-beta play on the broader crypto narrative. This perception limits its appeal to institutional investors seeking uncorrelated assets for diversification. For XRP to truly emerge as a distinct asset class, it needs to demonstrate resilience during market downturns and establish a track record of independent price discovery.

We’ve seen similar patterns in other asset classes during their early stages. For example, emerging market equities initially traded in tandem with developed market indices before diverging as their economies matured and attracted dedicated investment flows. XRP’s decoupling will likely follow a similar trajectory, driven by its growing utility and increasing institutional acceptance.

XRP’s Intrinsic Value Proposition

Aljarrah’s thesis rests on the idea that XRP’s value is fundamentally tied to its utility in global finance, rather than speculative trading. He points to the increasing adoption of Ripple’s payment solutions, tokenized assets, and real-time settlement capabilities as evidence of this intrinsic value. These use cases, while not immediately reflected in price charts, lay the groundwork for future demand and ultimately support a higher valuation.

The key here is that XRP offers tangible benefits in terms of speed, cost, and reliability compared to traditional systems like SWIFT. This advantage is particularly compelling for institutions dealing with cross-border payments and liquidity management. As these institutions integrate XRP into their workflows, the demand for the token will increase, driving its price higher and decoupling it from the speculative froth of the broader crypto market.

Consider the early days of internet stocks. Many companies were valued based on “eyeballs” and speculative growth projections. However, the companies that ultimately thrived were those that provided real value to users and businesses. XRP’s focus on solving real-world problems in the financial industry positions it for long-term success, even if its price remains volatile in the short term.

Mathematical Necessity for High Valuation

Aljarrah argues that XRP’s design makes high valuations mathematically necessary to efficiently facilitate global liquidity. Given the trillions of dollars in global settlement markets, including FX, derivatives, and cross-border flows, XRP’s limited supply could drive its price to significantly higher levels as its full utility is realized. This is particularly relevant for institutional players who require large amounts of liquidity to execute their strategies.

The concept of fractionalization further enhances XRP’s utility at higher price levels. By dividing each XRP token into one million drops, transactions remain affordable even as the overall valuation increases. This allows institutions to settle payments in fractions of tokens, making liquidity more efficient and accessible. Ripple CTO David Schwartz has illustrated this point, noting that higher XRP prices reduce the number of tokens needed for large transactions, thereby optimizing capital efficiency.

This argument is akin to the “network effect” seen in other industries. As more participants join a network, the value of that network increases exponentially. Similarly, as more institutions adopt XRP for settlement and liquidity management, the value of the XRP network will increase, justifying a higher valuation for the token.

Community Sentiment and Decoupling Signals

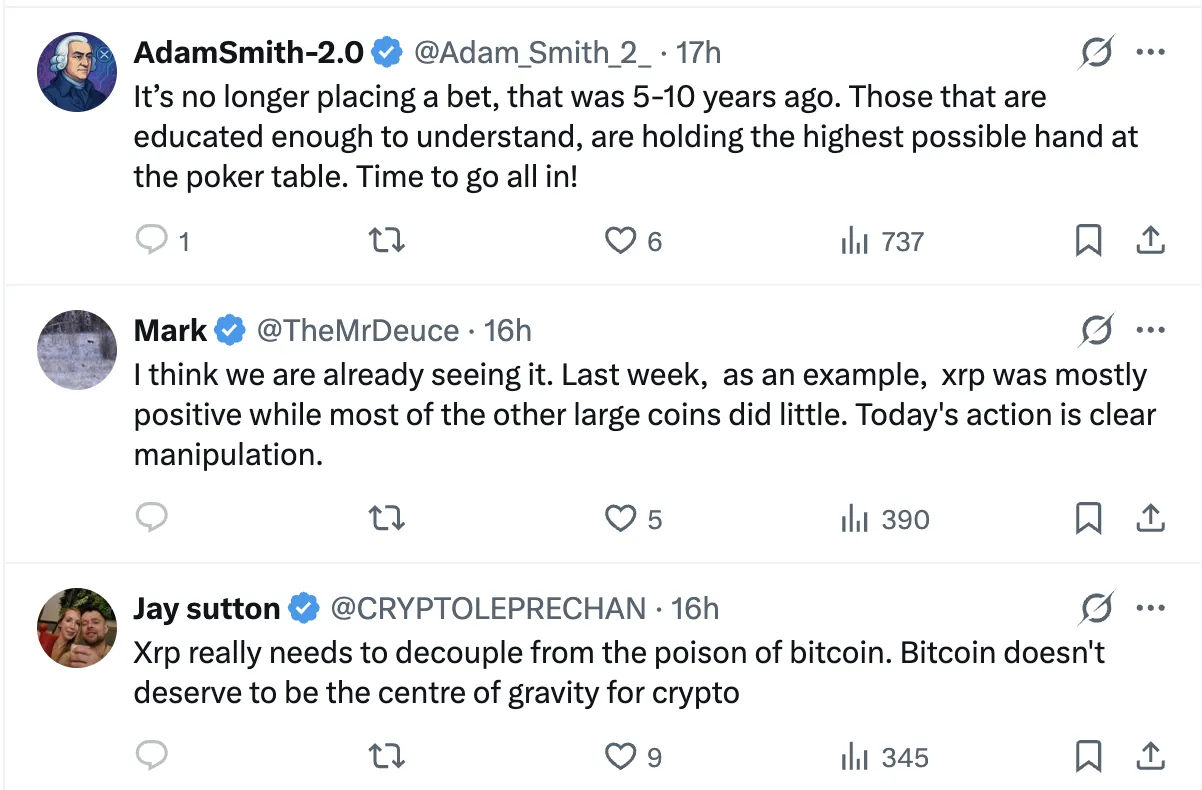

Community sentiment reflects a growing belief that XRP is nearing a major turning point. Some observers note that XRP has demonstrated relative strength during recent market downturns, holding up better than Bitcoin and other large-cap assets. This is seen as a potential signal that XRP is beginning to decouple from the broader crypto market and establish its own independent price discovery mechanism.

However, it’s important to note that community sentiment can be a lagging indicator. While enthusiasm among XRP holders is certainly a positive sign, it doesn’t guarantee future price performance. Institutional adoption, regulatory clarity, and continued technological development are all critical factors that will ultimately determine XRP’s long-term success.

We’ve seen similar patterns in other asset classes where strong community support initially drives price appreciation, but ultimately, fundamental factors determine long-term value. XRP’s decoupling will likely be a gradual process, driven by a combination of increasing utility, institutional adoption, and favorable regulatory developments.

Ultimately, the decoupling of XRP from Bitcoin and the broader crypto market hinges on its ability to establish itself as a distinct asset class with real-world utility. As institutional adoption grows and regulatory clarity emerges, XRP’s intrinsic value as a facilitator of global settlements and liquidity management will likely drive its independent valuation. While speculative pressures may persist in the short term, the long-term trajectory for XRP appears promising, provided it continues to deliver on its technological promises and gain traction in the global financial landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Black Swan Capitalist founder Versan Aljarrah predicts XRP will eventually decouple from Bitcoin’s price action and broader crypto market cycles. Aljarrah argues that XRP’s utility in global settlements and liquidity management will drive its independent valuation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.