Firelight Protocol has launched, introducing native XRP staking and yield opportunities. The protocol aims to provide on-chain economic security, protecting DeFi assets from exploits. Backed by Flare and Sentora, Firelight emphasizes a security-first approach with multiple audits.

What to Know:

- Firelight Protocol has launched, introducing native XRP staking and yield opportunities.

- The protocol aims to provide on-chain economic security, protecting DeFi assets from exploits.

- Backed by Flare and Sentora, Firelight emphasizes a security-first approach with multiple audits.

The launch of Firelight Protocol marks a significant development for XRP holders, offering them the ability to earn passive income through staking. This DeFi chain aims to provide native staking and yield opportunities for XRP, potentially unlocking new value and utility for the token. For institutional investors and active traders, the introduction of staking mechanisms can influence liquidity dynamics and market participation.

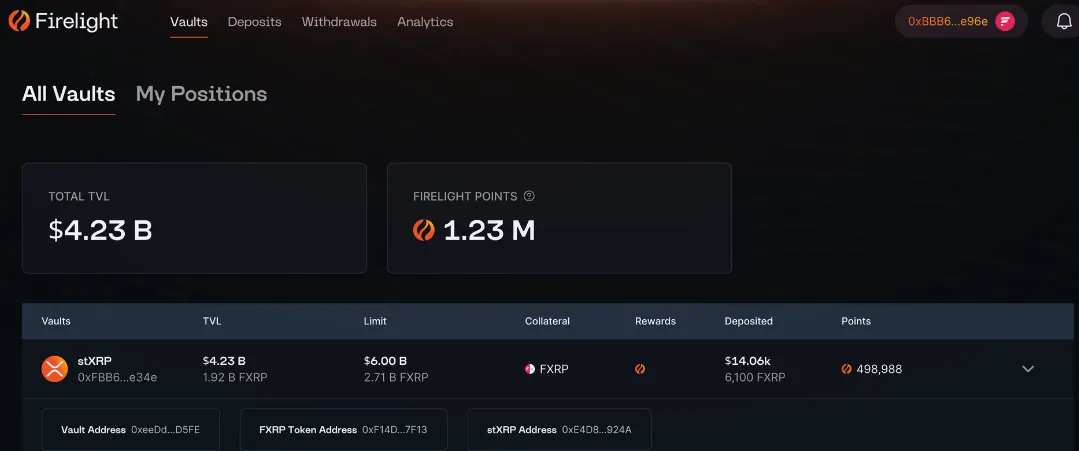

Firelight’s launch is structured in two phases. The initial phase allows XRP holders to deposit their assets into vaults and receive stXRP, an ERC-20 token pegged 1:1 to XRP. This stXRP can then be utilized within the Flare DeFi ecosystem for various activities, including swapping on decentralized exchanges or as collateral in lending pools. The ability to earn Firelight Points by depositing XRP in the launch vault adds an additional incentive for early adopters. Shortly after launch, the vault attracted over $4.2 billion worth of tokens, signaling strong initial interest. This kind of rapid accumulation of assets can create significant shifts in market liquidity and potentially impact price discovery.

The second phase focuses on allocating staked XRP to back a DeFi cover mechanism. This mechanism is designed to provide on-chain cover, safeguarding asset value in case of hacks and exploits. By staking their XRP, users contribute to the security of the protocol and receive rewards in return. The Firelight team has emphasized that this approach aims to add a new layer of value for XRP by utilizing staked tokens to provide on-chain cover that DeFi protocols can contract to protect asset value. This is akin to an insurance mechanism, where staked XRP acts as collateral to protect against potential losses.

Security is a key focus for Firelight, with the protocol backed by blockchain solutions platform Sentora and Flare. Sentora provides technical services, while Flare offers a bridge to connect XRP to the DeFi ecosystem. Ripple’s backing of both Flare and Sentora underscores the commitment to expanding DeFi capabilities for XRP. To ensure maximum compliance with security protocols, Firelight has undergone three audits by leading security platforms OpenZeppelin and Coinspect, as well as a bug bounty program supported by Immunifi. This multi-layered approach to security is crucial for attracting institutional investors who prioritize the safety and reliability of their assets.

The introduction of XRP staking through Firelight has several implications for the broader market. First, it provides XRP holders with a new avenue for generating yield on their assets, which can increase the attractiveness of holding XRP. Second, the DeFi cover mechanism adds a layer of security to the DeFi ecosystem, potentially encouraging greater participation from both retail and institutional investors. Third, the involvement of established players like Flare and Sentora lends credibility to the project and increases the likelihood of long-term success.

From a market structure perspective, the launch of Firelight could lead to increased liquidity and trading activity for XRP. As more XRP is staked and used within the Flare DeFi ecosystem, it could reduce the available supply on exchanges, potentially driving up the price. Additionally, the availability of stXRP as a liquid token allows for greater flexibility and composability within the DeFi space. This is similar to how the introduction of wrapped Bitcoin (wBTC) on Ethereum unlocked new opportunities for Bitcoin holders to participate in DeFi.

The regulatory outlook for XRP and DeFi protocols remains a key consideration for institutional investors. While the regulatory landscape is still evolving, the emphasis on security and compliance by Firelight could help to mitigate some of the risks associated with DeFi. By undergoing multiple audits and working with established players, Firelight is taking steps to demonstrate its commitment to responsible innovation.

In conclusion, the launch of Firelight Protocol represents a positive development for XRP holders and the broader DeFi ecosystem. By providing native staking and yield opportunities, while prioritizing security and compliance, Firelight has the potential to unlock new value and utility for XRP. This development fits into the broader trend of increasing institutional interest in digital assets and the growing demand for secure and reliable DeFi solutions.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Firelight Protocol has launched, introducing native XRP staking and yield opportunities. The protocol aims to provide on-chain economic security, protecting DeFi assets from exploits. Backed by Flare and Sentora, Firelight emphasizes a security-first approach with multiple audits.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.