XRP demonstrates bullish indicates amid surging network activity and decreasing exchange supply, suggesting potential for price appreciation. On-chain metrics, including velocity and whale activity, point to increased user engagement and liquidity within the XRP Ledger.

What to Know:

- XRP demonstrates bullish signals amid surging network activity and decreasing exchange supply, suggesting potential for price appreciation.

- On-chain metrics, including velocity and whale activity, point to increased user engagement and liquidity within the XRP Ledger.

- Key support levels, particularly around $2.15, are crucial for maintaining the current bullish momentum and paving the way for further gains.

XRP is showing renewed signs of strength, recovering ground after a recent dip below $2. The digital asset is navigating a landscape ripe with regulatory scrutiny and evolving market dynamics. For institutional investors and active traders, these on-chain signals and market structure shifts offer insights into potential opportunities and risks.

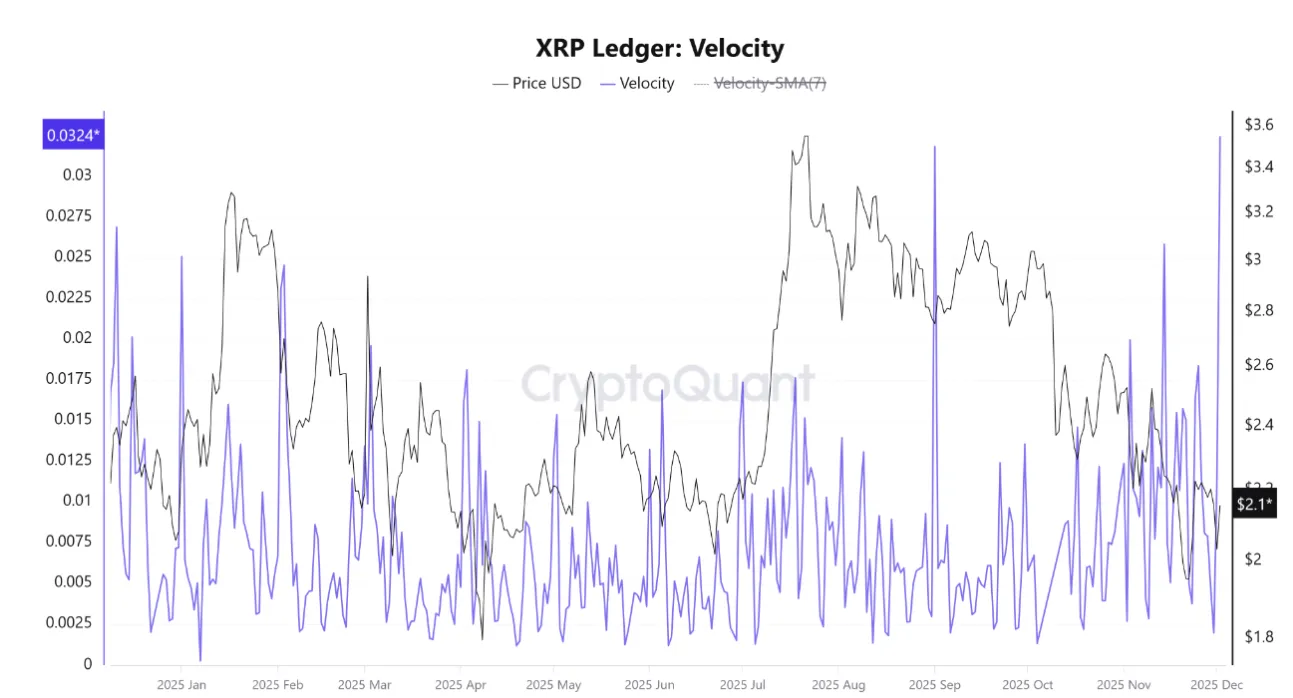

The velocity of the XRP Ledger has recently spiked, reaching yearly highs. This metric, representing the frequency at which XRP changes hands, is a key indicator of network activity. High velocity suggests that XRP is being actively used in transactions rather than sitting idle, reflecting greater liquidity and user engagement. Consider this alongside the backdrop of traditional finance, where velocity of money is similarly watched as an indicator of economic health; a parallel can be drawn here, suggesting growing utility for XRP within its ecosystem.

“Such a surge typically signifies high liquidity and substantial involvement from traders or significant movements by whales.”

Adding to this picture, data indicates sustained high values in the spot average order size, signaling continued activity from larger players, or “whales,” in the XRP market. This suggests institutional interest or at least high-net-worth individuals accumulating XRP. We’ve seen similar patterns in Bitcoin before major price movements, as large holders establish positions before broader market recognition.

Simultaneously, the amount of XRP held on exchanges has been declining sharply, reaching levels not seen since 2018. This decrease in exchange supply often indicates a reduced willingness to sell among holders, as they move their tokens to cold storage or stake them within decentralized finance (DeFi) protocols. The psychology here is straightforward: less supply available on exchanges can lead to upward price pressure if demand remains constant or increases.

The net position change of XRP on exchanges has also seen record outflows, reinforcing the narrative of accumulation. These outflows often precede significant price movements, as seen with other digital assets like Ethereum leading up to major protocol upgrades. However, it’s important to remember that past performance is not indicative of future results, and unforeseen regulatory developments could quickly change the landscape.

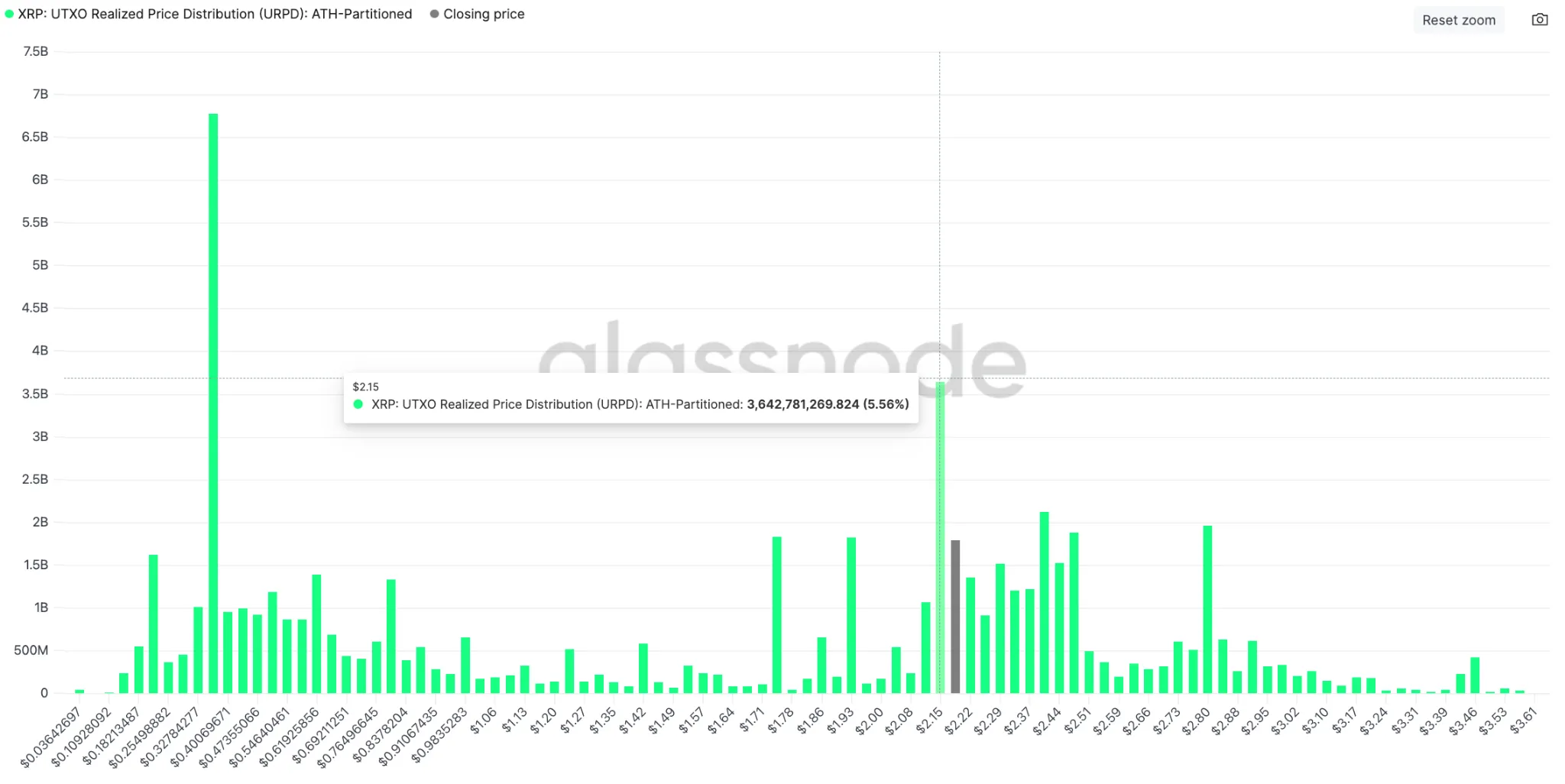

Technically, XRP’s ability to maintain support above $2.15 is crucial. This level aligns with the 50-period simple moving average (SMA), a widely watched indicator among technical analysts. Historically, holding this trendline has foreshadowed further price appreciation for XRP. However, market participants should be wary of potential fakeouts, where the price briefly breaks below support before reversing course.

Realized price distribution data suggests that $2.15 represents a significant accumulation zone for XRP, with a substantial number of tokens acquired around this price. This further reinforces the importance of this level as a key battleground between buyers and sellers.

In summary, XRP’s current market dynamics reveal a confluence of bullish signals, including increased network activity, decreasing exchange supply, and the establishment of key support levels. While these factors suggest the potential for further price appreciation, investors should remain vigilant and conduct thorough due diligence, considering both the opportunities and risks inherent in the digital asset market.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP demonstrates bullish signals amid surging network activity and decreasing exchange supply, suggesting potential for price appreciation. On-chain metrics, including velocity and whale activity, point to increased user engagement and liquidity within the XRP Ledger.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.