XRP exchange-traded funds (ETFs) are rapidly approaching $1 billion in assets under management, signaling strong institutional interest. Ripple CEO Brad Garlinghouse believes the current ETF inflows are just the beginning, indicating substantial growth potential for crypto ETFs in the broader market.

What to Know:

- XRP exchange-traded funds (ETFs) are rapidly approaching $1 billion in assets under management, signaling strong institutional interest.

- Ripple CEO Brad Garlinghouse believes the current ETF inflows are just the beginning, indicating substantial growth potential for crypto ETFs in the broader market.

- Vanguard’s policy reversal to list XRP ETFs marks a significant shift, potentially amplifying mainstream access to digital assets.

The rapid growth of XRP exchange-traded funds is capturing the attention of institutional investors, with assets under management nearing the $1 billion mark. This milestone, combined with positive commentary from Ripple CEO Brad Garlinghouse, suggests a bullish outlook for XRP and the broader crypto ETF market. The increasing institutional adoption, highlighted by major players like Vanguard, points to a maturing digital asset landscape.

Garlinghouse’s Bullish Stance on Crypto ETFs

Brad Garlinghouse’s recent remarks at Binance Blockchain Week in Dubai underscored his optimism regarding the future of crypto ETFs. He refuted concerns about cooling interest, emphasizing that the recent approval and subsequent inflows into XRP ETFs reflect pent-up demand. Garlinghouse noted that crypto ETFs currently represent a small fraction of the global ETF industry, suggesting substantial room for growth as regulatory obstacles diminish and institutional acceptance increases.

Institutional Inflows and Market Dynamics

Garlinghouse highlighted a shift in institutional behavior, noting that firms previously hesitant due to regulatory uncertainties and risk concerns are now entering the crypto market cautiously. Ripple’s prime brokerage platform is witnessing this evolution firsthand, with institutions gradually increasing their engagement. This measured approach mirrors historical patterns observed during the early stages of other asset classes entering the ETF market, such as gold, where initial skepticism gave way to widespread adoption as the regulatory environment clarified and market infrastructure matured.

Vanguard’s Policy Reversal and Market Access

Vanguard’s decision to list XRP spot ETFs on its brokerage platform represents a pivotal moment for digital assets. As one of the world’s largest asset managers, Vanguard’s prior reluctance to embrace crypto products underscored the regulatory and reputational hurdles facing the industry. This policy reversal is expected to broaden mainstream access to XRP, potentially mirroring the transformative impact of gold ETFs on precious metals investing. The increased accessibility could drive further inflows and solidify XRP’s position within institutional portfolios.

XRP ETF Performance and Market Sentiment

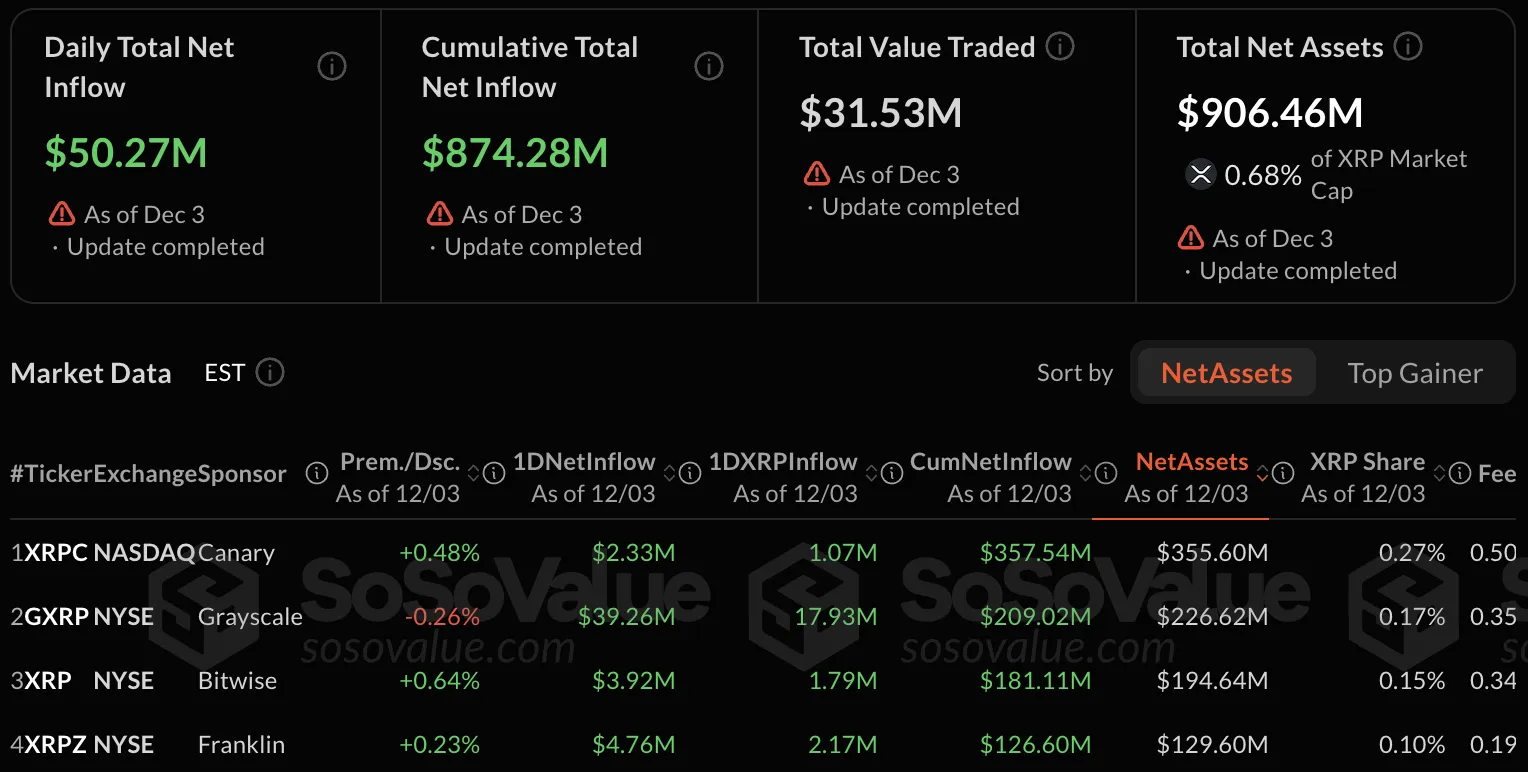

Recent market data indicates that XRP ETFs hold approximately $906.46 million in total assets, with consistent net inflows since their launch. This strong performance, coupled with zero days of outflows, reflects positive investor sentiment and confidence in XRP’s long-term prospects. The rapid accumulation of assets underscores the pent-up demand for regulated investment vehicles that provide exposure to digital assets without the complexities of self-custody. This trend aligns with the broader institutional preference for regulated and familiar investment structures.

Future Growth and Market Allocation

With XRP ETFs nearing the $1 billion milestone and major players like 21Shares securing approvals for their spot XRP ETFs, the ecosystem’s sentiment is increasingly bullish. Garlinghouse’s projection that crypto’s share of the ETF market will grow significantly over the next few years suggests a long-term perspective on digital asset adoption. As regulatory frameworks become clearer and institutional infrastructure develops further, allocations to crypto ETFs are expected to increase, driving further growth and maturation of the market.

In conclusion, the rapid growth of XRP ETFs and the positive outlook from Ripple’s CEO highlight the increasing institutional interest in digital assets. Vanguard’s policy reversal and the consistent inflows into XRP ETFs signal a maturing market landscape. As crypto ETFs continue to gain traction, they are poised to play a significant role in the broader financial ecosystem, offering regulated and accessible avenues for institutional and retail investors alike.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP exchange-traded funds (ETFs) are rapidly approaching $1 billion in assets under management, signaling strong institutional interest. Ripple CEO Brad Garlinghouse believes the current ETF inflows are just the beginning, indicating substantial growth potential for crypto ETFs in the broader market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.