The first XRP spot ETF launched with strong inflows, signaling institutional interest. Despite the ETF launch, XRP’s price has declined, reflecting broader market weakness. An XRP market cap of $1.137 trillion would imply a price of $18.95, potentially outpacing major companies.

What to Know:

- The first XRP spot ETF launched with strong inflows, signaling institutional interest.

- Despite the ETF launch, XRP’s price has declined, reflecting broader market weakness.

- An XRP market cap of $1.137 trillion would imply a price of $18.95, potentially outpacing major companies.

The recent launch of the first pure spot-based XRP ETF, the Canary Capital XRP ETF (XRPC), has turned heads on Wall Street, debuting with impressive volume and net inflows. This move signals a potential shift in institutional perception of XRP, opening doors for increased investment and liquidity. However, despite the ETF’s promising start, XRP’s price has faced headwinds, prompting a deeper look at its market dynamics and future potential.

ETF Launch and Market Sentiment

The launch of a spot XRP ETF is a significant step toward mainstream acceptance, mirroring the earlier impact of Bitcoin ETFs. The initial $58 million volume and $245 million in net inflows demonstrate pent-up demand and a willingness from investors to gain exposure to XRP through regulated investment vehicles. However, the subsequent price decline highlights the complex interplay between ETF inflows and broader market sentiment, reminding us that ETF success doesn’t guarantee immediate price appreciation.

XRP’s Market Cap and Price Potential

XRP’s current market cap of $137.12 billion is a far cry from its all-time high of $216.69 billion. While past performance isn’t indicative of future results, understanding XRP’s potential in a bullish scenario is crucial for investors. If XRP were to add $1 trillion to its market cap, reaching $1.137 trillion, the implied price would be around $18.95, based on the circulating supply of 60 billion tokens. This target, while ambitious, underscores the potential upside if XRP captures a larger share of the digital asset market.

Historical Context and Future Projections

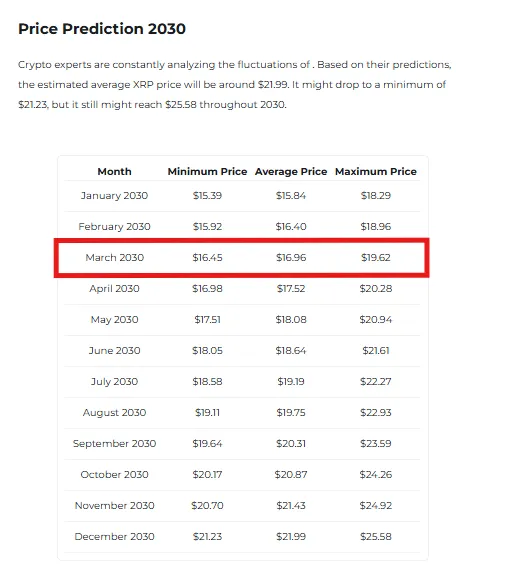

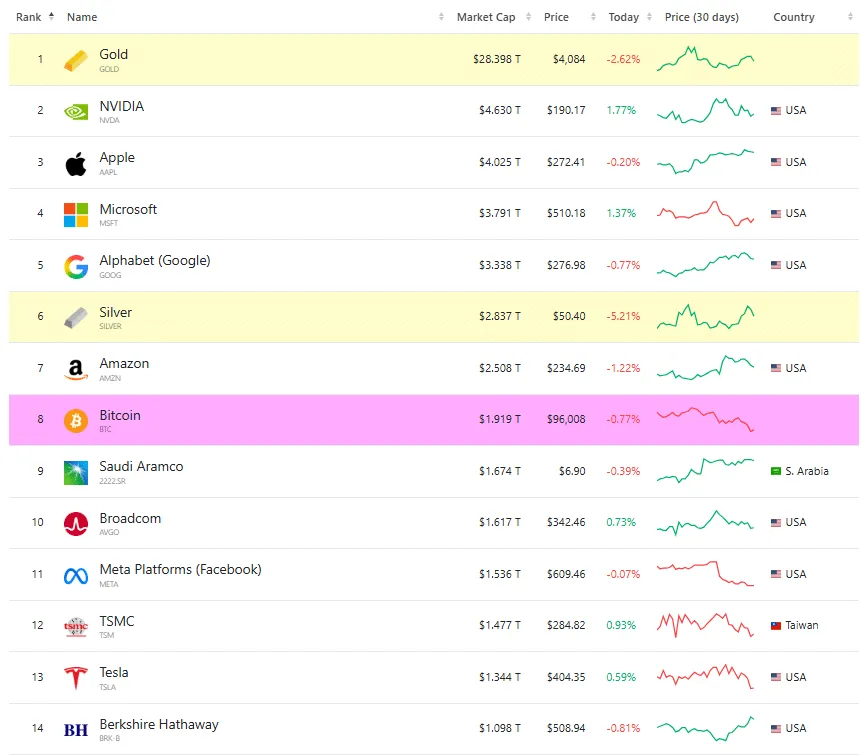

Bitcoin’s journey to and beyond the $1 trillion market cap provides a useful parallel. BTC first achieved this milestone in February 2021, reaching $1.3 trillion before succumbing to bear market pressures. Today, it has reclaimed this level, demonstrating the potential for sustained growth in the digital asset space. While analysts at firms like Changelly predict XRP could reach the $19 level by 2030, these projections are inherently uncertain. Macroeconomic factors, regulatory developments, and technological advancements will all play a role in XRP’s future price trajectory.

XRP’s Potential Market Dominance

Reaching a $1.137 trillion market cap would position XRP among the world’s largest assets, surpassing established companies like Berkshire Hathaway, JPMorgan, Walmart, and Visa. This comparison highlights the transformative potential of digital assets and the possibility for XRP to disrupt traditional financial hierarchies. However, it’s essential to remember that market cap isn’t the only metric of success. Liquidity, regulatory clarity, and real-world adoption are equally important factors in determining XRP’s long-term viability.

Regulatory Landscape and Institutional Adoption

The ongoing regulatory scrutiny surrounding XRP remains a key consideration for institutional investors. While the launch of an XRP ETF suggests a growing level of comfort, the regulatory landscape is constantly evolving. Clarity on XRP’s legal status could unlock further institutional adoption, driving increased liquidity and price appreciation. Conversely, any adverse regulatory developments could dampen enthusiasm and hinder XRP’s growth potential.

Conclusion

The launch of the first XRP spot ETF marks a significant milestone, potentially paving the way for increased institutional involvement and liquidity. While the immediate price action has been muted, the long-term potential for XRP remains substantial. Reaching a $1 trillion market cap, and a price near $19, would require significant market adoption and a favorable regulatory environment, positioning XRP among the world’s leading assets.

Related: XRP ETFs Reach $1 Billion; Rally Signals

Source: Original article

Quick Summary

The first XRP spot ETF launched with strong inflows, signaling institutional interest. Despite the ETF launch, XRP’s price has declined, reflecting broader market weakness. An XRP market cap of $1.137 trillion would imply a price of $18.95, potentially outpacing major companies.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.