XRP is currently trading near a critical support level that could determine its short to mid-term trajectory. A break below $1.9835 could trigger a significant sell-off, potentially driving the price down to the $1.80-$1.85 range. Traders should closely monitor this level for potential breakout or breakdown indicates.

What to Know:

- XRP is currently trading near a critical support level that could determine its short to mid-term trajectory.

- A break below $1.9835 could trigger a significant sell-off, potentially driving the price down to the $1.80-$1.85 range.

- Traders should closely monitor this level for potential breakout or breakdown signals.

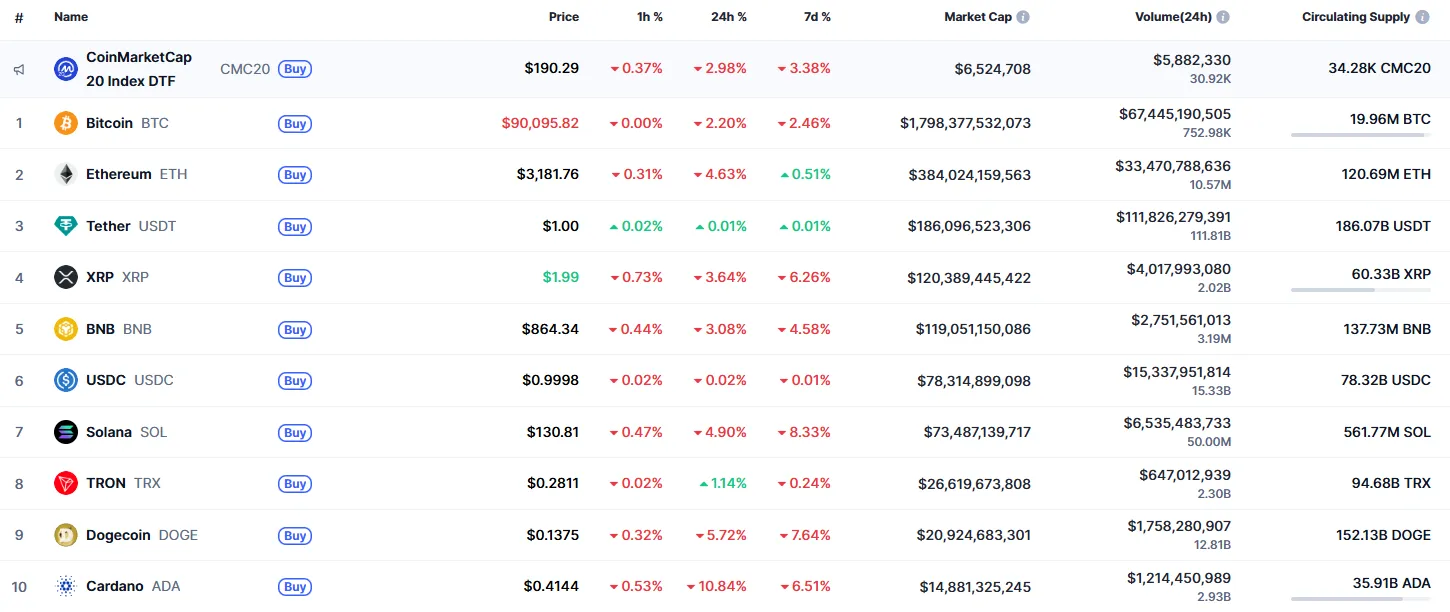

XRP, like much of the crypto market, has been under pressure recently, and its price action is now at a crucial juncture. The $1.9835 level represents a key support that, if breached, could lead to a substantial decline. Understanding the technical implications of this level is vital for institutional investors managing risk and seeking opportunities in the digital asset space.

Technical Breakdown

The immediate focus for XRP is its proximity to the $1.9927 support level. A failure to hold this level on the hourly chart could signal further downside, with a potential target of $1.95. This short-term weakness could be a precursor to a larger correction if broader market sentiment remains bearish. Such technical breakdowns often lead to cascading liquidations, exacerbating price declines.

Critical Support Level

Zooming out to a longer timeframe, the $1.9835 level becomes even more significant. A breakout below this point could unleash accumulated selling pressure, potentially driving XRP down to the $1.90 area in the near term. This level has acted as a key area of contention between buyers and sellers, and a decisive move below it would likely embolden bearish sentiment. Institutional desks will be watching closely for confirmation of this breakdown.

Mid-Term Outlook

From a mid-term perspective, the $1.9835 level remains the focal point. If the weekly candle closes below this level, it would confirm a bearish trend, potentially leading to a test of the $1.80-$1.85 range by the end of the month. This scenario would represent a significant correction and could test the resolve of long-term holders. Such corrections are not uncommon in the crypto market, often driven by a combination of technical factors and broader macroeconomic conditions.

Market Sentiment and Trading Strategy

Given the current technical setup, traders should exercise caution and closely monitor the $1.9835 level. A confirmed break below this level could present shorting opportunities, while a hold above it could signal a potential bounce. However, any long positions should be approached with caution, considering the overall bearish sentiment in the market. Risk management is paramount in such volatile conditions.

Historical Parallels and Institutional Implications

The current situation with XRP mirrors past instances in the crypto market where key support levels have been tested and broken, leading to significant price declines. Institutional investors should draw parallels to these events, adjusting their strategies accordingly. For instance, the launch of Bitcoin ETFs saw initial euphoria followed by a period of consolidation and correction. Similarly, XRP’s current price action needs to be viewed within the context of broader market cycles and regulatory developments.

In summary, XRP’s price is at a critical juncture, with the $1.9835 level acting as a key determinant of its short to mid-term trajectory. A break below this level could trigger a significant sell-off, while a hold above it may offer a temporary reprieve. Traders and investors should closely monitor this level and adjust their strategies accordingly, keeping a close eye on broader market sentiment and risk management.

Related: XRP’s Fate Sparks Debate

Source: Original article

Quick Summary

XRP is currently trading near a critical support level that could determine its short to mid-term trajectory. A break below $1.9835 could trigger a significant sell-off, potentially driving the price down to the $1.80-$1.85 range. Traders should closely monitor this level for potential breakout or breakdown signals.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.