Key takeaway #1 — XRP derivatives markets are currently dominated by bearish sentiment, evidenced by deeply negative funding rates. Key takeaway #2 — Declining XRP ETF volumes and a decrease in XRP Ledger TVL indicate fading interest in the XRP ecosystem.

What to Know:

- Key takeaway #1 — XRP derivatives markets are currently dominated by bearish sentiment, evidenced by deeply negative funding rates.

- Key takeaway #2 — Declining XRP ETF volumes and a decrease in XRP Ledger TVL indicate fading interest in the XRP ecosystem.

- Key takeaway #3 — The combination of derivatives data and on-chain metrics suggests a low likelihood of a near-term price rebound for XRP.

XRP’s recent slide below $2 has pushed funding rates to extreme lows, a condition that typically encourages bullish traders to enter the market. However, this time, traders seem hesitant. The negative funding rates and stagnant open interest in XRP derivatives suggest a strong bearish sentiment, raising concerns about the potential for a sustained price recovery.

XRP Derivatives Show Bearish Dominance

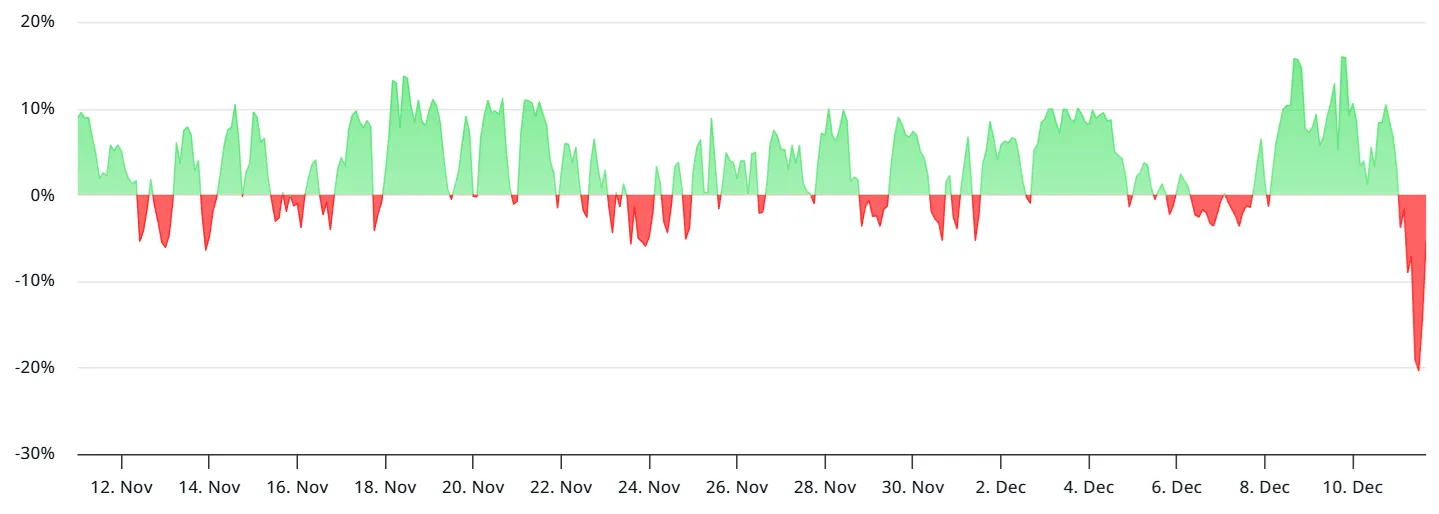

The funding rate on XRP perpetual futures plummeted to -20% on Thursday, marking the lowest level since the Oct. 10 crash. This negative reading signifies that short sellers are paying long buyers to maintain their positions, indicating a significant lack of demand from bullish traders. Typically, a balanced market sees funding rates ranging from 6% to 12% to cover the cost of capital for long positions.

Such deeply negative funding rates are uncommon and often short-lived. While some analysts view them as potential reversal signals, historical examples typically occur during flash crashes rather than extended corrective phases. The lack of appetite for leverage also raises questions about whether traders have simply withdrawn from XRP, impacting its liquidity.

Declining XRP ETF Activity and Fading TVL on XRP Ledger

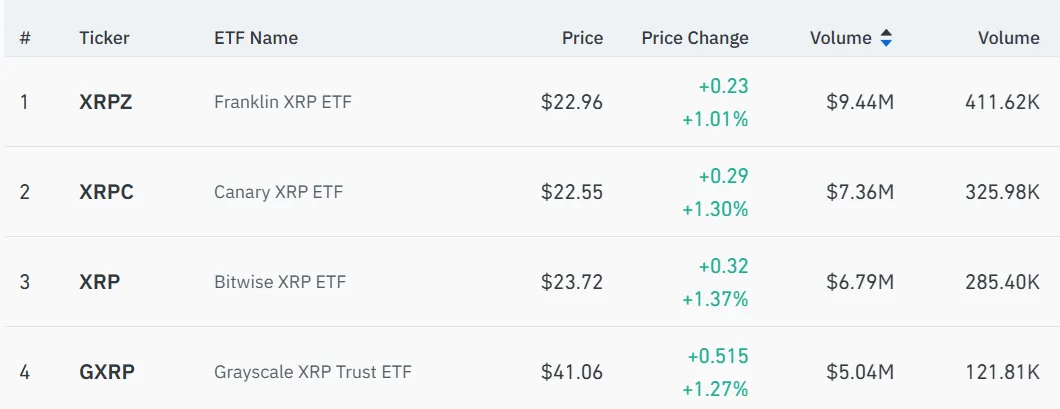

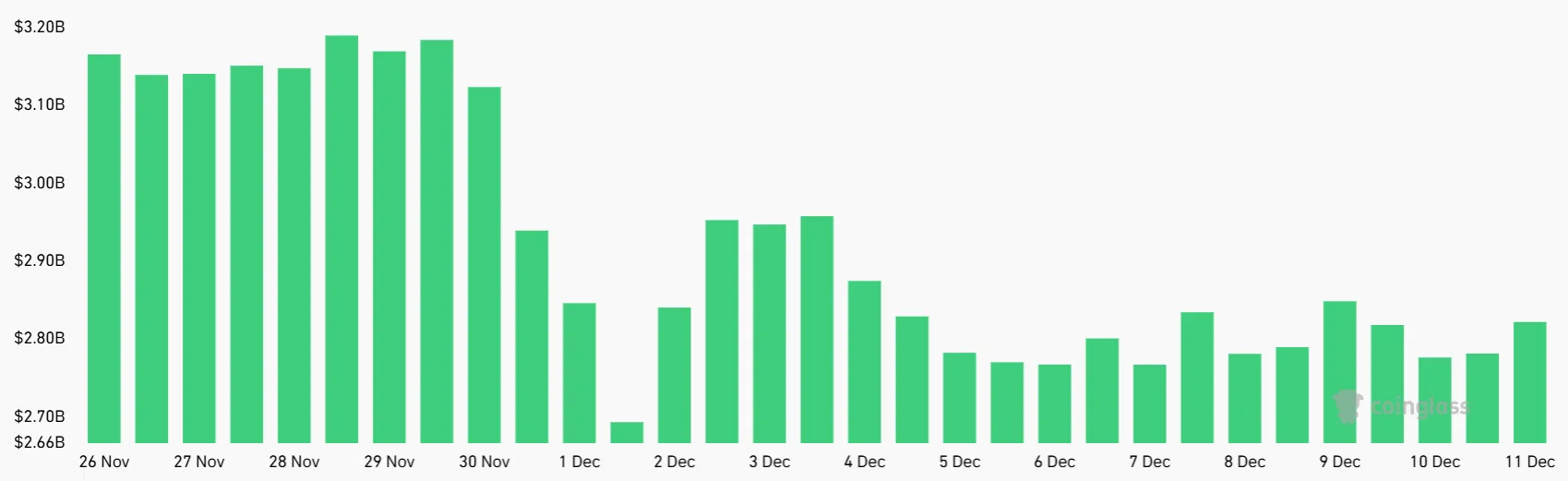

Part of the subdued appetite for bullish XRP positions can be attributed to the declining activity in U.S.-listed XRP ETFs. Despite strong expectations at the beginning of November, inflows and trading activity experienced a sharp decline after just three weeks. Consequently, assets under management have remained stagnant near $3.1 billion, according to CoinShares data. In comparison, Solana ETFs hold $3.3 billion in assets, highlighting the relatively weaker institutional sentiment towards XRP.

Daily volume on U.S.-listed XRP ETFs rarely surpasses $30 million, which significantly diminishes interest from institutional desks. This lack of institutional sentiment further contributes to the bearish outlook for XRP. Additionally, the fading demand for the XRP Ledger is another source of concern for XRP holders, impacting its overall liquidity and market perception.

What Factors Are Contributing to the Lack of Bullish Momentum for XRP?

The muted appetite for bullish XRP positions can be partly attributed to the declining activity in U.S.-listed XRP ETFs. After a promising start to November, inflows and trading activity sharply declined within three weeks. Consequently, assets under management have remained near $3.1 billion, according to CoinShares data. In comparison, Solana ETFs hold $3.3 billion in assets, indicating stronger institutional sentiment.

Moreover, the limited activity on the XRP Ledger creates a reinforcing cycle where investors have fewer incentives to hold XRP. This is especially true when compared to the native staking yields available on blockchains like BNB and Solana. The lack of clear evidence that increased XRP Ledger activity directly benefits XRP holders further dampens the bullish outlook.

How Does XRP Ledger’s TVL Compare to Other Blockchains?

More than $1 billion worth of RLUSD has been issued on Ethereum, compared with just $235 million on the XRP Ledger. This disparity highlights the preference for Ethereum’s infrastructure over XRP’s, even for Ripple-backed stablecoins. More concerning, the Total Value Locked (TVL) on the XRP Ledger has dropped to its lowest level of 2025 at $68 million, signaling declining engagement with the chain’s decentralized applications (DApps).

In contrast, the Stellar blockchain holds $176 million in TVL, despite XLM’s market capitalization being significantly smaller than XRP’s $121.8 billion. The declining TVL on the XRP Ledger reflects a broader trend of reduced liquidity and interest in the XRP ecosystem, impacting its overall market dynamics and institutional sentiment.

What Are the Implications of Negative Funding Rates for XRP?

Negative funding rates in the XRP derivatives market indicate that short sellers are dominant and are willing to pay a premium to maintain their positions. This situation arises when there is a strong expectation that the price of XRP will continue to decline. However, such extreme conditions are typically short-lived, and some analysts view them as potential reversal signals.

Despite this possibility, the overall market sentiment remains bearish due to the lack of bullish participation and the reluctance of traders to increase their exposure. The aggregate open interest in XRP futures has not recovered to previous levels, suggesting that even after a 45% drop since July, bears are cautious about further increasing their positions. This cautious approach reflects broader concerns about the potential for a sustained recovery in XRP’s price.

XRP’s Struggle Amidst Competing Blockchains

XRP remains under pressure as competing blockchains like BNB Chain and Solana continue to strengthen their positions in the DApps ecosystem. The limited activity on XRP Ledger creates a reinforcing cycle in which investors have fewer incentives to hold XRP, especially when compared with the native staking yields available on BNB and SOL. This competitive disadvantage further dampens investor enthusiasm and impacts XRP’s market performance.

The lack of a clear catalyst to drive increased activity on the XRP Ledger also contributes to the negative outlook. Without significant developments that translate into direct benefits for XRP holders, the token faces an uphill battle in attracting and retaining investors. This situation underscores the importance of innovation and ecosystem growth for XRP to regain bullish momentum and compete effectively in the crypto market.

XRP derivatives indicate increased confidence among bears, while on-chain metrics and ETF flows show fading interest, particularly from institutional investors. As a result, the odds of sustained bullish momentum for XRP appear low in the near term. The combination of negative funding rates, declining TVL, and subdued ETF activity paints a concerning picture for XRP’s immediate prospects.

Related: Sirgoo Lee’s Influence on Crypto Remains Strong

Source: Original article

Quick Summary

Key takeaway #1 — XRP derivatives markets are currently dominated by bearish sentiment, evidenced by deeply negative funding rates. Key takeaway #2 — Declining XRP ETF volumes and a decrease in XRP Ledger TVL indicate fading interest in the XRP ecosystem.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.