Ripple gained a major banking partnership in Europe and conditional approval for a US national trust bank charter. These developments occur amid a broader context of Ripple’s expanding influence and adoption of its technologies.

What to Know:

- Ripple gained a major banking partnership in Europe and conditional approval for a US national trust bank charter.

- These developments occur amid a broader context of Ripple’s expanding influence and adoption of its technologies.

- Despite these positive developments, XRP’s price has not reflected these wins, highlighting a disconnect between Ripple’s business progress and XRP’s market performance.

Ripple has continued its string of successes, securing a new European banking partnership and a conditional approval for a national trust bank charter in the US. These achievements underscore Ripple’s growing influence in the financial industry and the increasing adoption of its technologies. However, the price of XRP has not mirrored these positive developments, remaining under pressure despite the company’s significant progress.

Ripple’s Expanding Partnerships

Ripple’s recent partnership with Switzerland’s AMINA Bank marks its entry into the European banking sector. AMINA Bank will leverage Ripple’s stablecoin to facilitate near-real-time cross-border payments for its clients through Ripple Payments. This collaboration highlights the increasing demand for efficient and cost-effective cross-border payment solutions, with Ripple at the forefront of providing such services.

Conditional Approval for US National Trust Bank

In addition to the European partnership, Ripple received conditional approval from the US Office of the Comptroller of the Currency (OCC) to establish a national trust bank. This approval places Ripple alongside other digital asset companies like Circle, BitGo, Paxos, and Fidelity, solidifying its position as a regulated entity within the US financial system. The national trust bank charter will enable Ripple to offer regulated custody services for digital assets, further expanding its suite of services.

XRP’s Price Struggles

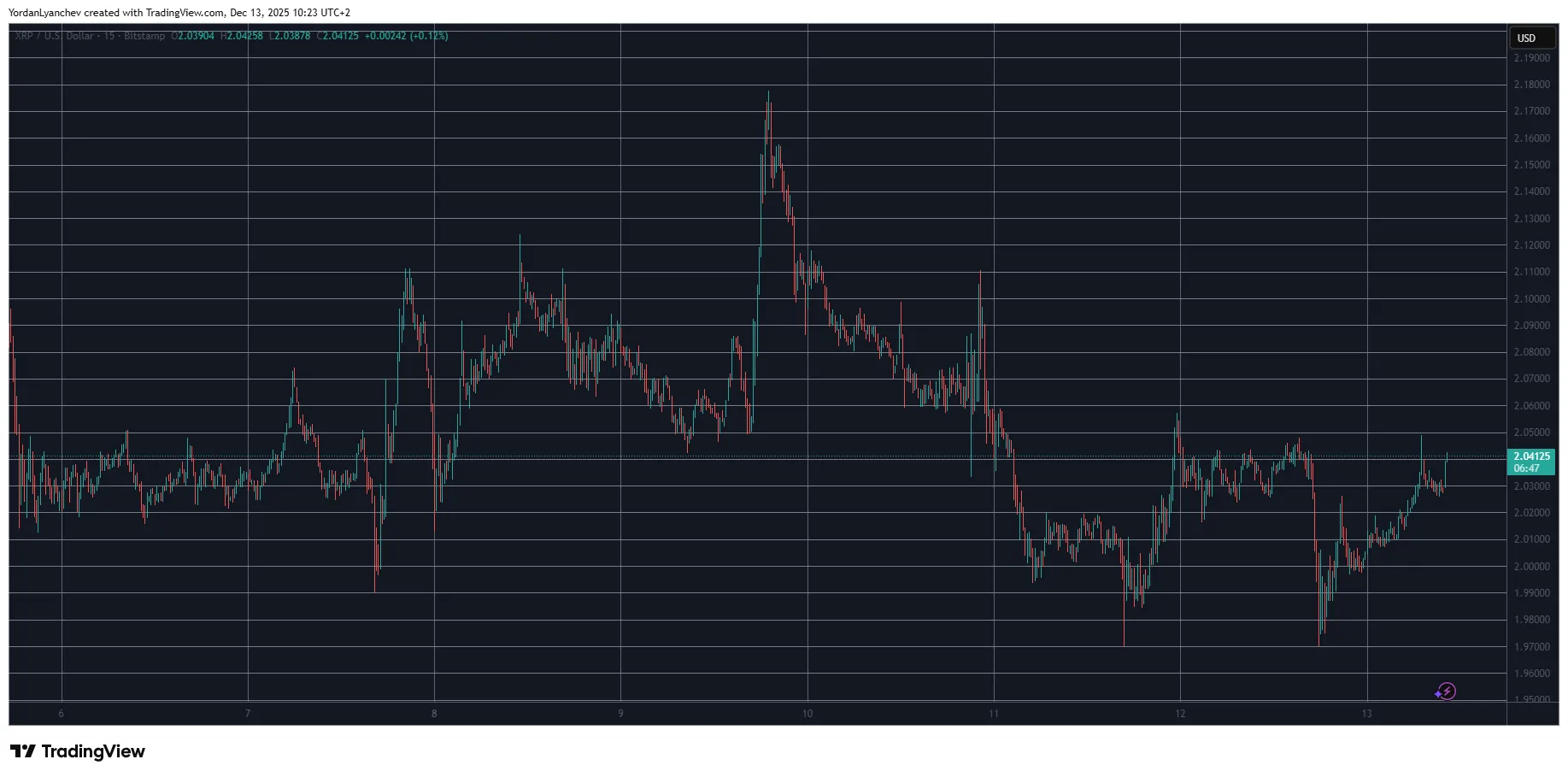

Despite Ripple’s positive news flow, XRP’s price has not experienced a corresponding boost. The launch of spot XRP ETFs in the US has not provided the expected price support, with XRP trading around $2.04, down nearly 20% in the past month and over 40% from its July high. This disconnect between Ripple’s business successes and XRP’s market performance raises questions about the factors influencing XRP’s price dynamics.

Market Dynamics and Liquidity

The lack of price appreciation in XRP could be attributed to various market factors, including broader market sentiment, regulatory uncertainties, and the specific dynamics of XRP’s supply and demand. While Ripple continues to build partnerships and expand its services, these developments may not directly translate into increased demand for XRP. The token’s utility within Ripple’s ecosystem and its role in facilitating cross-border payments are key factors that could influence its long-term price trajectory.

Broader Market Context

The performance of XRP also needs to be viewed within the context of the broader cryptocurrency market. Bitcoin and Ethereum, as the leading cryptocurrencies, often set the tone for the market, and their price movements can impact the performance of other digital assets. Macroeconomic factors, such as interest rates and inflation, can also influence investor sentiment and risk appetite, affecting the entire crypto market.

Conclusion

Ripple’s recent achievements, including its European banking partnership and conditional approval for a US national trust bank, highlight the company’s ongoing expansion and increasing influence in the financial industry. However, XRP’s price has not reflected these positive developments, remaining under pressure despite Ripple’s successes. The disconnect between Ripple’s business progress and XRP’s market performance underscores the complex dynamics influencing the token’s price, including market sentiment, regulatory factors, and the broader cryptocurrency market environment.

Related: XRP: Bollinger Bands Warn of Price Drop

Source: Original article

Quick Summary

Ripple gained a major banking partnership in Europe and conditional approval for a US national trust bank charter. These developments occur amid a broader context of Ripple’s expanding influence and adoption of its technologies.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.