Major US banks are increasingly offering Bitcoin services. This shift is driven by client demand and regulatory clarity. Banks are using third-party infrastructure to manage crypto operations.

What to Know:

- Major US banks are increasingly offering Bitcoin services.

- This shift is driven by client demand and regulatory clarity.

- Banks are using third-party infrastructure to manage crypto operations.

The financial landscape is evolving as major US banks begin to integrate Bitcoin into their services. After years of cautious observation, these institutions are now exploring ways to sell, safeguard, or advise on Bitcoin directly, signaling a significant shift in the perception and adoption of crypto assets. This move towards mainstream integration is expected to continue shaping the future of digital finance.

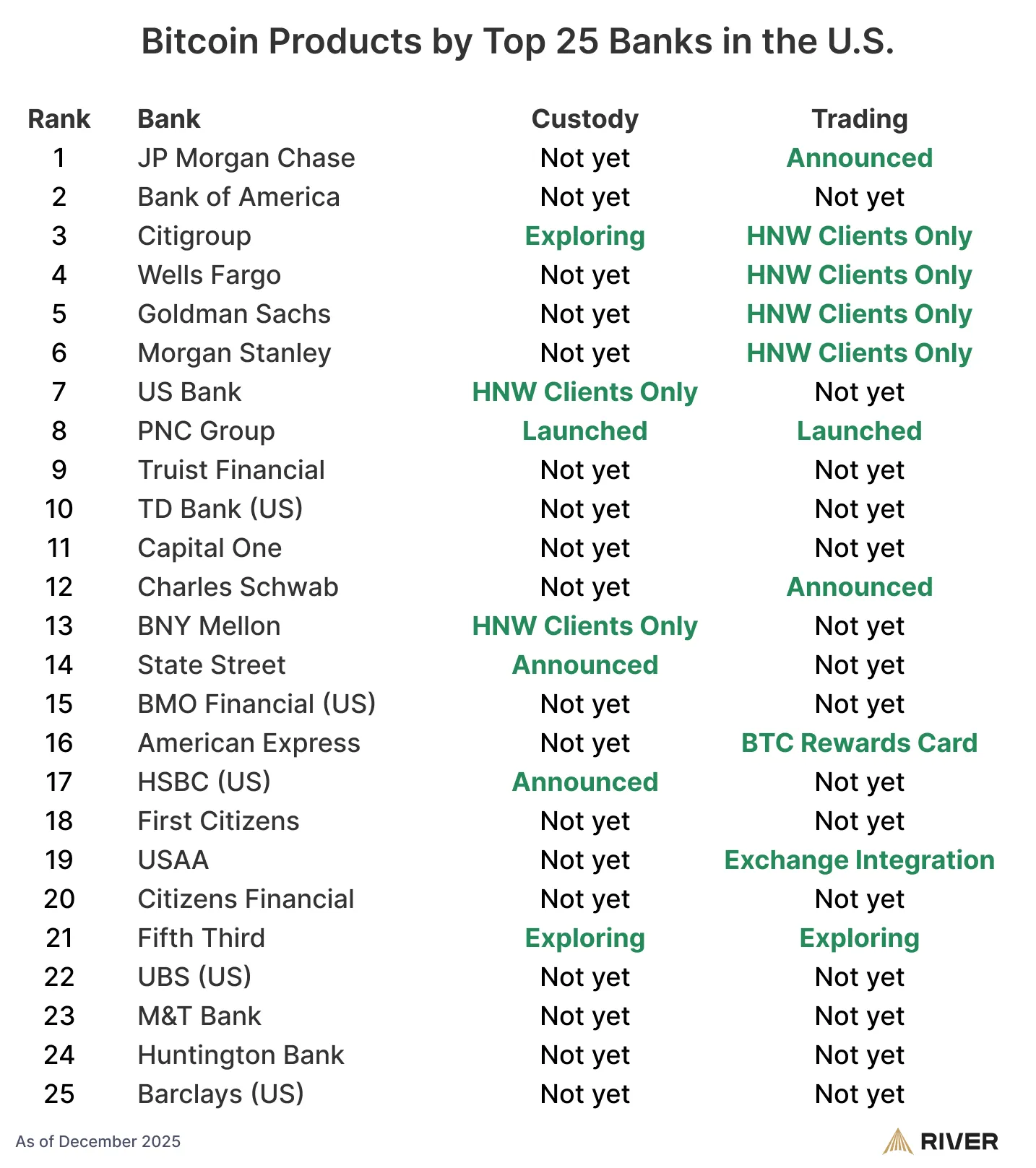

According to recent data, a substantial percentage of the largest US banks are actively pursuing Bitcoin-related services. This transition highlights the growing acceptance of Bitcoin, moving it from a fringe asset to a more routine component within mainstream wealth and custody management.

The initial phase of institutional Bitcoin adoption involved ETFs, providing banks with a familiar structure to meet client demand. This approach allowed asset managers and specialist custodians to handle much of the operational complexity, while banks could offer Bitcoin exposure within established frameworks.

The success of these ETFs has demonstrated that Bitcoin’s volatility can be managed within existing supervisory frameworks. Consequently, institutions are now considering allowing clients to hold and trade Bitcoin directly through their existing interfaces.

PNC Financial Services Group’s adoption of Coinbase’s “Crypto-as-a-Service” exemplifies this trend. This white-label structure enables banks to meet client demand without building their own extensive wallet infrastructure.

Recent regulatory guidance from the OCC has further facilitated this integration by clarifying how banks can treat crypto trades as riskless principal transactions. This reduces the capital impact of market risk, making it easier to incorporate Bitcoin desks into traditional financial operations.

A supportive regulatory environment is crucial to this shift, with frameworks like the GENIUS Act providing clarity for stablecoin issuers. The OCC’s conditional national trust charters for crypto firms also create regulated counterparties that fit within existing risk and capital frameworks.

US Bancorp’s revival of its institutional Bitcoin custody service, using NYDIG as a sub-custodian, illustrates how banks are leveraging these developments. Other major players like BNY Mellon are also developing digital-asset platforms to cater to institutions seeking secure Bitcoin storage with trusted brands.

The normalization of Bitcoin within traditional finance introduces new systemic risks. Banks are increasingly reliant on a small number of infrastructure providers for key services like execution, wallet technology, and key security, creating potential points of failure.

While riskless principal models and ETF wrappers limit direct market risk, they do not eliminate counterparty and operational risks. Major outages or cyber incidents at core sub-custodians could impact various sectors, from retail trading to institutional custody businesses.

Despite these risks, the integration of Bitcoin into mainstream finance continues to progress. Initiatives from US Bancorp, PNC, Schwab, Morgan Stanley, Bank of America, and JPMorgan collectively point toward a future where Bitcoin is woven into the operational fabric of traditional finance.

While BTC price volatility and policy changes remain potential obstacles, the current trajectory suggests that by 2026, clients will be more concerned with how their Bitcoin exposure is managed—whether through ETFs, direct holdings, or advisory models—and which institutions they trust to facilitate these services.

Banks are adapting to client demand by building the necessary infrastructure to manage and offer Bitcoin, ensuring they remain competitive in a rapidly evolving financial landscape.

Related: XRP: Drop Shifts Market Structure

Source: Original article

Quick Summary

Major US banks are increasingly offering Bitcoin services. This shift is driven by client demand and regulatory clarity. Banks are using third-party infrastructure to manage crypto operations. The financial landscape is evolving as major US banks begin to integrate Bitcoin into their services.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.