XRP’s price action remains in a downtrend despite some signs of waning selling pressure. Payment volume has cooled from previous spikes but remains elevated above baseline, suggesting sustained network usage. Divergences between on-chain activity and price could precede accumulation or a relief bounce.

What to Know:

- XRP’s price action remains in a downtrend despite some signs of waning selling pressure.

- Payment volume has cooled from previous spikes but remains elevated above baseline, suggesting sustained network usage.

- Divergences between on-chain activity and price could precede accumulation or a relief bounce.

XRP continues to garner attention from institutional investors seeking exposure to blockchain-based payment solutions. Despite regulatory uncertainties and broader market volatility, monitoring XRP’s on-chain metrics and price action provides valuable insight into its potential for adoption and price appreciation. Examining payment volumes, technical indicators, and potential market scenarios can inform investment strategies in this evolving digital asset.

Downtrend Persists

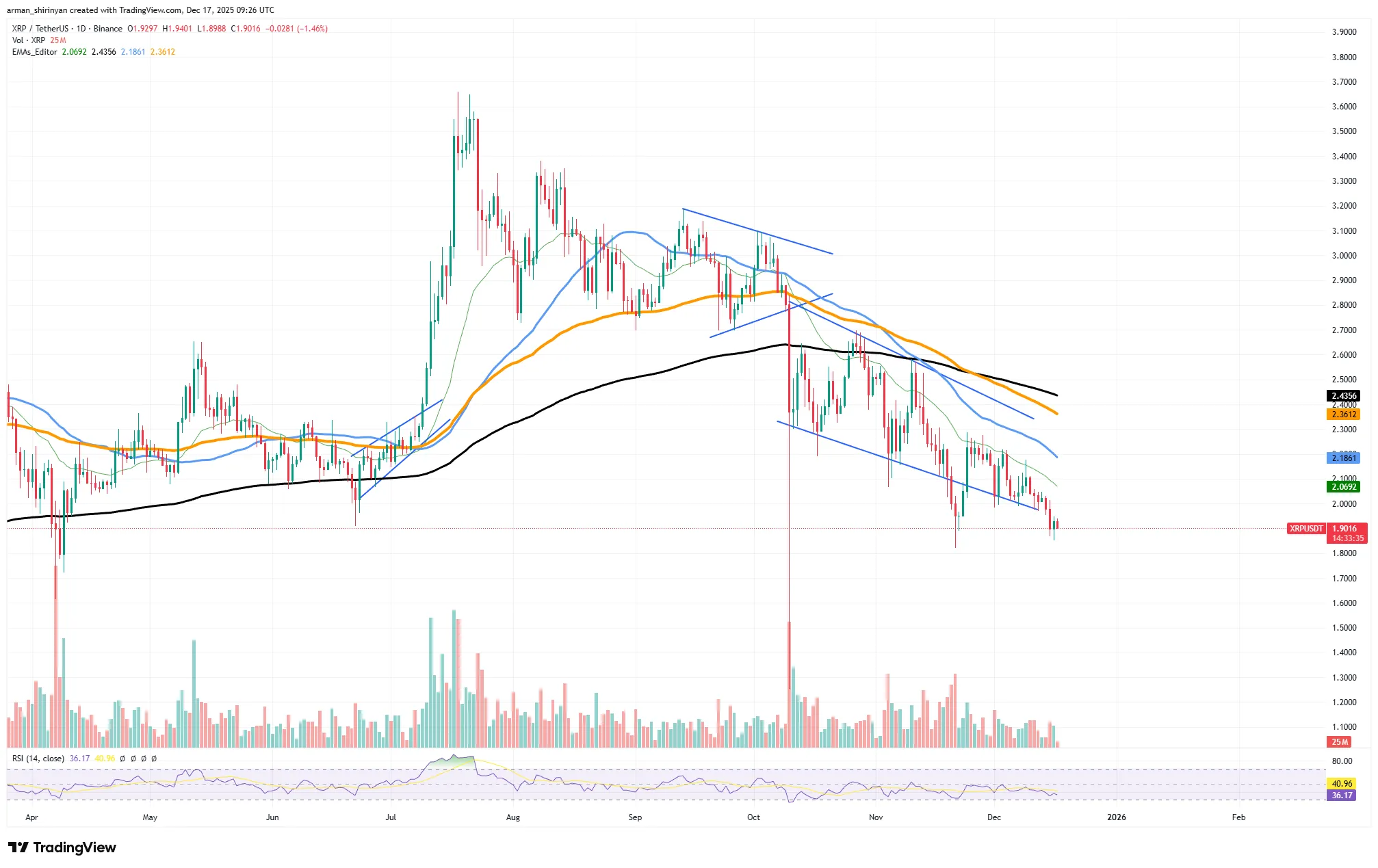

XRP’s price trajectory remains bearish, trading below key moving averages and exhibiting a pattern of lower highs and lower lows. The loss of support around $2.00-$2.10 intensified selling pressure. However, the rate of decline has slowed, with wicks emerging on the downside and the Relative Strength Index (RSI) indicating oversold conditions. This suggests that aggressive selling is diminishing, potentially setting the stage for a change in momentum.

Payment Volume Analysis

While payment volume has decreased from previous speculative surges, it remains elevated compared to baseline levels. The earlier spike was characterized by rapid distribution and capital rotation, which is common in speculative frenzies. The current activity level, though lower, suggests ongoing network usage beyond short-term speculation. Sustained payment volume, even at reduced levels, is more indicative of institutional and utility flow, which could support a more stable price floor.

Institutional vs. Retail Behavior

The timing of XRP payments reveals insights into the nature of network usage. The majority of payments occur on weekdays, aligning with institutional behavior rather than retail-driven hype. This pattern suggests that underlying network usage remains resilient even as the price corrects. Such divergences, where on-chain activity remains steady despite declining prices, have historically preceded either a prolonged accumulation phase or a significant relief bounce, offering potential entry points for discerning investors.

Potential Market Scenarios

Investors should consider two primary scenarios for XRP. If XRP can hold the $1.85-$1.90 range and reclaim short-term moving averages, a relief rally towards the $2.20-$2.40 zone becomes feasible. Conversely, if payment volume continues to decline and the price loses its current base, XRP risks entering a deeper consolidation range. Monitoring these levels and payment volume trends will be crucial in assessing the near-term outlook.

Historical Context and Future Outlook

XRP’s current market behavior mirrors patterns observed in other digital assets during periods of consolidation and accumulation. Similar to the early days of Bitcoin and Ethereum, XRP is navigating regulatory scrutiny and market skepticism while demonstrating real-world utility. The ability of XRP to maintain its network activity and attract institutional interest will be key determinants of its long-term success. As the digital asset landscape matures, XRP’s role in facilitating cross-border payments could position it favorably for future growth.

Related: XRP ETF Flows Outperform; Signals Cooling

Source: Original article

Quick Summary

XRP’s price action remains in a downtrend despite some signs of waning selling pressure. Payment volume has cooled from previous spikes but remains elevated above baseline, suggesting sustained network usage. Divergences between on-chain activity and price could precede accumulation or a relief bounce.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.