XRP shows potential for recovery if it maintains support, with substantial liquidity noted above $3. Current market behavior reflects cautious sentiment and technical indicates that could influence short-term movements.

What to Know:

- XRP shows potential for recovery if it maintains support, with substantial liquidity noted above $3.

- Current market behavior reflects cautious sentiment and technical signals that could influence short-term movements.

- Institutional investors should monitor these levels for potential entries or exits, considering the broader market structure and liquidity dynamics.

XRP has demonstrated a slight recovery, trading around $1.91, marking a 1.5% increase over the last day. Despite this uptick, its recent performance remains subdued, reflecting broader market hesitancy. Investors are keenly observing technical indicators and liquidity zones to gauge future price action.

Will XRP Find a Floor?

XRP’s daily price movements are presenting crucial technical signals that could dictate its next moves. Currently, the price hovers near the lower Bollinger Band, around $1.88, with the upper band at $2.23. A test of this lower band suggests a potential move toward that support again.

Holding this support level could provide XRP with the necessary momentum for a recovery. Breaching it, however, might signal further downside pressure, potentially targeting the $1.85 region. The Stochastic RSI indicator is also flashing oversold conditions, with values around 11.09, hinting at a possible short-term reversal if buying interest picks up. This could lead to a bullish divergence in the near term.

Nevertheless, the bearish momentum remains evident through the downtrend in the Stochastic RSI and the movement away from the 20-period moving average (SMA). Regaining bullish traction requires XRP to surpass the middle Bollinger Band, currently at $2.05, which could pave the way for a rally toward the $2.23 resistance level.

XRP’s Path to $3?

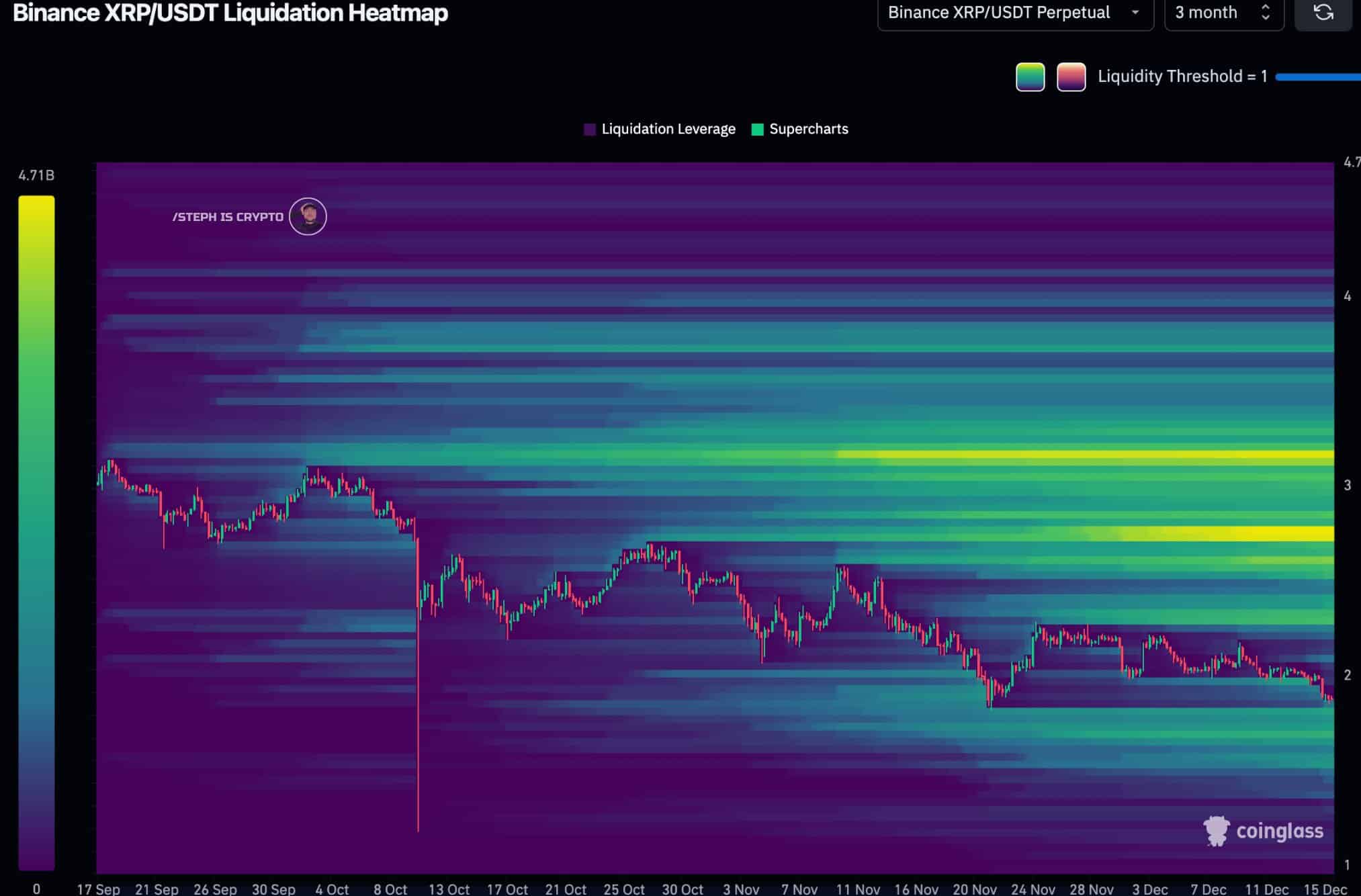

An analyst’s three-month heatmap for XRP reveals a growing liquidity magnet above the $3 mark. This suggests accumulating liquidity in that area, potentially attracting significant price action as XRP approaches this zone.

Price often gravitates toward areas with higher liquidity, implying a potential upward move if this level is reached. Traders should monitor the $3 mark for a possible breakout or significant resistance. Surpassing $3 would require XRP to rally approximately 57.07% from its current price of $1.91.

Broader Market Context

The broader cryptocurrency market is exhibiting cautious sentiment, influenced by regulatory developments, macroeconomic factors, and settlement system efficiencies. Institutional investors are closely monitoring these dynamics, adjusting their portfolios based on risk assessments and potential return opportunities. Derivatives positioning and ETF mechanics are also playing crucial roles in shaping market movements. Liquidity, as highlighted by the heatmap, often dictates the direction of price action, making it a key metric for fund managers.

Regulatory Posture and Institutional Flows

Regulatory clarity remains a significant factor influencing institutional investment in digital assets. Ambiguity can lead to hesitancy, while clear guidelines can unlock substantial capital inflows. Recent developments in the regulatory landscape are being closely watched, as they could significantly impact market structure and investor confidence. Ripple’s ongoing legal battles also add a layer of complexity, influencing sentiment around XRP.

Strategic Outlook

Given the technical signals and liquidity dynamics, a strategic approach is warranted. Monitoring key support and resistance levels, along with broader market indicators, can provide valuable insights. While the potential for a rally toward $3 exists, prudent risk management and diversification remain essential. Institutional investors should also consider the long-term macro cycles and regulatory posture when making investment decisions.

In conclusion, XRP’s short-term trajectory hinges on maintaining key support levels and overcoming resistance. The presence of significant liquidity above $3 suggests potential upside, but caution is advised given the prevailing market conditions. Institutional investors should remain vigilant, balancing potential opportunities with inherent risks.

Related: XRP Targets Yield: Ripple’s Asia Venture

Source: Original article

Quick Summary

XRP shows potential for recovery if it maintains support, with substantial liquidity noted above $3. Current market behavior reflects cautious sentiment and technical signals that could influence short-term movements. Institutional investors should monitor these levels for potential entries or exits, considering the broader market structure and liquidity dynamics.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.