DTCC is exploring tokenization, and X (formerly Twitter) is preparing to launch its X Money product. These developments occur amid growing regulatory clarity and the broader adoption of blockchain technology for financial assets.

What to Know:

- DTCC is exploring tokenization, and X (formerly Twitter) is preparing to launch its X Money product.

- These developments occur amid growing regulatory clarity and the broader adoption of blockchain technology for financial assets.

- XRP could benefit significantly if it integrates with these platforms, potentially influencing its long-term price action and institutional appeal.

XRP has faced considerable selling pressure despite positive developments within its ecosystem. While the broader crypto market has shown resilience, XRP has struggled, declining approximately 35% over the past three months to around $1.86. This downturn marks a potential third consecutive monthly loss, a pattern not seen since late 2022. However, some analysts believe this disconnect between price and progress presents a future opportunity.

XRP’s Bearish Price Action Amid Bullish Catalysts

The current price weakness contrasts with several bullish developments. Recently, XRP ETFs have launched and are gaining traction, surpassing $1 billion in total inflows. Additionally, Ripple secured conditional approval to operate under a banking license, enhancing its regulatory standing. These factors suggest a foundation for a potential price recovery, provided market sentiment shifts.

DTCC’s Foray Into Tokenization

The Depository Trust & Clearing Corporation (DTCC), a major player in traditional finance, is moving into tokenization. In a CNBC interview, DTCC CEO Frank La Salla discussed the firm’s tokenization pilot program, noting that increasing regulatory clarity has encouraged the tokenization of real-world assets. DTCC, which oversees approximately $100 trillion in assets, aims to provide a foundational layer for tokenization, allowing assets to operate across various blockchain networks. This move could significantly reduce fragmented liquidity and streamline asset management for institutions.

X Money and Potential Crypto Integration

Speculation is growing around X Money, the forthcoming financial product from X. Elon Musk’s vision includes a potential convergence of AI and crypto, suggesting that X Money’s backend could be powered by blockchain technology. Analysts speculate that Stellar’s XLM, XRP, or both could play a crucial role in this system, offering a scalable and efficient infrastructure for transactions. This integration could expose XRP to a massive user base, driving adoption and utility.

Assessing XRP’s Price Potential

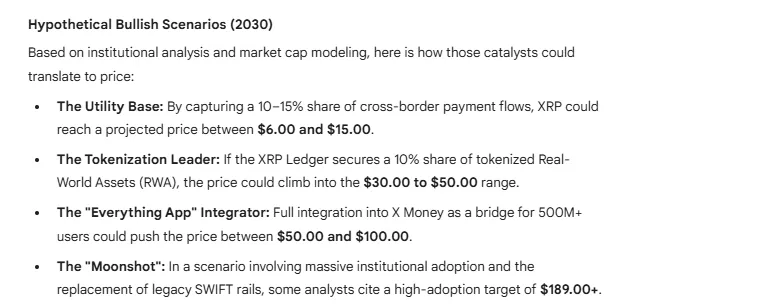

The successful integration of XRP into tokenization initiatives and X Money could substantially impact its price. Google Gemini assessed potential price targets based on various adoption scenarios. If XRP captures 10% to 15% of global cross-border payment flows, it could reach between $6 and $15. Securing 10% of the tokenization market could push prices to $30 to $50. Full integration with X Money, potentially serving over 500 million users, might drive XRP into the $50 to $100 range.

Macro Factors and Institutional Adoption

Beyond specific integrations, broader macro factors and increased institutional adoption could further boost XRP’s prospects. If XRP sees high adoption through institutional use and replaces legacy systems like SWIFT, some analysts project long-term prices exceeding $189. Such a scenario would require significant regulatory support and a shift in institutional attitudes toward digital assets.

Conclusion

While XRP’s recent price action has been disappointing, key developments such as DTCC’s tokenization efforts and the launch of X Money present significant opportunities. Successful integration into these platforms, combined with favorable regulatory conditions and growing institutional interest, could catalyze a substantial price appreciation. Investors should closely monitor these developments, understanding that market dynamics and adoption rates will ultimately determine XRP’s future trajectory.

Related: XRP Signals Buy: Derivatives Data Reveals Why

Source: Original article

Quick Summary

DTCC is exploring tokenization, and X (formerly Twitter) is preparing to launch its X Money product. These developments occur amid growing regulatory clarity and the broader adoption of blockchain technology for financial assets.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.