An analyst suggested XRP could help investors retire, sparking debate about required price appreciation. Achieving substantial returns through XRP requires significant market movement, given current prices and retirement savings goals.

What to Know:

- An analyst suggested XRP could help investors retire, sparking debate about required price appreciation.

- Achieving substantial returns through XRP requires significant market movement, given current prices and retirement savings goals.

- For institutional investors, the conversation highlights the need for comprehensive financial planning beyond mere asset appreciation.

An analyst’s recent assertion that XRP could be a key to retirement for many investors has ignited discussions about the potential returns needed to meet retirement goals. While such claims capture attention, a deeper analysis reveals the complexities and financial planning required to turn crypto investments into a comfortable retirement fund. For institutional and high-net-worth investors, this scenario underscores the importance of strategic asset allocation and sophisticated financial planning.

Realistic Retirement Targets

The amount required for retirement varies widely based on individual circumstances, lifestyle, and geographical location. While some may find $500,000 sufficient, those in high-cost areas often need significantly more. For example, a CNBC report indicated that retiring comfortably in Hawaii could necessitate $2.21 million over 25 years. This variability highlights the need for personalized financial planning rather than relying on blanket investment strategies.

XRP’s Required Appreciation

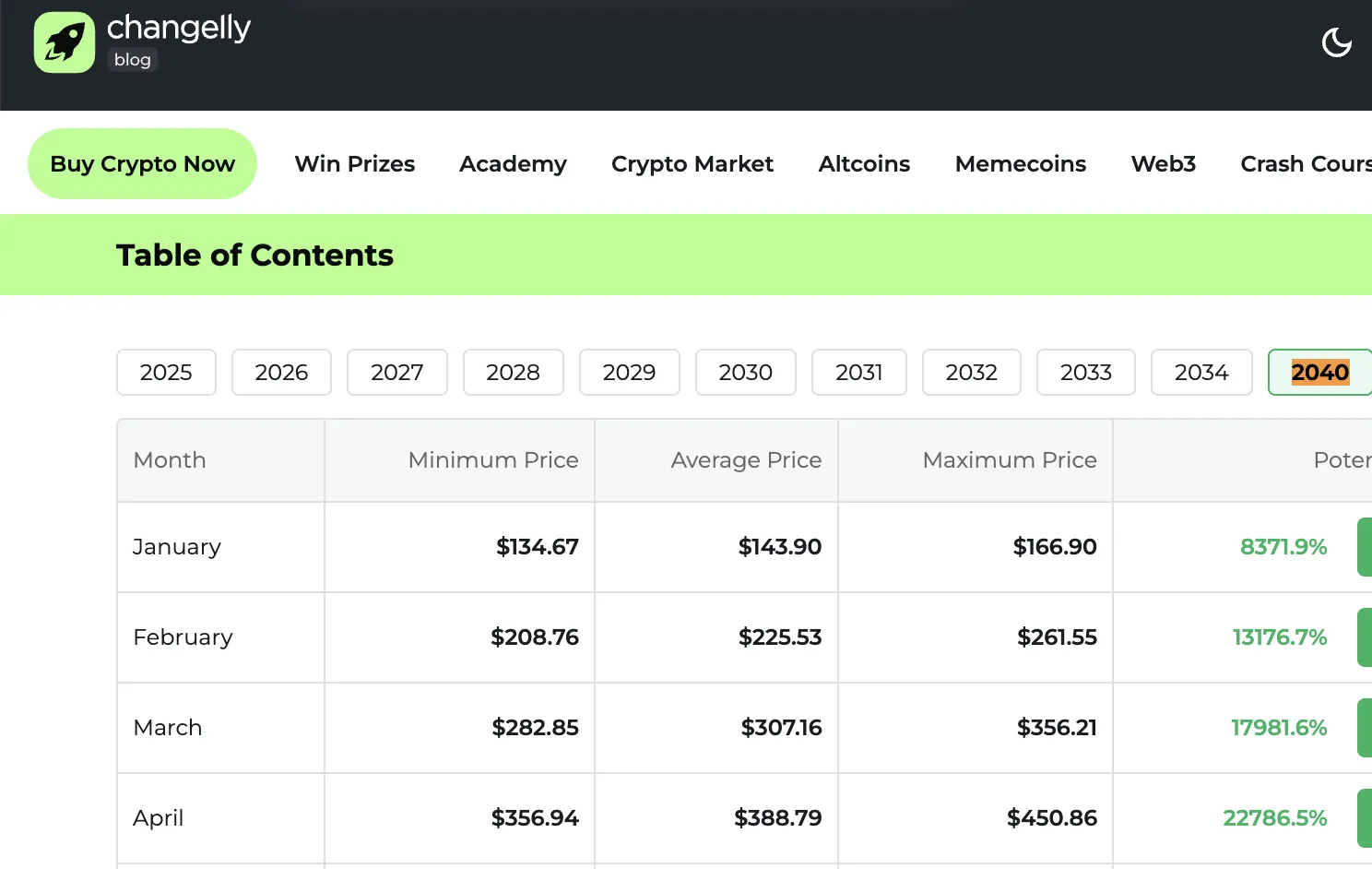

To assess the feasibility of XRP as a retirement vehicle, consider a hypothetical investment. An initial $10,000 investment at XRP’s price of $1.91 would yield 5,263 tokens. To reach a $2 million retirement target, XRP would need to appreciate to approximately $380 per token. This would require a staggering 19,900% increase, pushing XRP’s market capitalization to an improbable $22.8 trillion. While such growth is theoretically possible, it remains highly speculative and unlikely in the near to medium term. Market forecasts vary, with some predicting XRP could reach these levels by 2040, while others doubt it will ever reach such valuations.

Alternative Investment Scenarios

A more pragmatic approach involves considering larger initial investments. For instance, to retire with $2 million when XRP reaches $100, an investor would need to hold 20,000 XRP tokens, costing approximately $38,000 at current prices. Similarly, holding 50,000 XRP (costing just under $100,000) would achieve the $2 million goal if XRP hits $40. For those with substantial capital, such as a $500,000 investment, the path to $2 million becomes more accessible, requiring XRP to climb to around $7.60 per token. These scenarios illustrate that while XRP can contribute to retirement savings, the scale of investment and realistic price targets are critical considerations.

Beyond Price Appreciation

Industry experts emphasize that careful financial preparation is paramount. Jake Claver, CEO of Digital Ascension Group, advises investors to focus on comprehensive strategies that address taxes, security risks, and estate planning. He recommends tools such as trusts and LLCs to manage and protect crypto assets. Additionally, using XRP as collateral for loans can provide liquidity without triggering immediate tax liabilities. For larger portfolios, establishing a digital family office can ensure governance, succession planning, and long-term wealth preservation. Without these measures, crypto wealth is often at risk of dissipation.

Planning for Generational Wealth

Preserving wealth across generations requires a holistic approach that integrates legal, tax, and security strategies. Many investors overlook the importance of planning beyond immediate gains, which can lead to wealth erosion within two generations. By proactively addressing these factors, institutional and high-net-worth individuals can ensure their crypto investments contribute to lasting financial security and legacy.

While the prospect of XRP facilitating early retirement is enticing, achieving this goal requires substantial capital, realistic price expectations, and comprehensive financial planning. For institutional investors, the focus should be on integrating crypto assets into a broader, well-structured investment strategy that accounts for risk management, tax implications, and long-term wealth preservation.

Related: Crypto Signals: Bitcoin Defends $88K Level

Source: Original article

Quick Summary

An analyst suggested XRP could help investors retire, sparking debate about required price appreciation. Achieving substantial returns through XRP requires significant market movement, given current prices and retirement savings goals. For institutional investors, the conversation highlights the need for comprehensive financial planning beyond mere asset appreciation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.