XRP is facing persistent selling pressure despite expectations of an ETF-driven rally, as large holders transfer tokens to exchanges, signaling potential profit-taking.

What to Know:

- XRP is facing persistent selling pressure despite expectations of an ETF-driven rally, as large holders transfer tokens to exchanges, signaling potential profit-taking.

- Technical analysis identifies key support zones around $1.82–$1.87 and potentially $1.50–$1.66 if inflows persist, suggesting possible downside risk.

- Despite price headwinds, XRP ETFs have recorded 30 consecutive days of inflows, indicating sustained institutional interest even as short-term price action remains bearish.

XRP has been under pressure despite the broader anticipation that a spot ETF would unlock institutional demand. Recent on-chain analysis highlights substantial inflows into exchanges from large holders, suggesting that some early investors may be using the ETF narrative as an opportunity to realize gains. This dynamic creates a complex picture for XRP, as ETF inflows contrast with immediate selling pressure.

Whale Activity and Exchange Inflows

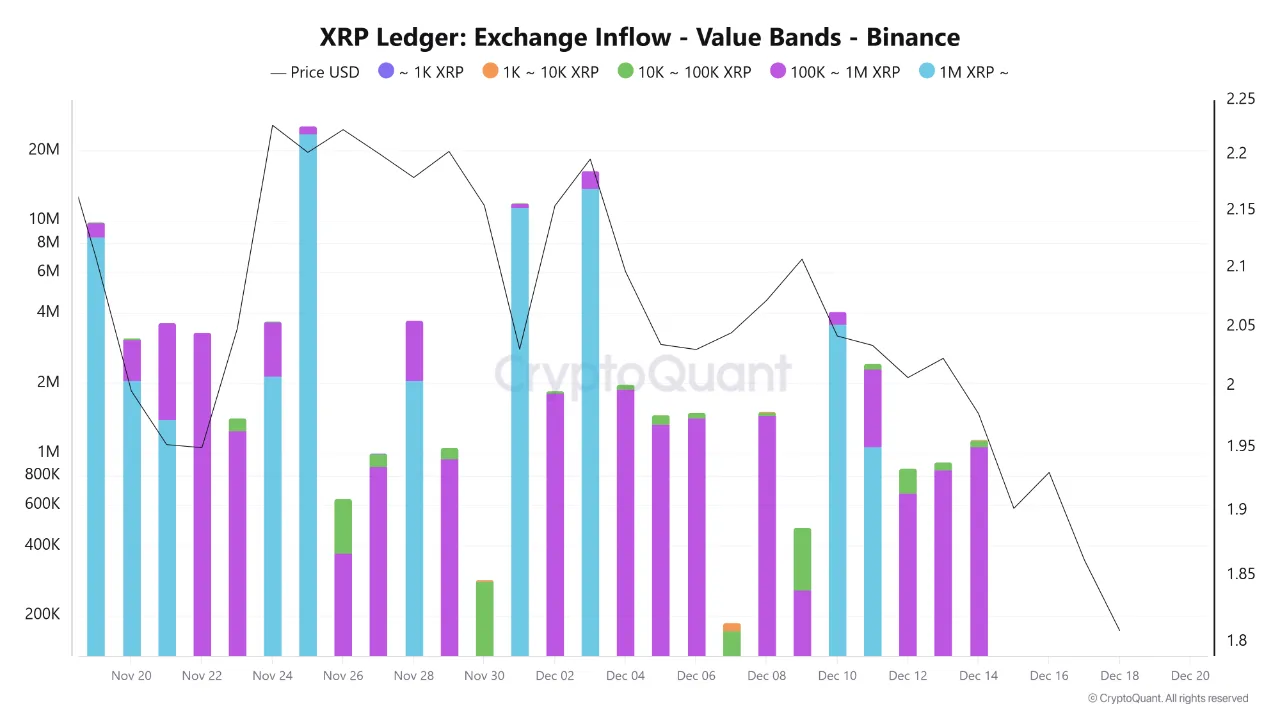

Recent data from CryptoQuant reveals that significant XRP inflows into Binance are concentrated among large holders, specifically those moving between 100,000 to over 1 million XRP. Historically, such movements to exchanges often precede selling activity. This behavior suggests that, rather than accumulating, whales are positioning themselves to potentially offload XRP holdings, thereby increasing the available supply on exchanges.

This increase in supply puts downward pressure on XRP’s price, especially in the absence of equally strong spot buying. The market structure indicates that supply is outpacing demand, a scenario that could delay any potential rally. Institutional investors will be closely watching these dynamics, as sustained exchange inflows from large holders could signal a period of consolidation or correction before any sustained upward movement.

Technical Support Levels

The current technical structure suggests that XRP’s first major support zone lies around $1.82–$1.87, where previous stabilization and limited retail buying have been observed. However, if large inflows persist, the analysis points to a potential decline toward the $1.50–$1.66 range. These levels are crucial for traders and investors to monitor, as a break below these supports could trigger further downside.

These technical levels become important reference points for assessing risk and managing positions. Institutional players often use such levels to gauge market sentiment and adjust their strategies accordingly. The ability of XRP to hold these support levels will be a key indicator of underlying strength or weakness.

ETF Inflows vs. Market Sentiment

Despite the selling pressure, XRP ETFs have recorded an impressive streak of 30 consecutive days of inflows. This divergence between ETF inflows and spot market performance highlights a split in sentiment. While some investors are using the ETF as a vehicle to gain exposure to XRP, others are taking profits, creating a supply overhang.

This situation is not uncommon in the early stages of new ETF launches. The initial enthusiasm often gives way to profit-taking, especially among those who accumulated positions before the ETF approval. The key will be whether the ETF inflows can eventually absorb the selling pressure and establish a new equilibrium for XRP’s price.

Ripple CEO’s Perspective

Ripple CEO Brad Garlinghouse has acknowledged the ETF inflows, which underscores the significance of this trend. The fact that major issuers like Franklin Templeton and Bitwise have launched XRP ETFs, with Grayscale also entering the market, suggests a broader institutional acceptance of XRP as an asset class. These developments are essential for long-term price stability and growth.

The involvement of established asset managers lends credibility to XRP and provides additional avenues for investors to access the token. However, the market still needs to digest the current supply dynamics before the positive effects of these ETFs can fully materialize in price appreciation.

Looking Ahead

For XRP to break free from the current selling pressure, a decrease in exchange inflows is essential. Until the supply overhang is cleared, expecting a sustained bullish move may be unrealistic. Investors should closely monitor exchange flows, ETF inflows, and overall market sentiment to gauge the potential for a future rally.

In the short term, XRP may continue to face headwinds, but the long-term outlook remains cautiously optimistic, especially if ETF inflows continue to provide a supportive base. The interplay between these factors will determine XRP’s trajectory in the coming months.

In conclusion, XRP’s current market dynamics are characterized by a tug-of-war between ETF inflows and selling pressure from large holders. While the ETF inflows signal long-term institutional interest, the immediate price action is being weighed down by increased supply on exchanges. Monitoring these dynamics will be crucial for assessing XRP’s potential for a sustainable rally.

Related: XRP Lending Protocol Targets XRPL Growth

Source: Original article

Quick Summary

XRP is facing persistent selling pressure despite expectations of an ETF-driven rally, as large holders transfer tokens to exchanges, signaling potential profit-taking. Technical analysis identifies key support zones around $1.82–$1.87 and potentially $1.50–$1.66 if inflows persist, suggesting possible downside risk.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.