Most analysts entered 2025 with bullish forecasts for Bitcoin, citing factors like regulatory clarity and ETF inflows. Bitcoin failed to meet these expectations, facing resistance and macro headwinds that prevented it from reaching projected highs.

What to Know:

- Most analysts entered 2025 with bullish forecasts for Bitcoin, citing factors like regulatory clarity and ETF inflows.

- Bitcoin failed to meet these expectations, facing resistance and macro headwinds that prevented it from reaching projected highs.

- The divergence between predictions and reality highlights the challenges of forecasting in the volatile crypto market, particularly for assets like XRP and Ripple navigating regulatory landscapes.

As 2025 draws to a close, Bitcoin finds itself in a position few analysts predicted at the start of the year. Buoyed by regulatory optimism and the promise of institutional adoption via ETFs, many forecasts pointed toward a banner year for the leading cryptocurrency. However, Bitcoin’s performance fell short, underscoring the inherent unpredictability of the digital asset market and its susceptibility to broader economic forces.

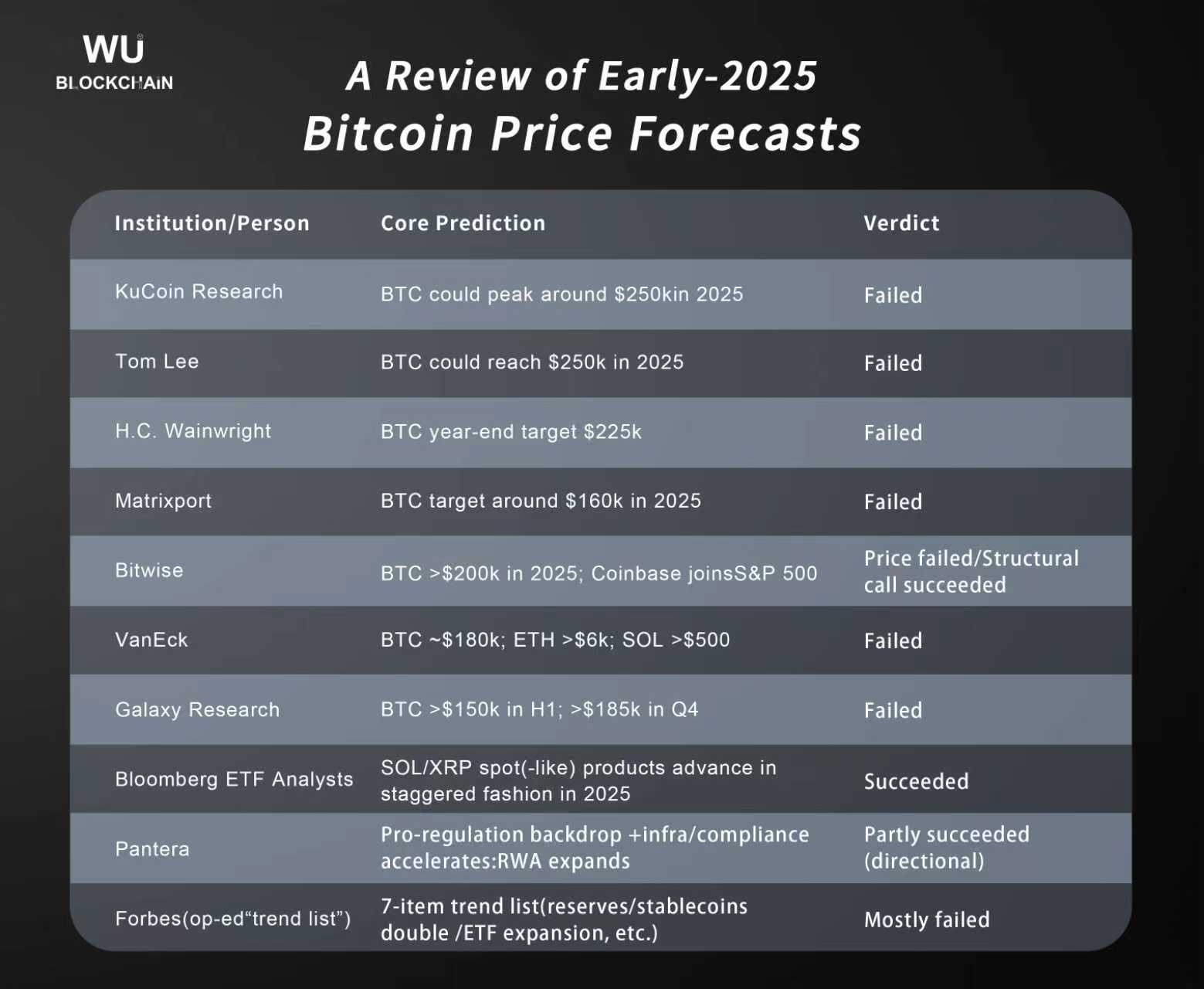

Ambitious Price Targets Miss the Mark

At the beginning of 2025, Bitcoin was widely expected to surge, with price targets ranging from $200,000 to $250,000. Instead, Bitcoin has struggled, experiencing a significant downturn in the last quarter. The asset is down roughly 3.6% year-to-date and trading near $90,130, a far cry from the bullish projections that dominated market sentiment early in the year.

KuCoin Research: A Post-Halving Peak That Never Materialized

KuCoin Research was among the most bullish, projecting a peak near $250,000 based on historical post-halving trends and anticipated institutional demand. They also forecasted a $3.4 trillion market cap for altcoins, anticipating a broad rally across the crypto space. While progress occurred with compliant products, including potential Solana and XRP ETFs, Bitcoin’s price action diverged sharply, peaking just above $126,000 before retreating.

Fundstrat’s Tom Lee: Liquidity and Regulatory Tailwinds Fail to Lift Bitcoin

Fundstrat’s Tom Lee also set a $250,000 target, citing improving liquidity, regulatory tailwinds, and market resilience. However, repeated drawdowns and volatility prevented Bitcoin from sustaining upward momentum. The anticipated catalysts failed to materialize in a way that would propel Bitcoin to the projected levels.

Matrixport: A More Conservative Target Still Out of Reach

Matrixport offered a more restrained outlook, targeting $160,000 for Bitcoin in 2025. Even this more conservative estimate proved too optimistic, as Bitcoin’s price remained below the projected mark. This highlights the difficulty in accurately forecasting even with a degree of caution, given the market’s susceptibility to unforeseen events and shifting sentiment.

VanEck: Cycle Predictions Fall Flat

VanEck’s roadmap for 2025 anticipated an early-year peak, followed by a correction and renewed momentum. Their cycle-top target was near $180,000. While the market experienced volatility and drawdowns, Bitcoin never reached the projected highs. This underscores the challenge of timing market cycles, even with sophisticated analysis and historical data.

Navigating Crypto’s Unpredictable Waters

The wide gap between expectations and reality in Bitcoin’s 2025 performance serves as a reminder of the crypto market’s inherent volatility and susceptibility to external factors. While regulatory developments and institutional adoption remain critical drivers, macro conditions, risk sentiment, and unforeseen events can significantly impact price action. For assets like XRP and Ripple, navigating the regulatory landscape adds another layer of complexity, making accurate forecasting even more challenging.

Related: Crypto Muted as Gold Surges

Source: Original article

Quick Summary

Most analysts entered 2025 with bullish forecasts for Bitcoin, citing factors like regulatory clarity and ETF inflows. Bitcoin failed to meet these expectations, facing resistance and macro headwinds that prevented it from reaching projected highs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.