XRP investment products bucked the trend of overall crypto fund outflows, attracting significant inflows even as Bitcoin and Ethereum saw capital leave. The sustained inflows into XRP suggest institutional investors may be strategically positioning themselves in anticipation of greater regulatory clarity.

What to Know:

- XRP investment products bucked the trend of overall crypto fund outflows, attracting significant inflows even as Bitcoin and Ethereum saw capital leave.

- The sustained inflows into XRP suggest institutional investors may be strategically positioning themselves in anticipation of greater regulatory clarity.

- While the price of XRP has not yet reacted dramatically, the divergence in fund flows indicates a potential shift in institutional sentiment toward the asset.

Despite a broader pullback in digital asset investment products, XRP has demonstrated notable resilience, attracting significant inflows. As institutional investors navigate the evolving regulatory landscape and assess the prospects of various crypto assets, the flow of funds into specific assets offers valuable insights. The recent performance of XRP, as highlighted by CoinShares data, warrants a closer examination for its implications on market structure and future price action.

Diverging Fund Flows

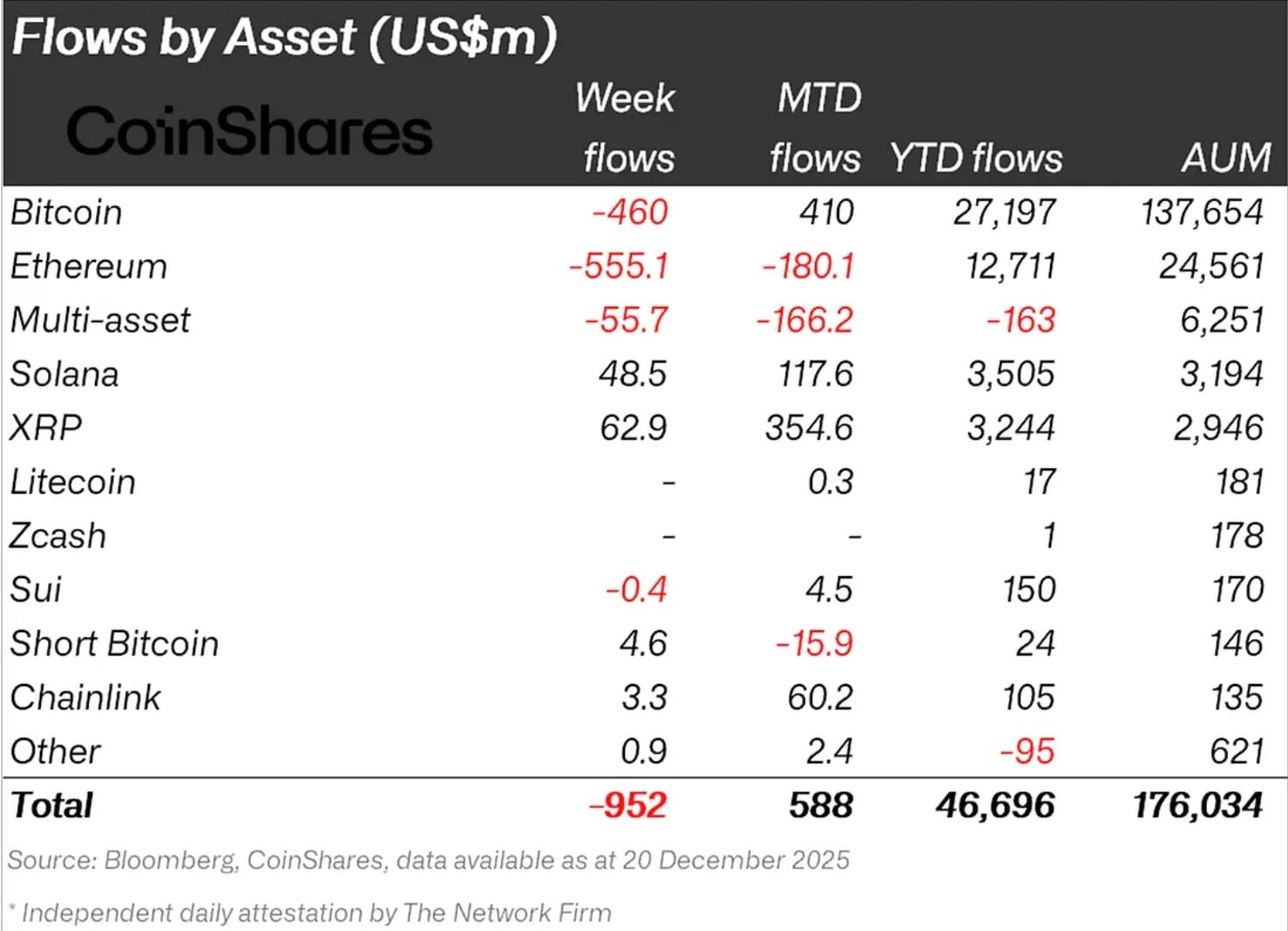

The past week witnessed a substantial outflow of $952 million from digital asset investment products, with Bitcoin and Ethereum bearing the brunt. However, XRP stood out as an exception, attracting $62.9 million in inflows, a 34% increase from the previous week. This divergence suggests a specific interest in XRP, potentially driven by factors such as regulatory developments or perceived undervaluation. These fund flows offer a glimpse into how institutional investors are positioning themselves amidst regulatory uncertainty.

ETF Activity Mirrors Positive Sentiment

The trend observed in fund flows is echoed in the activity of XRP spot ETFs. On December 19th, these ETFs recorded a net inflow of $13.21 million, contributing to a cumulative net inflow of $1.07 billion. This continued accumulation of XRP in ETF wrappers further reinforces the narrative of institutional interest. The ETF landscape often serves as a barometer for institutional sentiment, and the inflows into XRP ETFs suggest a growing acceptance and demand for the asset.

Regulatory Considerations

The contrasting fund flows, with money exiting Bitcoin and Ethereum while entering XRP, signal institutional views on regulatory progress and sentiment. XRP’s resilience may stem from expectations surrounding its regulatory outlook, particularly in light of ongoing legal proceedings involving Ripple. Institutional investors often seek assets with clearer regulatory frameworks, as this reduces uncertainty and potential risks. The allocation of fresh capital to XRP, even as other assets face outflows, suggests a calculated bet on its regulatory prospects.

Price Action and Positioning

Despite the positive fund flows, the price of XRP has not yet experienced a significant surge, currently hovering around $1.93. However, the true significance lies in the positioning of institutional investors. By allocating capital to XRP while reducing exposure to Bitcoin and Ethereum, institutions are signaling their strategic priorities. This positioning could indicate a longer-term investment thesis, anticipating future growth and adoption of XRP.

Historical Context and Market Dynamics

The current market dynamics surrounding XRP can be contextualized by examining previous instances of regulatory developments and ETF launches in the crypto space. For example, the launch of Bitcoin ETFs triggered a wave of institutional inflows, driving up the price of Bitcoin. Similarly, positive regulatory signals for Ethereum have often led to increased investment activity. The inflows into XRP, amidst regulatory proceedings, suggest a potential parallel to these historical events.

Conclusion

The recent fund flows and ETF activity surrounding XRP present a compelling case for its growing institutional appeal. While the price has yet to reflect the positive sentiment fully, the strategic positioning of institutional investors suggests a longer-term bullish outlook. As regulatory clarity continues to unfold, XRP is poised to potentially benefit from increased adoption and investment.

Related: XRP Rebounds: Signals $184M Move

Source: Original article

Quick Summary

XRP investment products bucked the trend of overall crypto fund outflows, attracting significant inflows even as Bitcoin and Ethereum saw capital leave. The sustained inflows into XRP suggest institutional investors may be strategically positioning themselves in anticipation of greater regulatory clarity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.