Bitcoin’s price faced resistance at $90,000, leading to a retracement and broader market decline. This price action reflects fragile market conditions amid on-chain indicates, macro pressures, and waning speculative activity.

What to Know:

- Bitcoin’s price faced resistance at $90,000, leading to a retracement and broader market decline.

- This price action reflects fragile market conditions amid on-chain signals, macro pressures, and waning speculative activity.

- XRP and other altcoins mirrored Bitcoin’s downturn, impacting overall liquidity and market sentiment.

The cryptocurrency market experienced a period of choppy price action, marked by unsuccessful attempts to sustain gains. Bitcoin’s struggle to decisively break above $90,000 resulted in a retracement, pulling down the broader market. This recent volatility underscores the challenges faced as the year approaches its end.

Bitcoin’s $90,000 Hurdle

Bitcoin’s repeated failures to maintain momentum above $90,000 highlight the resistance at this level. The price retraced by approximately 2.5% over the past 24 hours, settling around $87,500. This pullback led to substantial liquidations, with nearly $200 million affecting long traders. Bitcoin is on track to close the fourth quarter with a loss of around 22%, potentially marking its weakest Q4 performance since 2018. The current market behavior suggests a fragile phase, influenced by on-chain signals, macroeconomic pressures, and reduced speculative activity.

Altcoins Follow Bitcoin’s Lead

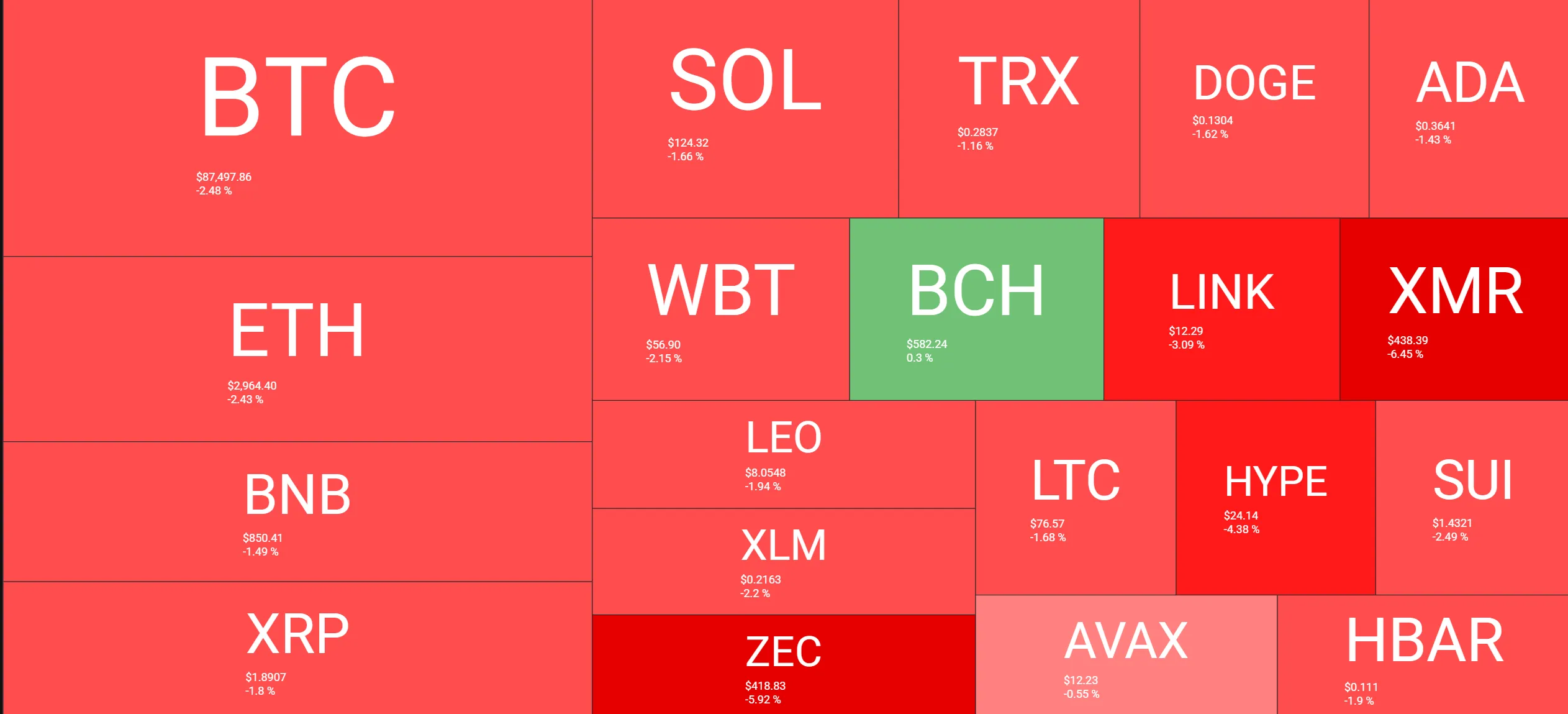

The majority of leading altcoins mirrored Bitcoin’s downward trend. Ethereum struggled to maintain its position above $3,000, experiencing a similar loss to Bitcoin and trading around $2,950. Other prominent altcoins, including SOL, TRX, DOGE, ADA, XRP, and BNB, saw declines between 1.5% and 2%. Privacy-focused coins like ZEC and XMR experienced more significant drops, around 6%.

Top Performers and Losers

Amid the widespread downturn, Provenance Blockchain’s HASH token stood out as a notable gainer, increasing by 8.4% over the past 24 hours, followed by Rain with a 6.5% increase. Conversely, Midnight (NIGHT) experienced the most significant loss, plummeting by 21%. PUMP, the native cryptocurrency of Pump.fun, also saw a substantial decrease of 13% during the same period.

Analyzing Market Liquidity

The recent market movements highlight the importance of liquidity within the cryptocurrency space. The failure of Bitcoin to sustain gains above $90,000 triggered liquidations and a broader market pullback, demonstrating how quickly sentiment can shift. For XRP and other altcoins, maintaining adequate liquidity is crucial for stability and minimizing price volatility during market fluctuations.

Implications for Institutional Investors

Institutional investors should closely monitor these market dynamics. The correlation between Bitcoin’s price action and the performance of altcoins like XRP underscores the interconnectedness of the crypto market. As institutional interest in crypto continues to grow, understanding these patterns and managing risk accordingly will be essential for navigating potential volatility.

In conclusion, the cryptocurrency market is currently facing headwinds as Bitcoin struggles to overcome resistance at $90,000. This has led to a broader market pullback, impacting altcoins and highlighting the importance of liquidity and risk management. Investors should remain vigilant and prepared for potential volatility in the near term.

Related: XRP, Altcoins: Top Performers Forecast Signals

Source: Original article

Quick Summary

Bitcoin’s price faced resistance at $90,000, leading to a retracement and broader market decline. This price action reflects fragile market conditions amid on-chain signals, macro pressures, and waning speculative activity. XRP and other altcoins mirrored Bitcoin’s downturn, impacting overall liquidity and market sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.